-

"The broader themes from the demand perspective are that it's choppy and people are not necessarily jumping into high-yield munis with both feet," said First Eagle's John Miller.

June 10 -

The software uses pre-trade quote data to help predict the next trade level of bonds.

June 10 -

The state of Maryland is going to market on Wednesday by selling $1.56 billion of general obligation bonds, which will be the first major sale since the state absorbed a credit downgrade from Moody's.

June 10 -

However, the new-issue calendar may not be "absorbed as easily, given valuations have grown less compelling after this week's performance," said Birch Creek strategists.

June 9 -

Armed with higher ratings since its last sale four years ago, the city is set to return to the market with a bang.

June 9 -

The National Association of Bond Lawyers is looking for answers from the Internal Revenue Service regarding a few questions.

June 9 -

Chicago is facing myriad headwinds. But its GO bond sale last week was oversubscribed and city officials said that allowed them to lower yields in repricing.

June 9 -

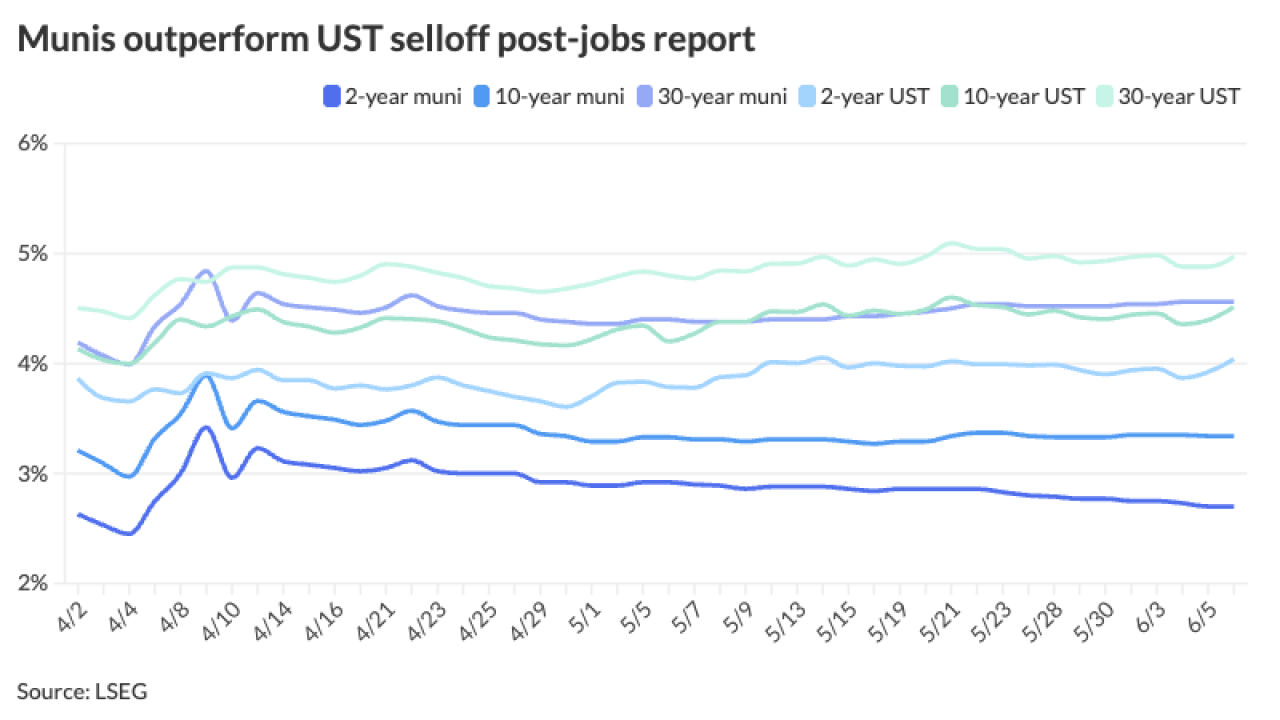

The nonfarm payrolls report shows the economy is "hanging in there," though it is slowing, said Jeff MacDonald of Fiduciary Trust International.

June 6 -

The upshot of the report by Payden & Rygel's Travis McGahey is that the risk of severe credit deterioration and bond defaults remains low.

June 6 -

This week the market has performed "exceedingly well" with the tailwind of June 1 reinvestment capital, said J.P. Morgan strategists led by Peter DeGroot.

June 5