-

The New York City Transitional Finance Authority leads the new-issue calendar with $2 billion of future tax-secured subordinate refunding bonds.

December 12 -

The well-regarded pediatric hospital system is not alone in facing downgrades amid the myriad challenges healthcare has experienced in recent years.

December 12 -

The final judgment in the case was filed Dec. 10 in the U.S. District Court for the Southern District of New York.

December 12 -

Both Janney and Huntington are among the top 30 underwriters in the muni market and are neck in neck.

December 12 -

Pasadena and the Rose Bowl Operating Co. are suing UCLA, saying plans to relocate football games to SoFi stadium could jeopardize $130 million in revenue bonds.

December 12 -

"With its third straight rate cut, the Fed is sending a clear message: it's no longer just watching inflation — it's managing risk," said Gina Bolvin, president of Bolvin Wealth Management Group.

December 11 -

The bonds are to be used for a variety of projects aimed at recovering from multiple natural disasters that struck Lake Charles in 2020 and 2021.

December 11 -

Muni yields were little changed, and have barely moved over the past several trading sessions, said Kim Olsan, senior fixed income portfolio manager at NewSquare.

December 10 -

AllianceBernstein hired four municipal credit special situations analysts based in its Dallas office.

December 10 -

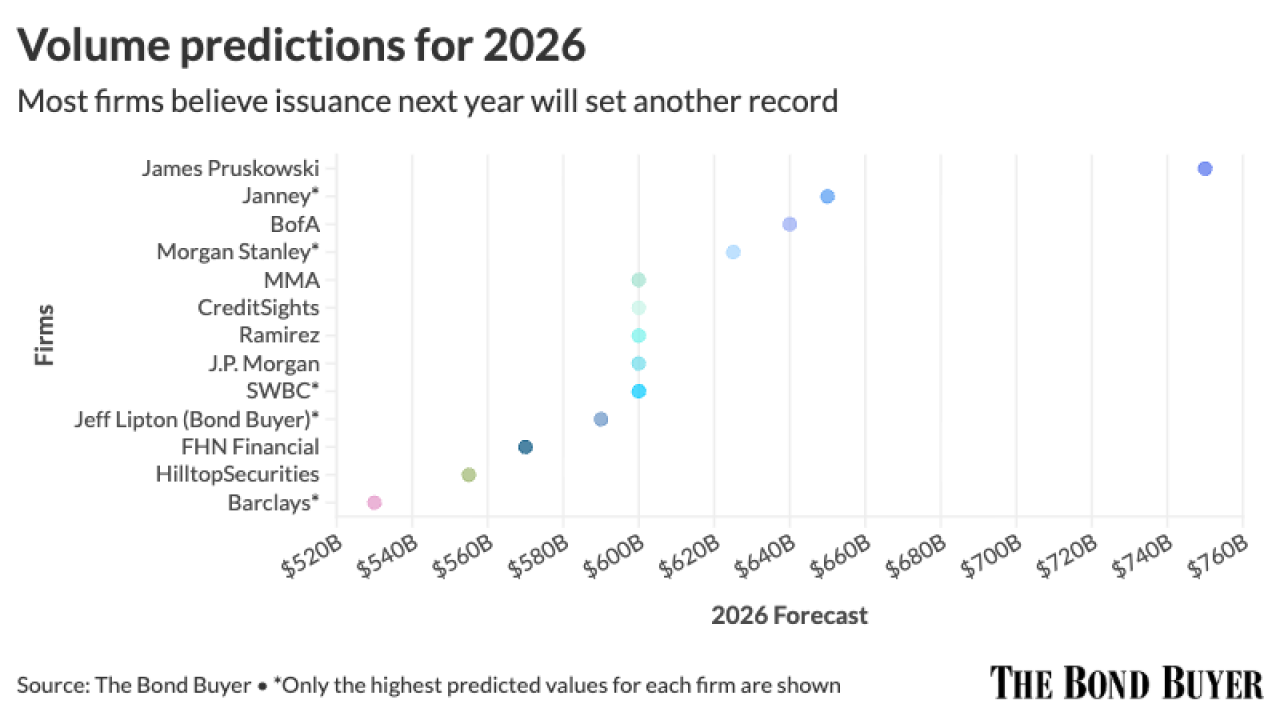

Municipal bond supply projections for next year range from a high of $750-plus billion to a low of $520 billion, with most firms expecting issuance to hover around $600 billion, easily surpassing 2025's record.

December 10