-

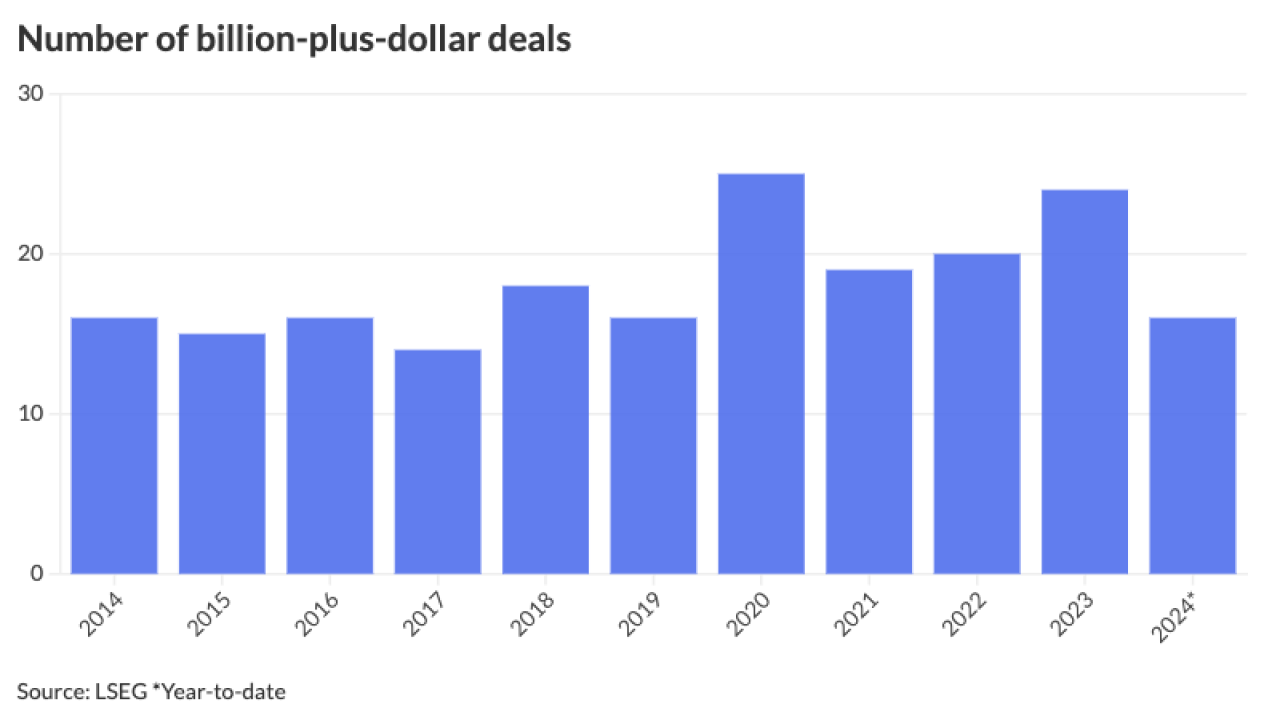

The muni market saw $507.585 billion of debt issued in 2024, up 31.8% from $385.061 in 2023. This surpasses the previous record of $484.601 billion in 2020 by more than $20 billion, per LSEG data.

December 31 -

In Jim McIntire's two terms as state treasurer, he sought to broaden the retail reach of state bond sales and advocated a lower state debt limit.

October 11 -

Issuers in five Far West states increased their borrowing the first half of the year, while four saw sizable decreases.

August 23 -

In the first half of 2024, winding-down federal aid, a resurgence of Build America Bond refundings and election uncertainty have contributed to the surge in issuance, said James Welch, a portfolio manager at Principal Asset Management.

June 28 -

Demand for the increased supply has been "solid" if nearly largely reliant on income-oriented small lot buyers, noted Municipal Market Analytics, Inc. Partner Matt Fabian. Through last week, buyers continued to be separately managed account/retail in size.

June 25 -

More funding went to oil and gas subsidies than into green energy projects in recent years, according to panelists at Milken Institute's Global Conference.

May 10 -

The pace of the issuance and the increase of refundings, surging 59.6% in the first quarter of 2024, have also led some firms to up their overall 2024 issuance projections.

April 11 -

The eight-year, $1.35 billion property tax levy would have to be approved by the City Council before going to voters in November.

April 8 -

The Washington state island hospital's financial turmoil brought rating downgrades from Moody's Ratings.

March 27 -

The calendar is led by several high-profile deals, including $2.7 billion of GOs from California, $1.5 billion from New York City and $1.1 billion from Washington. High-yield gets another dose of unrated project finance debt from Miami Worldcenter Project tax increment revenue bonds. The Bond Buyer 30-day visible supply sits at $12.06 billion.

March 22 -

The Washington refunding deal is built on an extraordinary optional redemption of Build America Bonds despite criticism from investors who hold them.

March 22 -

Raymond James' 10 hires include six senior bankers and an entire Citi public finance team focused on California.

March 11 -

Washington state lawmakers approved a $14.6 billion two-year transportation budget, a $1 billion increase.

March 1 -

"I think we are starting toward higher volume," said Raul Amezcua, senior director at Samuel A. Ramirez & Co.

February 23 -

Moody's Investors Service cited thinning operating performance for the downward outlook revision.

January 30 -

After the year-end rally, "2024 bond investors have been reluctant buyers, prices creeping lower perhaps until the data and the Fed's next steps are more clear," said Matt Fabian, partner at Municipal Market Analytics.

January 23 -

Growing new-issue supply is "adding to bidders' 'wait-and-see' mentality with a variety of credits coming to market at favorable spreads," said FHN Financial's Kim Olsan. Next week's calendar hits $8.4 billion.

January 19 -

Opponents of the state's capital gains tax will turn their efforts to a repeal ballot initiative following rejection by the high court.

January 18 -

S&P's outlook revision to positive means there is a one-in-three chance the state could have its AA-plus rating upgraded to AAA over the next two years.

January 12 -

Three districts are under Washington's state fiscal oversight and the largest, Marysville School District, took a multi-notch Moody's bond rating downgrade.

January 4