-

Other post-employment liabilities are more material problems for one in ten state and local governments, according to Moody's Investors Service.

August 27 -

Honolulu plans to price $725.4 million of double-A-plus GOs next week; a significant chunk of the deal will support Oahu's troubled rail transit project.

July 15 -

Hawaii lawmakers made changes to the budget this week in response to a flurry of vetoes from Gov. David Ige.

July 9 -

Hawaii lawmakers approved the budget before Treasury guidance banned the use of federal funds for debt payments or reserves.

July 7 -

Under Hawaii's system, the governor, David Ige, signals his intent to veto and then negotiates with lawmakers before making them formal.

June 24 -

A reported preliminary 25.8% drop in May issuance shows how strong fund inflows, improving credit and the reopening of governments are keeping the muni market issuer friendly.

May 26 -

Strong technicals have been the theme, and with federal aid and better-than-expected tax receipts coming in, issuers are not tapping the market as much as investors would hope.

May 21 -

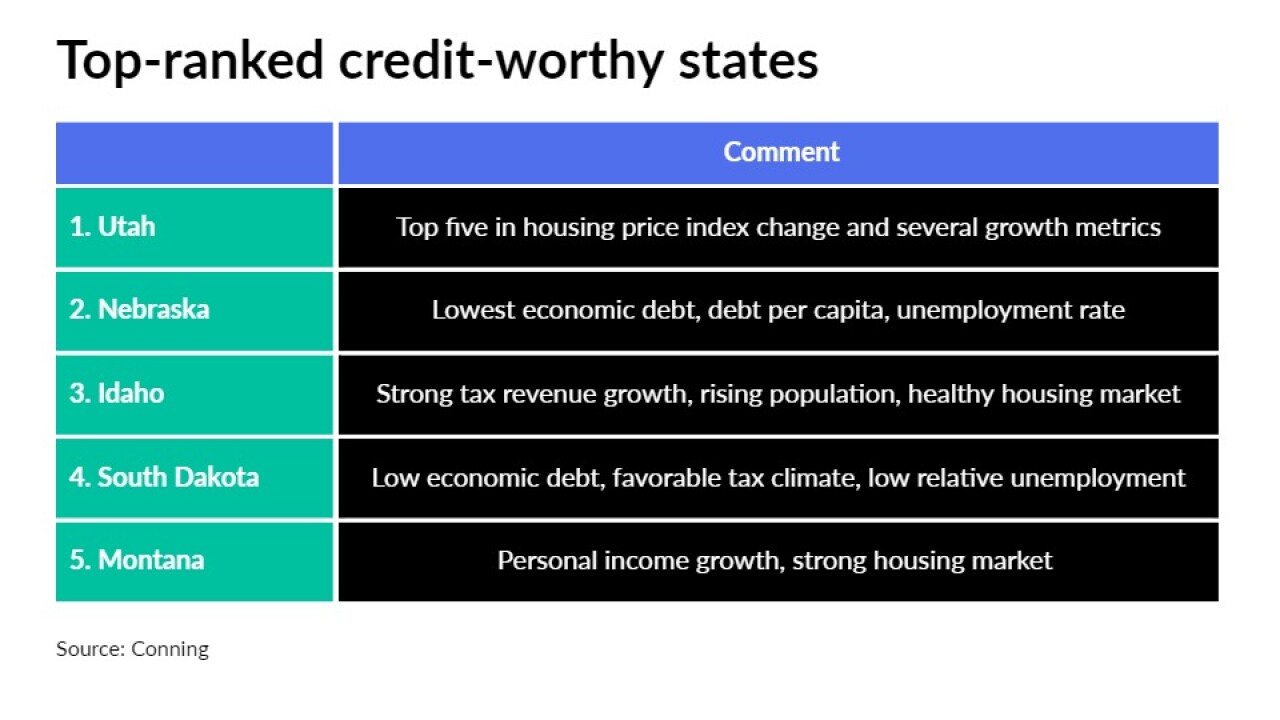

States are well-positioned to emerge from COVID-19, the investment firm said in its annual grading.

May 18 -

Tax-exempt bonds issued for a private hospital system in Honolulu fell further into junk territory with S&P Global Ratings downgrading the bonds to CCC from B-minus.

March 29 -

Far West municipal issuers sold $99.1 billion of debt last year, a 16% increase from 2019.

