-

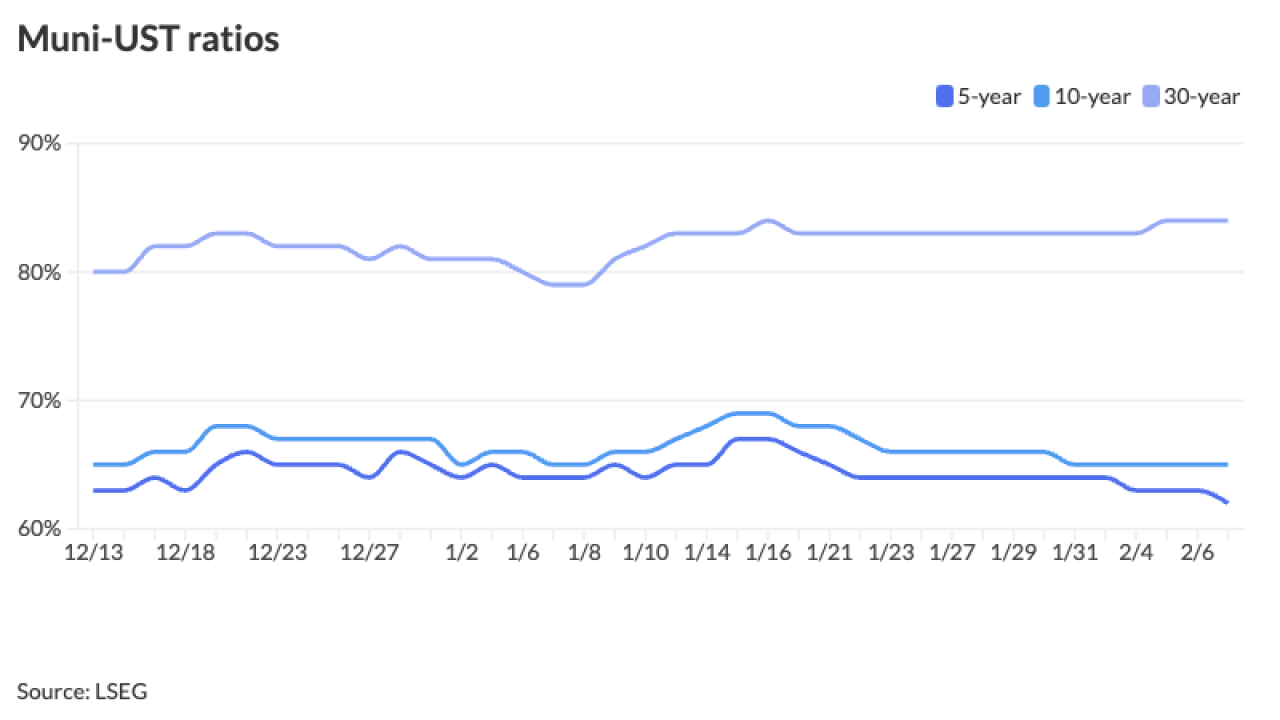

Munis continue to outpace USTs as ratios on the front end continue to richen relative to USTs, Jason Wong said.

February 10 -

Management is hiring a municipal advisor to evaluate its financial strategy.

February 10 -

"Our job is to take that volatility, figure out what's noise, figure out what's reality, and lean into the opportunities as we see them," said Alex Petrone, director of fixed income at Rockefeller Asset Management.

February 10 -

Yields have fallen over the past few weeks, so "any decent excuse that rates move up a little bit after that big rally" may have occurred as the market digested the report — which was a "little bit of a mixed bag" — after the initial headline figure, said Jeff MacDonald, EVP and head of fixed income at Fiduciary Trust International.

February 7 -

Texas Sen. John Cornyn remains a supporter of private activity bonds, his staff told BDA.

February 7 -

The NYC TFA will test how the national news cycle has affected the market's appetites.

February 6 -

A Moody's Ratings upgrade means Hawaii DOT's airport division is headed to market with across-the-board double-A ratings.

February 6 -

The Metropolitan Atlanta Rapid Transit Authority will issue $475 million in green sales tax revenue bonds for capital projects and refunding.

February 6 -

Muni yields were bumped one to eight basis points, depending on the scale, while UST yields fell three to 10 basis points, with the greatest gains out long.

February 5 -

Tax exemption concerns — though an elimination is unlikely — and the loss of federal stimulus will "most assuredly pull forward delayed issuance, with the first half of 2025 volume to exceed second half volume," said James Welch, a municipal portfolio manager at Principal Asset Management.

February 4