-

Total volume currently stands at $224.13 billion, up 38.5% from $161.848 billion at this time last year. As the end of the first half approaches, several firms are revisiting their supply projections for the year, given the growth so far this year.

June 25 -

With the "pretty good run" month-to-date, it would not be unexpected to see "the market take a breather, and with a large calendar this coming week, it may again move sideways," said AllianceBernstein strategists in a weekly report.

June 24 -

A 2023 U.S. Appeals Court ruling derailed federal approvals for the Uinta Basin Railway, which plans to seek up to $2 billion in private-activity bonds.

June 24 -

Broker-dealer Millennium will provide clients with real-time pricing and trade execution capabilities by connecting directly to the Investortools Dealer Network, or IDN.

June 24 -

The low-investment-grade offering for a high-profile public private partnership stood out in a crowded airport sector.

June 24 -

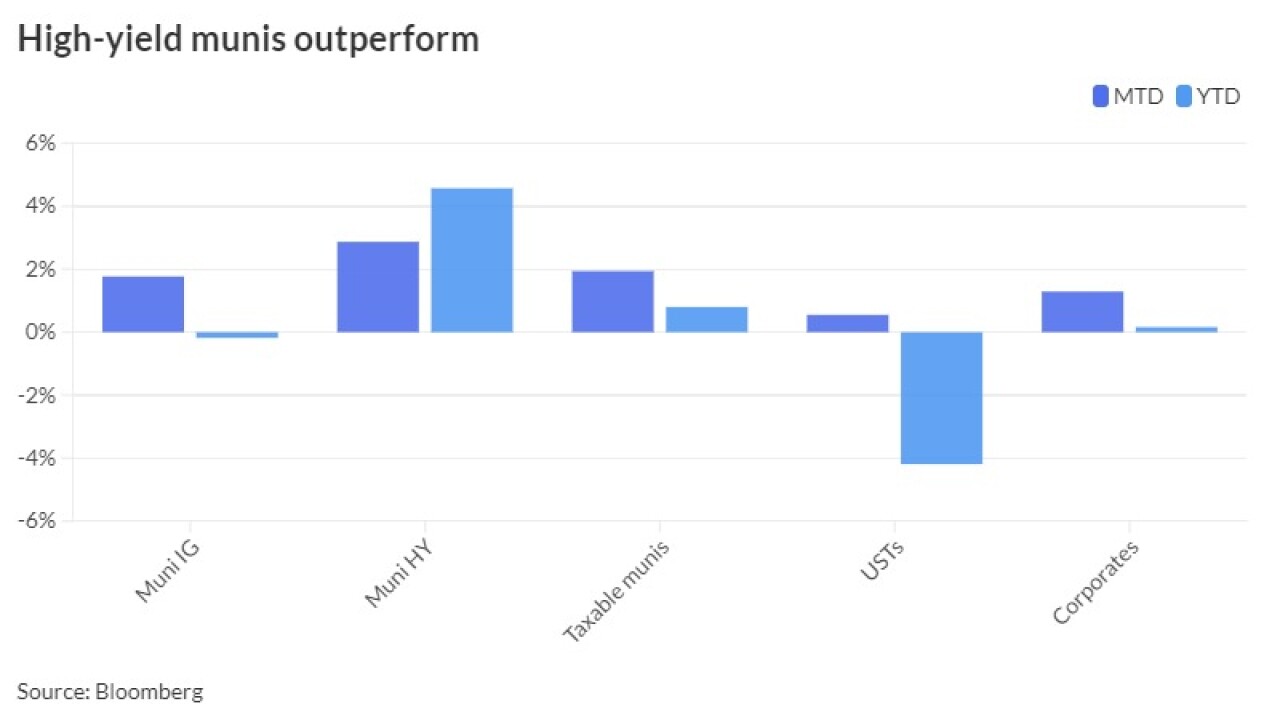

"It is hard to be overly excited about current valuations of tax-exempts relative to Treasuries; however, at tax-adjusted yields (using individual tax brackets), munis look quite attractive compared with other asset classes," noted Barclays PLC.

