Municipals continued to rally on the long end Wednesday, with yields dropping by as much as two basis points on the AAA scales.

Buyers saw more new issues come to market, which despite lowered yields were greeted with open arms.

“When the market rally in early May pierced the 1% level in 10 years and long bonds lost their 2% handle (5% AAAs), there were questions as to the sustainability that pre-dated the March selloff,” according to FHN Financial Senior Vice President Kim Olsan. “Then in early July intermediate bonds hit new lows and the curve steepened a bit, so that long yields had more implied value. Currently, the 10-year AAA sits at 0.60%, the one- to 30-year slope is 19 basis points flatter and general benchmark yield gains show no signs of slowing down.”

She said that many new deals are being heavily oversubscribed with yields on some maturities being lowered — which is either leading secondary bidding or following it.

“Regardless, the simple equation of more bonds leaving the market than coming in is strengthening bidders’ resolve,” Olsan said. “The combination of a smaller share of tax-exempt float and reduced bids-wanteds activity is additional fundamental support taking yields to new low ranges.”

She also noted a change in coupon structure.

"Past 15 years there is a dichotomy of heavy bank/insurance company inquiry driving coupons down for maximum yield and more traditional 5%-coupon demand,” she said. “A growing number of issues are being structured with sub-2% coupons, where the yield concession is 50 basis points or more to 5s.”

Primary market

BofA Securities issued price guidance on Hawaii’s (Aa2/AA+/AA/NR) $900 million of Series 2020FZ taxable general obligation bonds. The deal is expected to be priced on Thursday.

The bonds were seen being priced at about 50 basis points over the comparable U.S. Treasury in 2025 to around 110 basis points above Treasuries in 2040.

On Friday, Moody’s Investors Service lowered the

BofA priced the City and County of San Francisco Airport Commission’s (A1/A/A+/NR) $161.9 million of tax-exempt and $130.335 of taxable revenue bonds for the San Francisco International Airport.

The Series 2020A second series revenue refunding bonds subject to alternative minimum tax were priced to yield from 1.75% with a 5% coupon in 2027 to 2.01% with a 4% coupon in 2040.

The Series 2020B second series revenue refunding non-AMT governmental purpose bonds were priced to yield from 1.60% with a 4% coupon in 2037 to 1.76% with a 4% coupon in 2040.

The Series 2020C taxable second series revenue refunding bonds were priced at par to yield 2.958% in 2051.

Raymond James & Associates priced the Leander Independent School District, Texas’ (NR/AAA/NR/NR) $127.942 million of unlimited tax school building and refunding bonds.

The issue is backed by the Permanent School Fund guarantee program.

The Series 2020A school building bonds were priced to yield from 0.44% with a 5% coupon in 2026 to 1.56% with a 3% coupon in 2040. A 2045 maturity was priced to yield 1.54% with a 4% coupon and a 2050 maturity was priced to yield 1.76% with a 3% coupon.

The Series 2020B refunding bonds were priced with 4% coupons to yield 1.43% in 2041 and 1.54% in 2045.

JPMorgan Securities priced Anchorage, Alaska’s (NR/AAA/AA+/NR) $112.18 million of general obligation bonds

On Thursday, Morgan Stanley is expected to price the Waco Education Finance Corp., Texas’ (/A+/A+/) $217.325 million of taxable revenue and refunding bonds for Baylor University.

CUSIP: New requests drop in July

Municipal CUSIP request volume decreased in July after three months of increases, according to CUSIP Global Services. Issuance of new security identifiers can be an early indicator of debt activity over the next quarter.

The aggregate total of all municipal securities — including municipal bonds, long-term and short-term notes and commercial paper — fell 10.1% to 1,582 from 1,760 in June. July’s decline came after a 14.7% increase in June.

However, requests for short-term notes with maturities less than a year increased 31.8% to 170 in July during the annual peak notes issuance season from 129 in June.

On an annualized basis, total municipal CUSIP identifier request volumes are up 11.9% to 8,927 through July compared to 7,981 in the same period in 2019.

For municipal bonds alone, CUSIP requests in June fell 11.7% to 1,240 from 1.404 in June; they are up 14.6% to 7,256 on an annualized basis from 6,329 in the same period last year.

