-

California's April revenues came in $4 billion higher than anticipated.

May 13 -

Lawmakers have to wait another week for the governor's five-year infrastructure plan.

May 9 -

Legislation to put bond measures and the 2020 and 2022 ballots has cleared two Assembly committees.

May 9 -

The port's initiative is a credit-positive approach to the risk of online attacks, according to Moody's Investors Service.

May 7 -

Fiona Ma has been pushing the state's bond team to explore refundings and to sell new money bonds while rates remain low.

May 2 -

Trump's acting chief of staff said details may bedevil an infrastructure deal even if Democrats and Republicans agree on its size.

April 30 -

The fate of higher education was on the agenda at the Milken's Institute's Global Conference.

April 29 -

Utilities serving 40 million people and 5 million acres of irrigated farm land agreed to a federal plan to keep water flowing amid a two-decade drought.

April 25 -

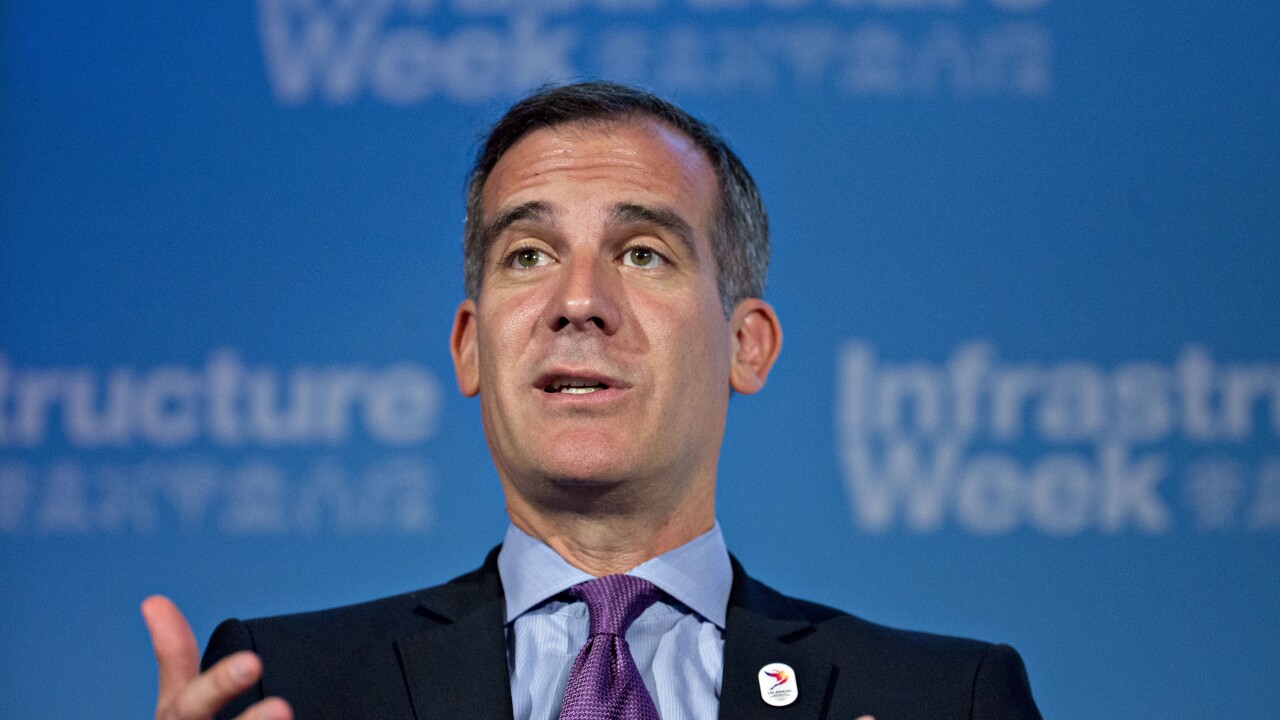

The layout of Los Angeles means the concept wouldn't work as proposed in Manhattan, Eric Garcetti said in New York.

April 24 -

Eric Garcetti unveiled his fiscal 2020 budget proposal for Los Angeles.

April 18 -

Kroll Bond Rating Agency lifted Los Angeles one notch to AA-plus.

April 17 -

Los Angeles received a one-notch upgrade to AA from Fitch Ratings following several years of revenues outpacing expenditure growth.

April 12 -

Four California and Chicago school districts are among issuers to earn negative outlooks in Fitch revisions after a ruling in Puerto Rico's bankruptcy.

April 12 -

The number of states aiding school districts with pension costs is expected to grow as pension burdens escalate.

April 11 -

Former Gov. Arnold Schwarzenegger celebrated when the California Transportation Commission voted, despite a host of warnings, to pay a contractor more than $1 billion to build two tunnels and a stretch of road outside San Francisco nine years ago.

April 10 -

Refundings of recession-era stimulus bonds are driving California's robust sales volume.

April 8 -

The Golden State keeps its issuance streak alive as it get set to sell $2.1 billion of general obligation bonds later this week. This deal is primarily a refunding — a result of bonds sold in 2009 under the Stimulus Act hitting their 10-year call date.

April 8 -

Whistleblower Johan Rosenberg has alleged that the conspiracy cost issuers over $1 billion — $719 million in California, $349 million in Illinois, and $134 million in Massachusetts.

April 4 -

Climate analytics business risQ is partnering with Municipal Markets Analytics to get a better handle on the risk climate change creates for municipal debt.

April 4 -

Moody's Investors Service downgraded one public electric utility and assigned negative outlooks to three after reviewing potential wildfire liability exposure.

March 28