-

It's not just the "right" thing to do; it's good for business, say the Freda Johnson Award winners, Massachusetts Treasurer Deborah Goldberg and Ballard Spahr's Emilie Ninan. They discuss how diversifying the industry is key to growth and success. Lynne Funk hosts.

December 6 -

Tax-exempt munis have now regained late September levels, and November's rally has eclipsed October's selloff, MMA notes in a weekly report.

November 29 -

Triple-A curves were a touch firmer in spots as secondary trading took a backseat to the larger primary activity with Connecticut and Massachusetts pricing general obligation bonds, a large CommonSpirit healthcare and several competitive issues led by Rhode Island GOs.

October 18 -

"Despite a pick-up in volatility in the rates market, municipals have been performing relatively well in October," according to Barclays PLC.

October 14 -

The rating outlook boost to positive from stable follows recent progress on steadying reserve rates and paying down debt, S&P said.

October 11 -

The October event will feature private and public sector experts on education, community development and ESG.

September 30 -

Massachusetts Treasurer Deborah Goldberg talks about the Bay State's economic recovery, the largest ESG bond deal ever done in the municipal space and special state initiatives such as promoting diversity and inclusion and creating a Baby Bond taskforce. Chip Barnett and Thomas Nocera host. (22 minutes).

September 13 -

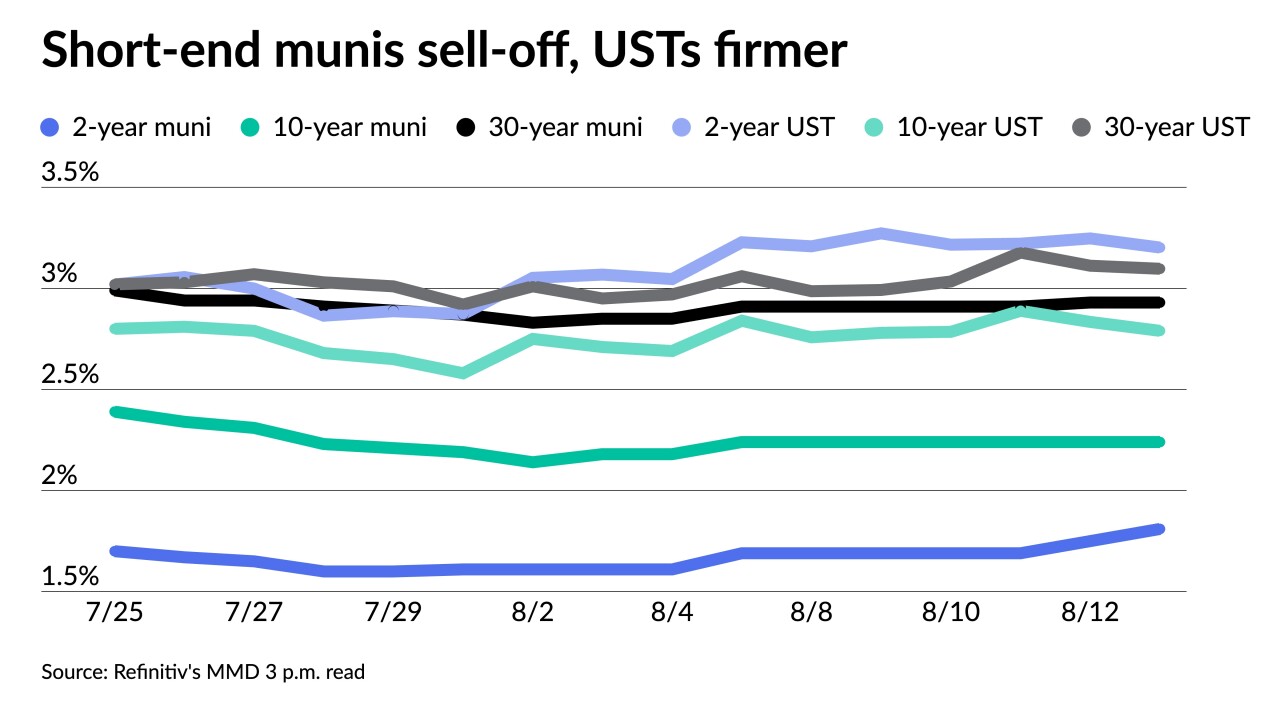

"Demand for low-duration tax-exempts has been so strong that short maturity benchmark yields are now lower than the after-tax yields for comparably rated benchmark taxable muni and corporate bonds," said CreditSights strategists Pat Luby and John Ceffalio.

August 15 -

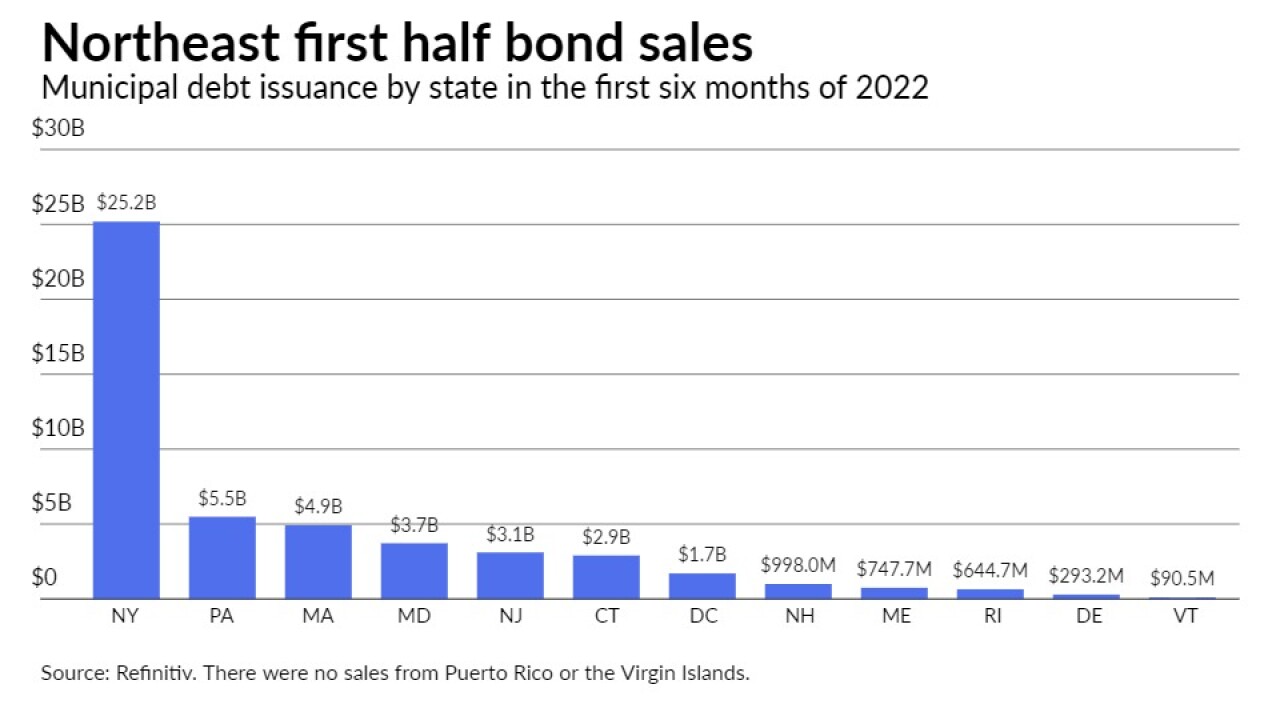

The Northeast's issuers sold $49.69 billion of municipal bonds in the first half of 2022, down more than 18% year-over-year.

August 12 -

Massachusetts had temporarily delayed the $2.7 billion sale as state lawmakers debated additional funding for the state's unemployment trust fund.

August 11