-

Conference sponsorships targeting bond firms led Mayor John Whitmire to call for a probe into actions by Controller Chris Hollins, who denied any wrongdoing.

October 18 -

Houston and other Texas cities face financial pressure caused by weather disasters, public safety salaries and pensions, or capped property tax collections.

October 15 -

The Dallas-based financial services firm, which launched a public finance business in May, announced a staff expansion.

October 7 -

The Texas city expects to finance 72% of the expansion program, which includes an arrivals and departures hall, with general airport revenue bonds.

October 1 -

Litigation in Arizona, Oklahoma, Texas, and Utah could determine bond issuance, culpability for defaults, or the constitutionality of underwriter bans.

October 1 -

September volume came in over $44 billion leading volume year-to-date to hit more than $380 billion, just shy of 2023's full-year total issuance.

September 30 -

Ramirez & Co. continues growth plans with the addition of bankers in Texas, Florida and New York.

September 27 -

Dan Callahan joined UMB Bank as a senior vice president and public finance banker.

September 25 -

They new hires will serve various functions in different regions of the country.

September 24 -

Water agencies in Texas, Oklahoma, and Denver are selling a combined nearly $2 billion of triple-A-rated bonds this week.

September 24 -

"Should September's positive returns hold as we expect, it would mark the fourth consecutive month of positive total returns — the first such period since the five-month period spanning from March through July 2021," BofA strategists Yingchen Li and Ian Rogow said.

September 20 -

The city of Clyde defaulted in August and recently revealed it used debt proceeds for debt payments in a manner that "disguised the deficit cash flow."

September 19 -

Up to $182 million of bonds will be issued by a city of Frisco entity to renovate Toyota Stadium, home to Major League Soccer's FC Dallas.

September 18 -

A negative outlook for the city's AA rating by Fitch Ratings follows similar action taken by S&P Global Ratings in July.

September 16 -

The passage of a $11 billion plan, which aims to fully fund police and fire pensions in 30 years, comes as the retirement system is pushing its own plan in court.

September 12 -

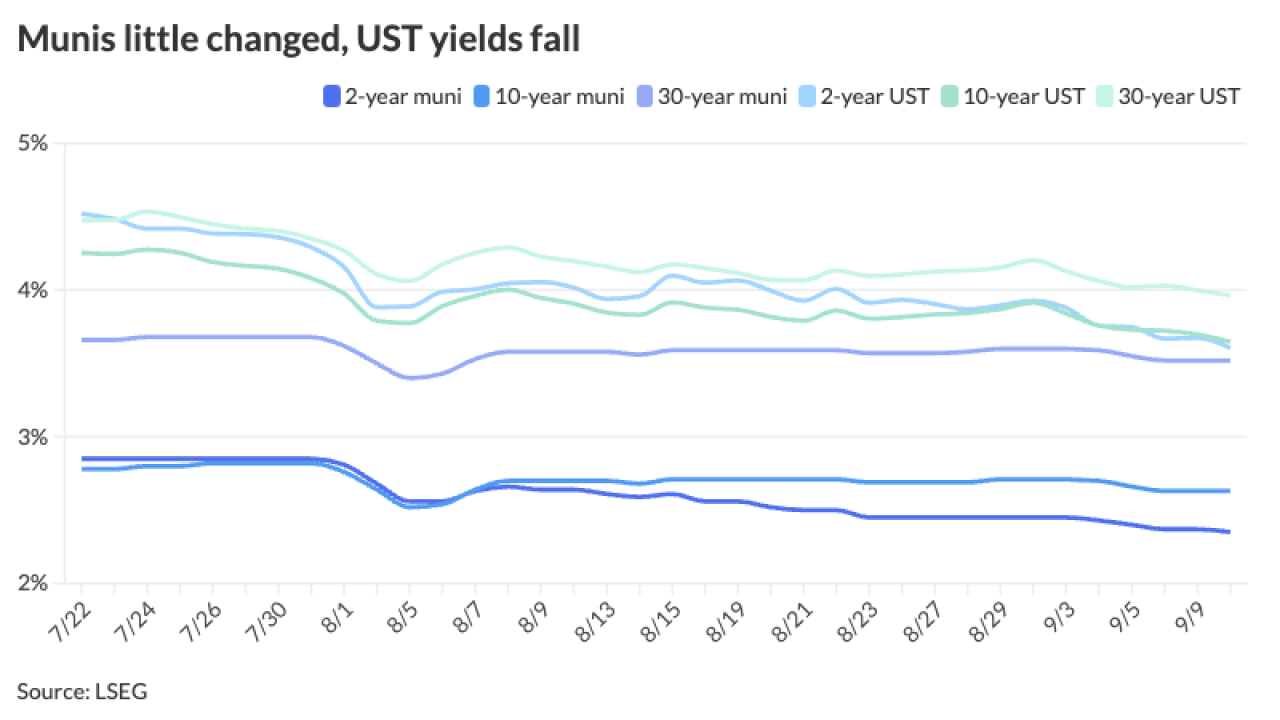

Municipals lagged the UST moves again, cheapening ratios and creating a valuable entry point for investors looking for compelling taxable equivalent yields, particularly 10-years and out.

September 10 -

Houston-based Texas Children's Hospital plans to sell about $222 million of tax-exempt, fixed-rate revenue bonds this week.

September 10 -

Stagnant per-pupil state funding amid rising costs led to budget deficits, lower reserves, and ballot proposals to raise property tax rates for some districts.

September 10 -

Municipal bond mutual funds saw inflows as investors added $956 million to funds after $1.047 billion of inflows the week prior, according to LSEG Lipper.

September 5 -

The Investment Company Institute reported more than $1.3 billion of inflows into muni mutual funds. The last time inflows topped $1 billion, per ICI data, was for the week ending Feb. 7. LSEG Lipper has reported weeks with $1 billion plus inflows on July 31 and May 8.

August 28