-

The New York Metropolitan Transportation Authority and the Triborough Bridge and Tunnel Authority are planning several note and bond sales this month as well as several remarketings, the MTA said.

March 6 -

The city has again proven to have a resilient economy, with better than budgeted revenues, said Howard Cure, a partner and director of municipal bond research at Evercore Wealth Management LLC.

March 5 -

The city and its related issuers picked financial advisors to work on upcoming bond deals, including GO issuances, TFA deals and water authority sales.

March 4 -

Mr. Fish worked at Bankers Trust Co., Donaldson, Lufkin, & Jenrette and ABN Amro and had served as a chair of the Municipal Analysts Group of New York and been a president of the Society of Municipal Analysts.

March 4 -

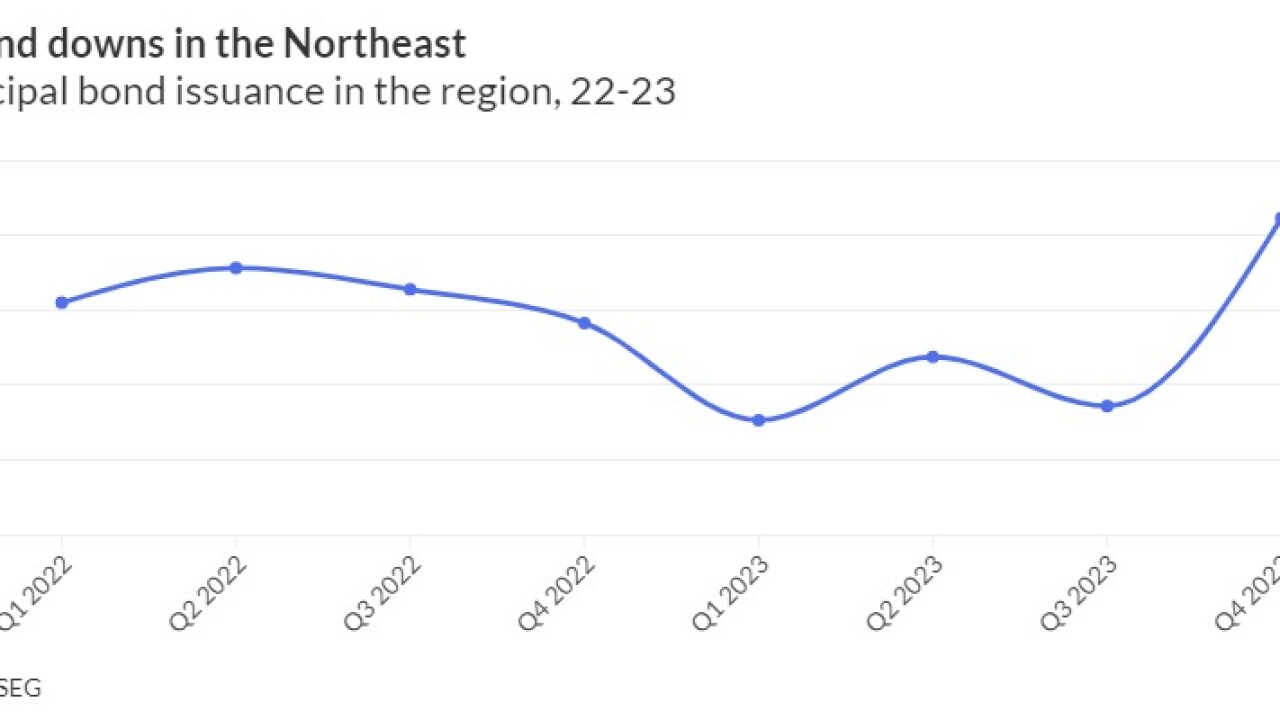

High rates and high inflation, coupled with rich reserves, pushed off or delayed issuers coming to market in 2023, noted James Pruskowski, chief investment officer at 16Rock Asset Management.

March 1 -

Legal challenges to congestion pricing tolls may delay much-needed repairs to the city's transit system, the Metropolitan Transportation Authority said.

February 28 -

Public finance lawyers Alison Radecki and Helen Pennock, who come to the firm from Orrick, Herrington & Sutcliffe, will work of of the New York City office.

February 28 -

Based in New York City, Ted Hynes has almost 40 years of experience in the fixed-income markets, the last 15 at Raymond James.

February 26 -

The bonds are rated Aa2 by Moody's Investors Service, AA by S&P Global Ratings and Fitch Ratings and AA-plus by Kroll Bond Rating Agency. All four rating agencies have a stable outlook on the credit.

February 26 -

An off year from municipal bond issuers in the Northeast in 2023 pulled the national volume numbers into negative territory.

February 26