-

New Jersey and Illinois have the lowest state bond ratings. But all three states have been ramping up pension contributions, according to S&P Global Ratings.

August 8 -

Private activity bonds for a coffee farm and general obligation bonds for an emergency center were cut with Gov. David Ige's veto pen.

July 14 -

Maui County's mayor now has to approve or veto the budget before the start of the fiscal year on July 1.

June 15 -

As summer beckons, it's time for a reporters' roundtable with some of the Bond Buyer's senior staff. Yvette Shields, Karen Pierog, Keeley Webster and Thomas Nocera talk with Chip Barnett about what's hot in their regions and what municipal bond market participants should expect to see in the months ahead. (25 minutes)

June 7 -

Issuers in California sold more than $86 billion of municipal bonds in 2021.

February 24 -

A whopping 27% increase in revenues in the second half of fiscal year 2021 sets the state up to replenish its reserves and restore positions cut during the pandemic.

January 3 -

The consequences of climate change for this island state are broadly evident. So is its official response.

December 2 Municipal Market Analytics

Municipal Market Analytics -

With a lot of cash still needing to be put to work, the Investment Company Institute showed another large week of inflows at $1.814 billion.

September 29 -

Month-to-date returns for municipals are in the red with the Bloomberg Fixed Income Indices municipal index returning -0.12%, high-yield at -0.15% and taxables at -0.32%.

September 24 -

Both S&P Global Ratings and Moody's Investors Service lifted their outlooks, citing a rebound from pandemic-driven budget pressures.

September 23 -

Other post-employment liabilities are more material problems for one in ten state and local governments, according to Moody's Investors Service.

August 27 -

Honolulu plans to price $725.4 million of double-A-plus GOs next week; a significant chunk of the deal will support Oahu's troubled rail transit project.

July 15 -

Hawaii lawmakers made changes to the budget this week in response to a flurry of vetoes from Gov. David Ige.

July 9 -

Hawaii lawmakers approved the budget before Treasury guidance banned the use of federal funds for debt payments or reserves.

July 7 -

Under Hawaii's system, the governor, David Ige, signals his intent to veto and then negotiates with lawmakers before making them formal.

June 24 -

A reported preliminary 25.8% drop in May issuance shows how strong fund inflows, improving credit and the reopening of governments are keeping the muni market issuer friendly.

May 26 -

Strong technicals have been the theme, and with federal aid and better-than-expected tax receipts coming in, issuers are not tapping the market as much as investors would hope.

May 21 -

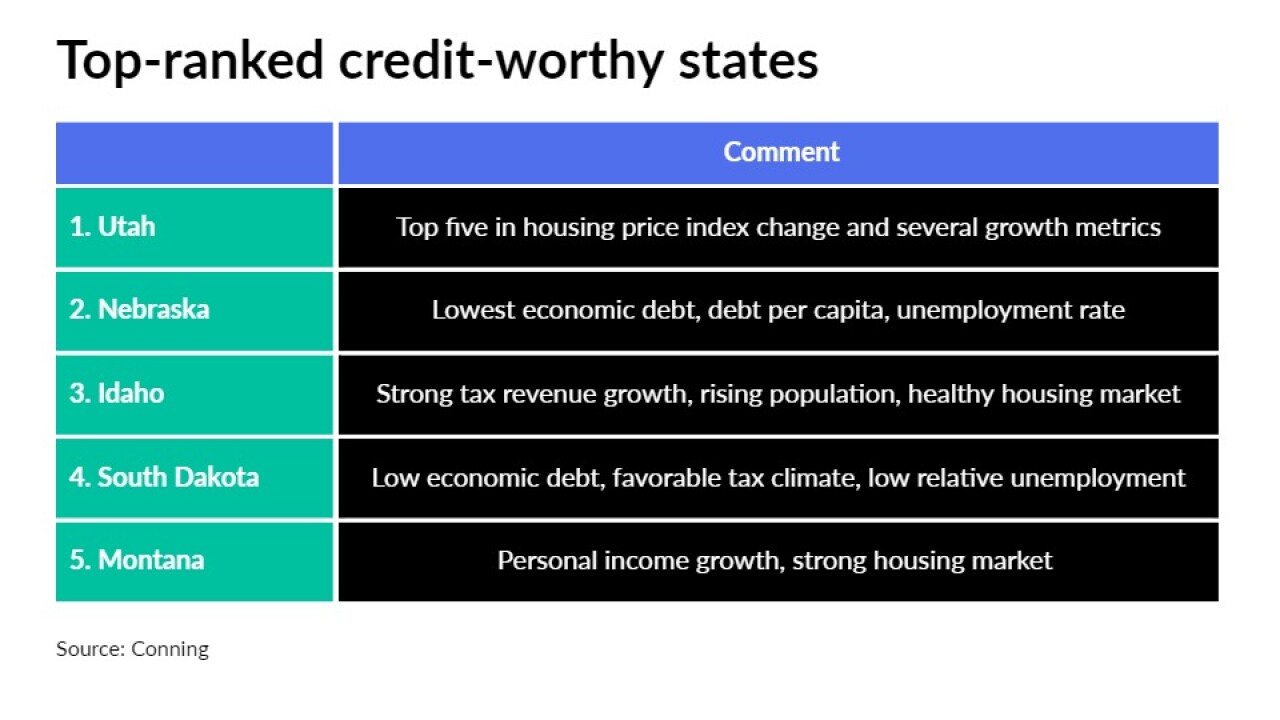

States are well-positioned to emerge from COVID-19, the investment firm said in its annual grading.

May 18 -

Tax-exempt bonds issued for a private hospital system in Honolulu fell further into junk territory with S&P Global Ratings downgrading the bonds to CCC from B-minus.

March 29 -

Far West municipal issuers sold $99.1 billion of debt last year, a 16% increase from 2019.

March 4