-

The $10,000 limit on the SALT deduction caused an estimated 10.88 million individual taxpayers to lose $323.1 billion in tax deductions for the 2018 tax year.

December 3 -

He will join Shawn Wooden's staff in Dec. 16 and brings 25 years of financial and management experience in the public and private sectors.

November 26 -

The question of how to pay for the governor's $21 billion, 10-year transportation bill points to the political third rail of highway tolls.

November 15 -

Cross, who served as associate tax legislative counsel at the Office of Tax Policy until Friday, said that he resigned in order to be closer to family.

November 13 -

Paige Cognetti will fill out the term of Bill Courtright, who resigned and pleaded guilty to corruption charges.

November 6 -

Vineyard Wind is revealing new details of its bid to develop an offshore wind farm off the southern coast of Massachusetts, including new investments in Bridgeport to convert a section of the city's fading port complex into a robust operations and maintenance hub.

October 21 -

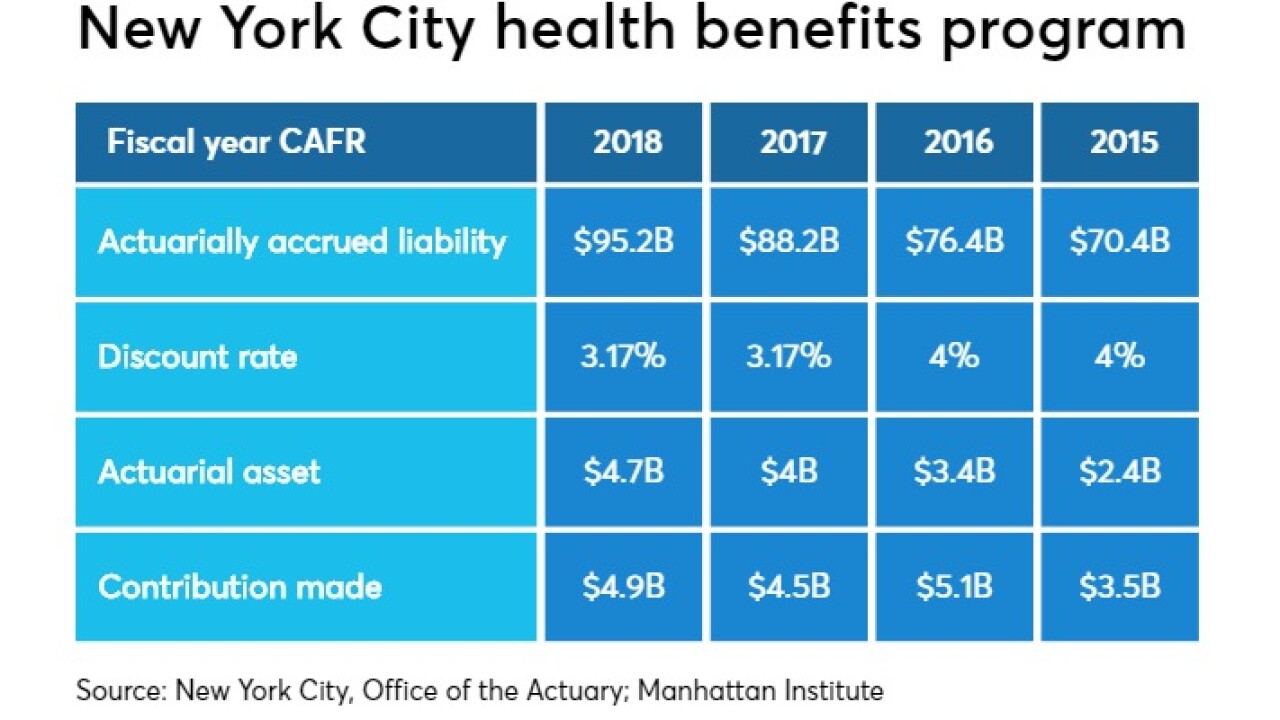

Variables related to other post-employment benefit liabilities jeopardize core services in the tri-state area, said the Manhattan Institute.

October 8 -

Most of the deal from Connecticut's largest city will be taxable, with the lion's share going to a pension fund.

October 8 -

The Connecticut Housing Finance Authority will price the housing mortgage finance program bonds through negotiation.

September 23 -

Marlboro College in Vermont will not partner with the University of Bridgeport in Connecticut.

September 19