-

The Los Angeles school district was at the forefront of a Build America Bond refunding wave with its $2.9 billion deal.

November 15 -

This month is experiencing similar volatility as 2016 when generic yields traded higher by 50 to 70 basis points during November of that year, said Kim Olsan, a senior fixed income portfolio manager at NewSquare Capital.

November 14 -

The finance team burned the midnight oil to assemble and market one of the most complex deals in the municipal market this year.

November 14 -

Market reaction to inflation numbers was "tempered," said Richard Flax, chief investment officer at Moneyfarm. But should inflationary pressures hold in 2025, "markets may anticipate that further rate cuts could be limited in scope, suggesting a more cautious investment outlook."

November 13 -

KBRA has placed Chicago's general obligation bond rating on watch for downgrade as the City Council prepares to vote tomorrow on a proposed property tax increase.

November 13 -

Trump's proposed corporate tax cut, if enacted, would further concentrate the buyer base and increase the chance of volatility, said Wells Fargo head of municipal strategy Vikram Rai.

November 13 -

PureCycle Technologies, which bought back its muni bonds earlier this year, continues to sell them on to support its liquidity needs, CFO Jaime Vasquez said.

November 13 -

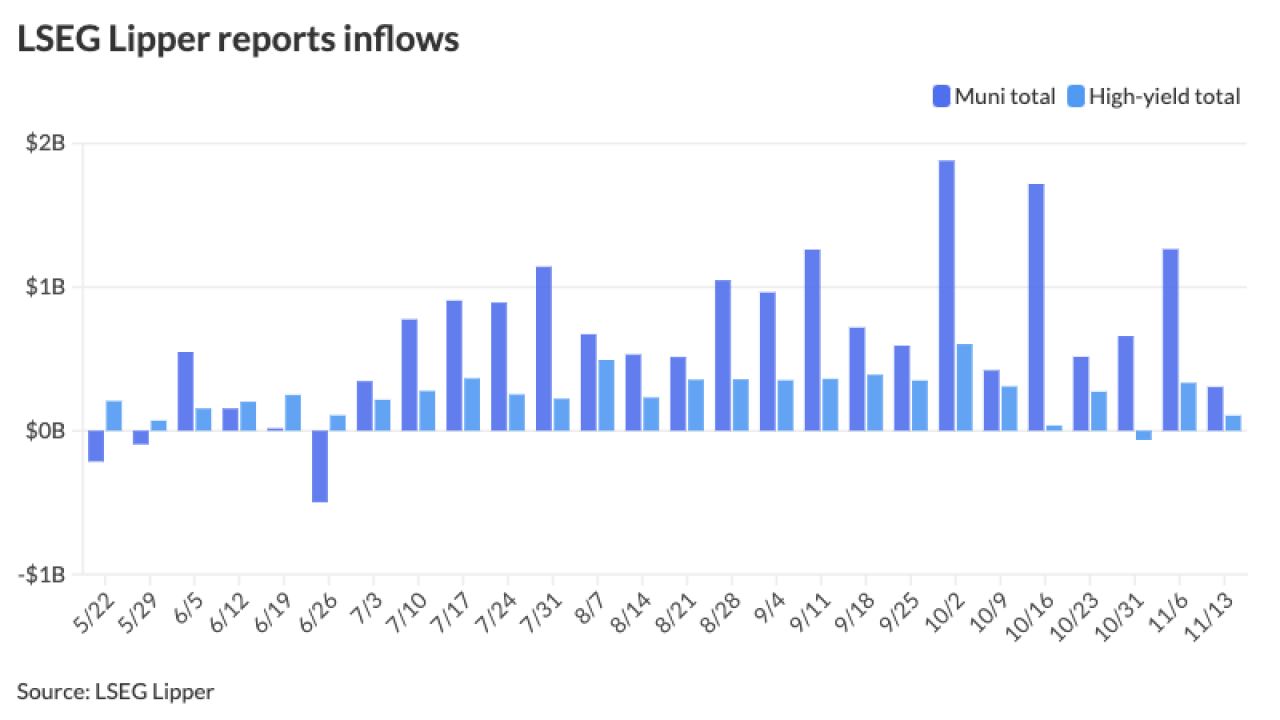

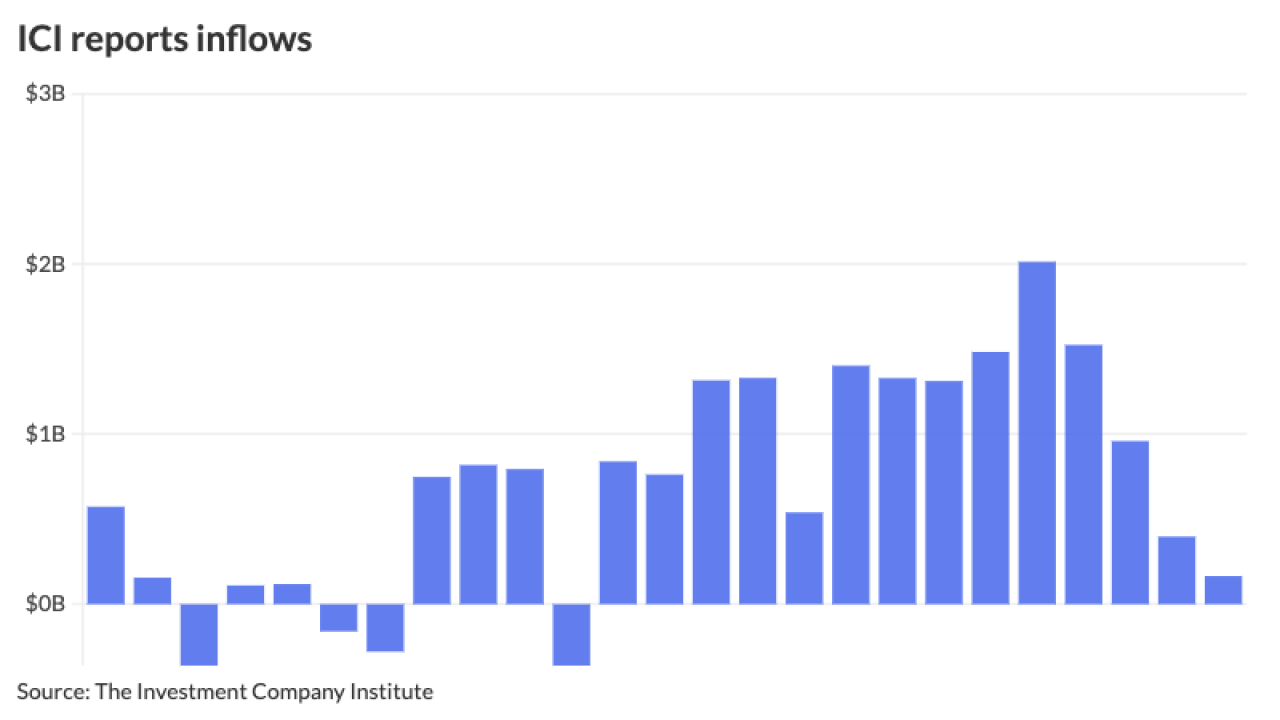

Municipals ignored USTs losses, leading to lower muni to UST ratios and adding to the better performance across the curve and credit spectrum.

November 12 -

The doctrine of separation of powers bars the court from telling him how to invest the county's money, he claims.

November 12 -

The borrower is planning to use a convertible taxable "Cinderella" structure in the wake of a delay in securing tax exemption for a chunk of the deal.

November 12