-

Membership in the Streamlined Sales Tax Governing Board is voluntary, but the Supreme Court ruling may serve as an impetus for more states and e-commerce retailers to join.

July 6 -

Sen. Jon Tester, D-Mont., and co-sponsors of a recently offered bill want to prevent businesses in their states from being forced to collect sales taxes from e-commerce transactions.

July 3 -

With the need for Congressional action lessened, governors and state legislatures can focus on fine tuning their own laws, officials said.

June 22 -

Thursday's 5-4 ruling involves a 2016 law enacted by South Dakota requiring out-of-state e-commerce retailers to collect sales tax if they have more than 200 transactions annually or $100,000 in sales within the state.

June 21 -

States could gain $8 billion to $33.9 billion in additional annual revenue if the high court rules in favor of South Dakota, while a loss would mean the status quo.

June 8 -

Tax administrators will consult with governors and governors, in turn, will consult with their legislatures before responding to any of several possible rulings in the case by the high court, officials said.

June 1 -

Many lawmakers in Congress have deferred to the high court on the issue in the belief that helping state and local governments collect sales tax for e-commerce might be construed as a new tax rather than an enforcement measure.

May 7 -

The case involves as much as $100 billion in state and local sales tax revenue over the next decade, according the e-commerce retailers that are defendants in the lawsuit.

April 18 -

The justices and attorneys both sides in a case involving South Dakota all appeared to prefer action by Congress to regulate this area of interstate commerce that has been forced on the high court by legislative gridlock.

April 17 -

A high court ruling on online sales taxes that favors the states “could gradually improve long-term revenue growth prospects,” Fitch said.

April 16 -

The report illustrates how federal, state and local laws must be changed if the Supreme Court rules in favor of South Dakota and against Wayfair Inc. in an online sales tax case.

March 27 -

The Trump administration and a bipartisan group of four senators weigh in on the states' ability to collect online sales taxes in friend-of-the-court briefs filed with the Supreme Court.

March 6 -

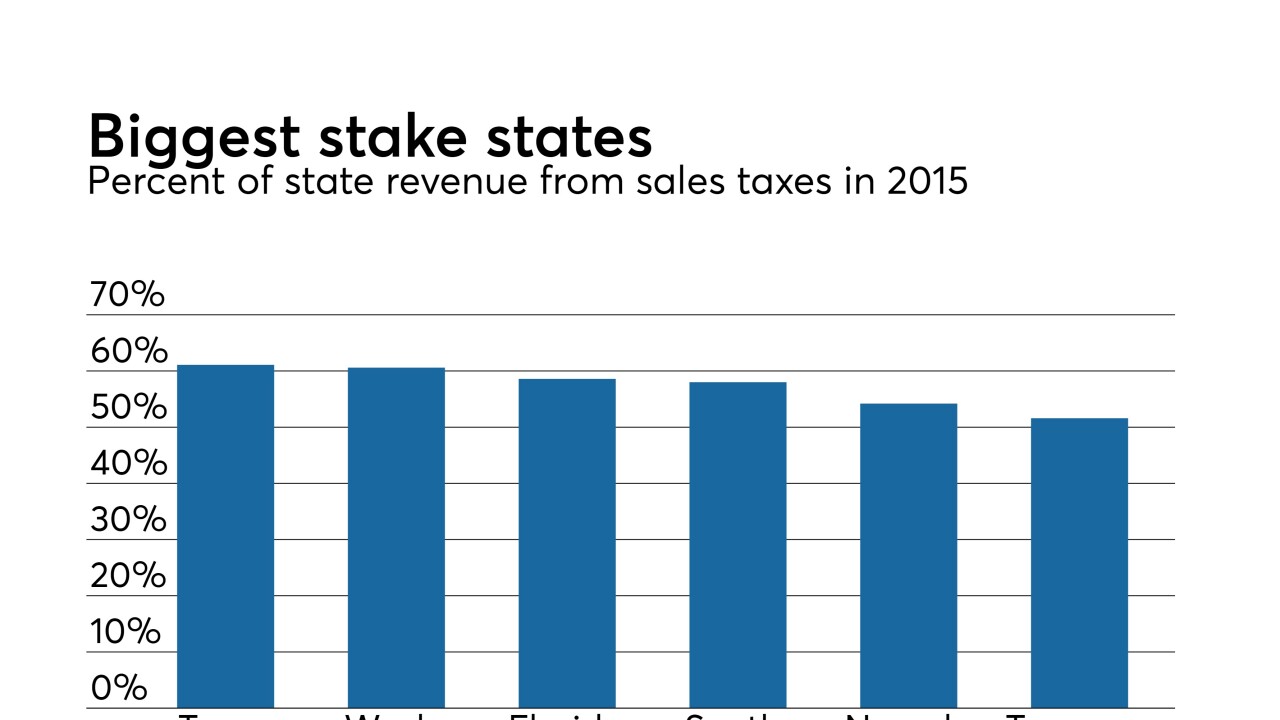

South Dakota, which has no state income tax and relies on sales and use taxes for much of its revenue, will make its oral arguments to the high court on April 17.

