-

Mr. Fish worked at Bankers Trust Co., Donaldson, Lufkin, & Jenrette and ABN Amro and had served as a chair of the Municipal Analysts Group of New York and been a president of the Society of Municipal Analysts.

March 4 -

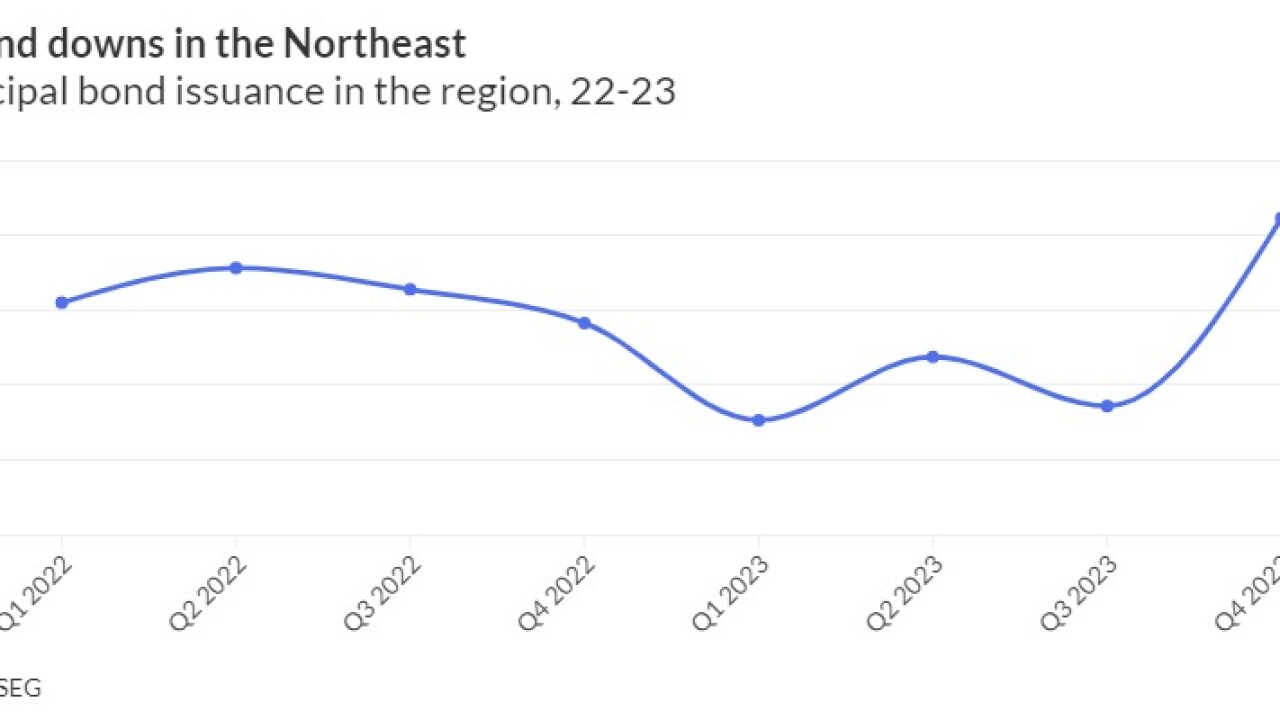

An off year from municipal bond issuers in the Northeast in 2023 pulled the national volume numbers into negative territory.

February 26 -

The top five bond financings have an average dollar volume of more than $917 million.

January 18 -

"The work done by our agency often focuses on the long-term," said Connecticut State Treasurer Erick Russell.

January 5 -

With fears of further Fed hikes subsided, Birch Creek strategists said with "loads of cash still sitting on the sidelines, and expectations that cash will no longer earn 5%+, we believe the muni market will benefit in 2024 from a return of investors looking to allocate to the asset class."

December 18 -

Triple-A yields fell up to five basis points Friday while USTs were mixed. Munis still underperformed taxables on the week, but the setup for the asset class going into yearend is decidedly positive.

December 15 -

The $250 million of new money social bonds will finance public school construction projects, with another $190 million refunding debt issued to build schools.

December 15 -

The top five bond financings have an average dollar volume of more than $1 billion.

December 11 -

The top five bond financings have an average dollar volume of more than $1 billion.

November 13 -

Municipal mutual fund losses continued last week as the Investment Company Institute reporting investors pulled $2.645 billion from the funds in the week ending Oct. 11. ETFs see more inflows, though.

October 18 -

As valuations got richer after muni outperformance this week, Barclays strategists expect munis to be "truly tested in the next several weeks, with supply picking up."

October 13 -

Officials in Connecticut, Massachusetts and Rhode Island say a multi-state coalition will help address the challenges of the new wind energy industry.

October 13 -

KBRA upgraded the long-term rating on the state's special tax obligation transportation infrastructure purposes bonds to AAA with stable outlook from AA-plus ahead of the deal, slated for the week of Oct. 16.

October 11 -

It's the bank's eighth issuance of its climate-certified one-year notes. Buy-in starts at $100.

October 5 -

The Revolution Wind, a 704-megawatt offshore wind farm being developed off Connecticut's coast, received a positive ruling after a federal environmental review.

August 24 -

Connecticut's baby bond trust received its initial funding without the need to borrow with the help of a debt reserve insurance policy.

August 11 -

Moody's Investors Service upgraded the Connecticut capital city's issuer rating to Baa3 from Ba2.

August 7 -

Buy in starts at $100 and the one-year taxable notes carry a 5% coupon rate. The Green Banks is seeking $350,000 for a green energy upgrade program.

June 30 -

Following a two-year delay in implementation, babies born after July 1 in Connecticut whose whose births are covered by the state's Medicaid program will see the deposits of $3,200 into a publicly managed trust fund.

June 29 -

Gov. Ned Lamont signed income tax rate cuts expected to benefit nearly 1 million people in the most comprehensive cut since the income tax was imposed in 1991.

June 13