June 21 -

S&P Global Ratings dropped Houghton University to BB-plus from BBB-minus, citing a track record of deficits plus a large operating shortfall.

June 20 -

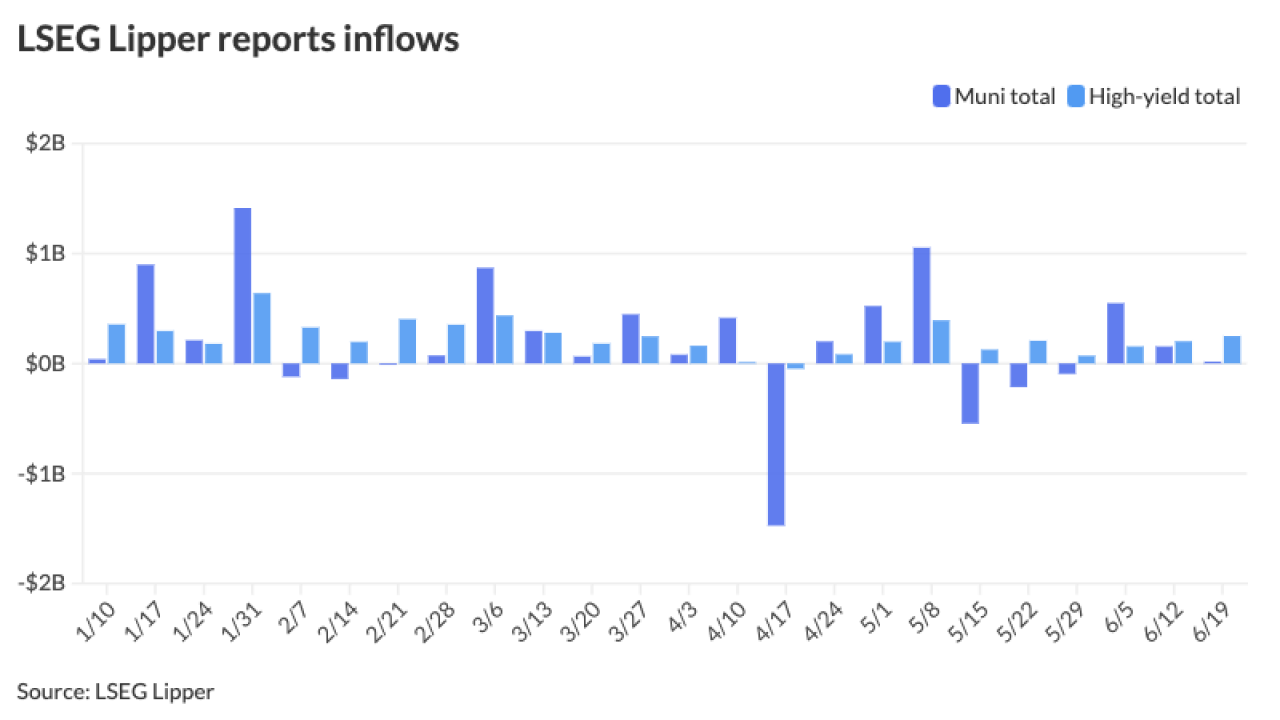

Municipal bond mutual funds saw small inflows as investors added $16.4 million to the funds after $154.4 million of inflows the week prior, according to LSEG Lipper.

June 20 -

The state's new law requires companies like investment banks to provide written verification of their positions, part of a trend among similar bills aimed at preventing Wall Street banks from lying about their positions, said a firearms industry lobbyist.

June 20 -

Issuance this year is "well on its way" to $450 billion, mostly from the tax-exempt supply of new money projects, said Matt Fabian, a partner at Municipal Market Analytics.

June 18