February 27 -

Issuers in the Midwest sold $82.98 billion of debt last year, a 5% drop from 2016.

February 27 -

If the debate leading up to a Wessington Springs School District bond election is any indication, residents can expect a close race when polls close Nov. 28.

November 20 -

It's back to the drawing board for Groton Area School District.

April 12 - Michigan

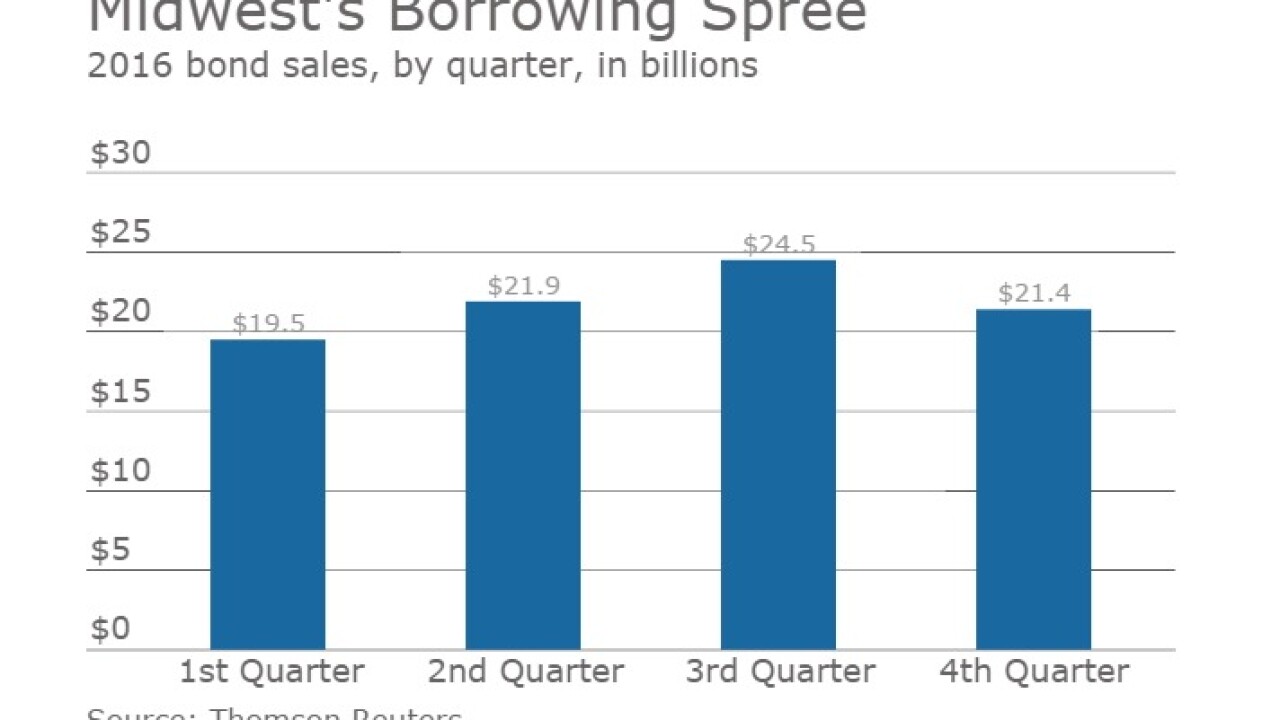

Issuers in the Midwest sold $87.2 billion of municipal bonds in 2016, a 23.4% year-over-year increase that was the biggest of any region.

February 14 - Missouri

The issuers of the Midwest sold $41 billion of municipal bonds in the first half of 2016, spurred by increased new money issuance, according to Thomson Reuters data.

August 23 - South Dakota

South Dakota can now claim three top-level credit ratings after Moodys Investors Service assigned an initial issuer credit rating of Aaa.

July 12 - South Dakota

South Dakota won a second triple-A rating as Fitch Ratings upgraded the state to AAA citing ample reserve balances and history of maintaining budgetary balance.

June 16