North American corporate bond requests totaled 4,086 in July, down 19.4% from June.

"Corporate and municipal debt issuers had been ramping up access to liquidity for the last several months, but that trend changed in July,” said Gerard Faulkner, director of operations for CGS. “While annualized volumes are still telling a story of relatively healthy capital markets, this one-month slow-down in request volume is something market participants may want to watch for any further signs of lower issuance in the second half of the year.”

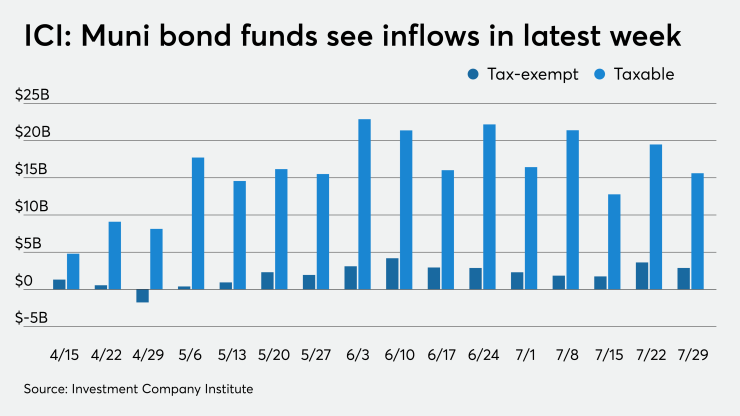

ICI: Muni bond funds see $2.9B inflow

Long-term municipal bond funds and exchange-traded funds saw combined inflows of $2.879 billion in the week ended July 29, the Investment Company Institute reported Wednesday.

It marked the 13th week in a row the funds saw inflows. In the previous week, muni funds saw an inflow of $3.622 billion, ICI said.

Long-term muni funds alone had an inflow of $2.448 billion in the latest reporting week after an inflow of $2.962 billion in the prior week.

ETF muni funds alone saw an inflow of $431 million after an inflow of $659 million in the prior week.

Taxable bond funds saw combined inflows of $15.617 billion in the latest reporting week after revised inflows of $19.477 billion in the prior week, originally reported as a $19.485 inflow.

ICI said the total combined estimated inflows from all long-term mutual funds and ETFs were $6.540 billion after a revised inflow of $13.291 billion in the previous week, originally reported as a $13.299 billion inflow.

Secondary market

On Wednesday, municipals were stronger on the long end once again, according to the final readings on Refinitiv MMD’s AAA benchmark scale.

“Munis are still chugging along to lower yields from five-years and longer,” said Peter Franks, senior market analyst at MMD Refinitiv. “Despite possible credit consequences lurking in the future as COVID 19-related expenses and uncertain tax revenues threaten the finances of state and local governments, muni yields continue to fall as the supply/demand imbalance persists,”

MMD reported yields on the 2021 and 2023 GO munis were unchanged at 0.11% and 0.13%, respectively. The yield on the 10-year muni fell two basis points to 0.62% while the 30-year yield dropped two basis points to 1.32%.

The 10-year muni-to-Treasury ratio was calculated at 114.8% while the 30-year muni-to-Treasury ratio stood at 108.2%, according to MMD.

“Another day, another push lower for muni yields,” ICE Data Services said in a market comment. “All points are now at an all-time low yield. Taxable yields, however, are higher today, up two to four basis points.”

The ICE AAA municipal yield curve showed short yields unchanged at 0.090% in 2021 and 0.102% in 2022. The 10-year maturity was down one basis point to 0.603% and the 30-year dropped two basis points to 1.353%.

ICE reported the 10-year muni-to-Treasury ratio stood at 120% while the 30-year ratio was at 108%.

The IHS Markit municipal analytics AAA curve showed the 2021 maturity yielding 0.09% and the 2022 maturity at 0.12% while the 10-year muni was at 0.64% and the 30-year stood at 1.33%.

Munis were little changed on the MBIS benchmark and AAA scales.

Treasuries were weaker as stock prices traded higher.

The three-month Treasury note was yielding 0.100%, the 10-year Treasury was yielding 0.547% and the 30-year Treasury was yielding 1.222%.

The Dow rose 0.24%, the S&P 500 decreased 0.03% and the Nasdaq lost 0.22%.