March 4 -

Hawaii's governor announced that state employees would be furloughed two days a month; the state sold $750 million of GO bonds in October to fund operations.

December 10 -

Oahu's 20-mile rail project could lose $250 million in federal funding if the Federal Transit Administration doesn't grant an extension.

December 2 -

The state is easing a strict quarantine requirement that has left its all-important tourism industry with very few tourists.

October 15 -

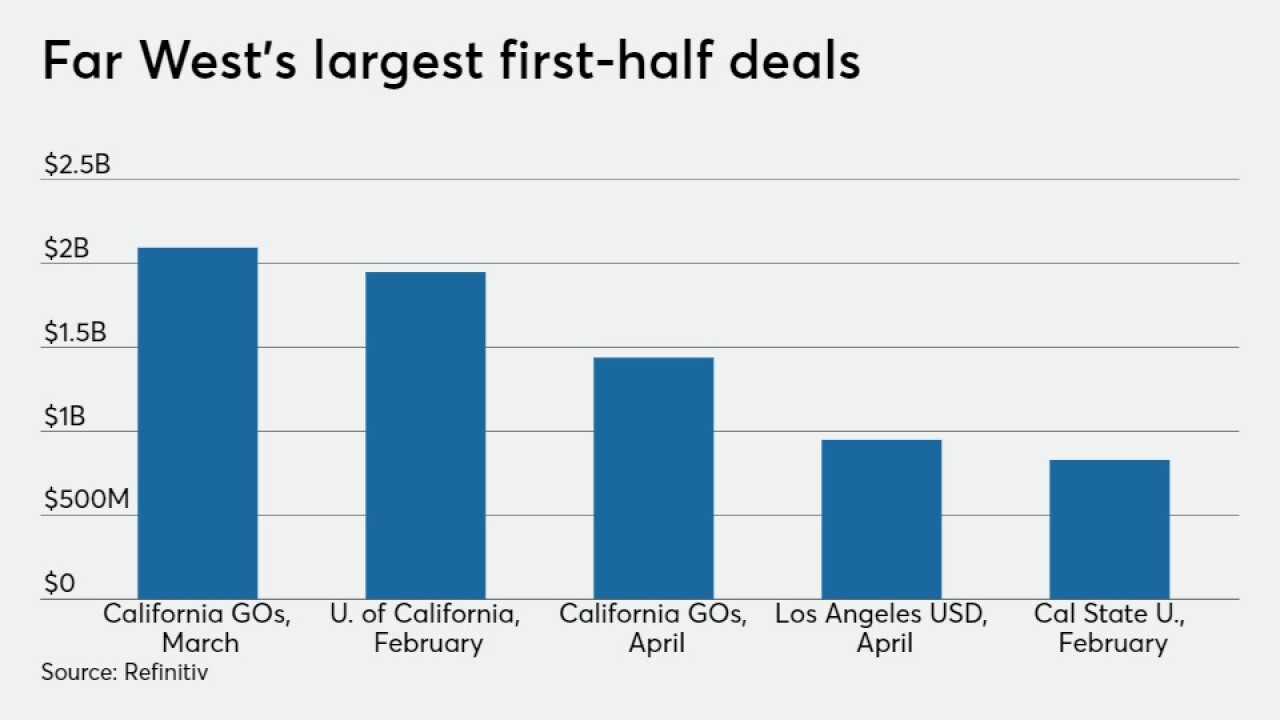

Municipal issuers in the Far West sold $38.7 billion in bonds during the first six months of 2020, 8.8% more than they did the year before.

August 27 -

Total municipal CUSIP requests fell in July after three months of increases, according to CUSIP Global Services.

August 5 -

The drop in tourism amid the coronavirus pandemic has resulted in a downgrade of Hawaii's ratings by Moody’s Investors Service affecting $9 billion in outstanding debt ahead of the state’s plans to price $900 million of taxable bonds Wednesday.

August 4 -

Municipal bonds were little changed on Monday ahead of this week's new-issue calendar.

August 3 -

Municipal bonds finished out the month on a strong note, with yields dropping by as much as two basis points on Friday.

July 31 -

Hawaii struggles to close shortfall while crafting reopening plan.

May 20 -

Fitch Ratings lowered its outlook on Hawaii's AA-plus rating to negative from stable, following a similar action by Moody's earlier this month.

April 27