-

NASBO Executive Director John Hicks said that deposits made to rainy days funds from budget surpluses will likely bring the total to more than $58 billion for fiscal 2018.

August 29 -

Such a move might allay fears in the capital markets while removing lawmakers from decision-making, according to consultant Jim Millstein.

August 29 -

New Jersey Gov. Phil Murphy cut an education bond measure to $500 million from $1 billion.

August 28 -

Wilshire Consulting said the aggregate funded ratio for U.S. state pension plans remained unchanged between and first and second quarters of 2018 at 70.8%, up 0.7 percentage points from the previous 12 months.

August 27 -

The proposed Treasury rules would limit states' use of charitable deductions as workarounds for the $10,000 cap on the federal deduction for state and local taxes.

August 23 -

The state is still measuring tax revenue from sports betting in the thousands of dollars.

August 22 -

Former New Jersey State Senator Ray Lesniak discusses his lengthy journey fighting to legalize sports betting and the revenue impact wagers will have on the Garden State and nationally. Andrew Coen hosts.

August 21 -

Moody's Investors Service raised the county to Aaa from Aa1.

August 20 -

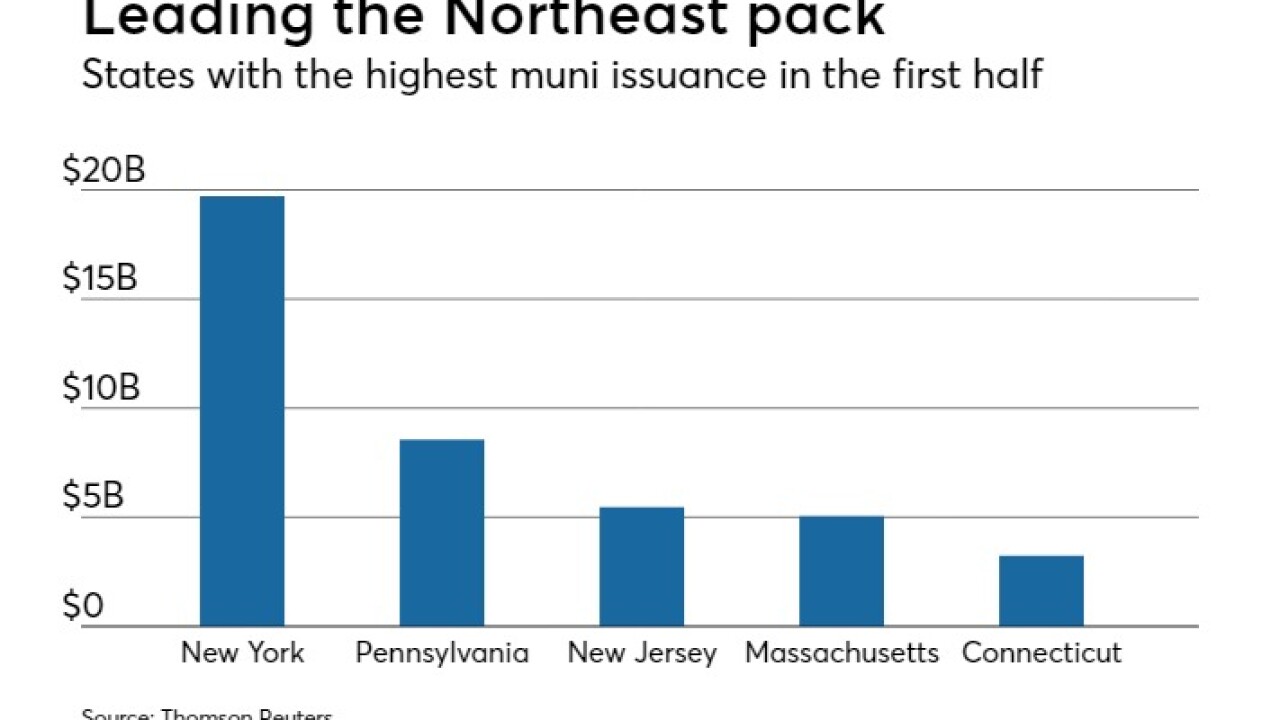

Northeast municipal bond issuance sank 11.7% in the first half of 2018 compared to a year earlier, reflecting a national trend driven by federal tax changes.

August 17 -

Two new Atlantic City casinos and the debut of legalized sports betting boosted the gambling take.

August 16 -

Gov. Phil Murphy signed a bill authorizing greater use of public-private partnerships.

August 15 -

Moody's Investors Service cut its rating to A2 from A1.

August 14 -

Recommendations released by a bipartisan New Jersey panel last week aimed at attacking the state’s beleaguered finances centered largely on combating soaring pension and benefit costs.

August 13 -

The authority received upgrades from Moody’s on its two variable rate debt issues backed by bank letters of credit.

August 7 -

The Trump administration’s effort to publish a proposed rule comes just over two months after the IRS announced May 23 it was working on the regulations to enforce the $10,000 cap on what previously was an unlimited personal deduction of state and local taxes, also known as SALT.

August 6 -

New Jersey’s shift toward giving firefighters and police officers control of their pension fund decisions may hamstring future efforts to control benefit costs, according to Moody’s Investors Service.

July 30 -

Tax Reform 2.0 would make permanent the lower individual tax rates in last year’s Tax Cuts and Jobs Act that are scheduled to expire in 2025.

July 26 -

A Civil War-era revenue measure is the centerpiece of the arguments in the lawsuit filed by four northeastern states.

July 18 -

New Jersey's legal sports books reported $3.5 million in June revenue from $16 million in bets, according to a state report.

July 17 -

New Jersey Gov. Phil Murphy’s administration is targeting a plan that would save more than $100 million in annual public-worker benefits as the next focus of trying to steer state finances toward better health.

July 16