Municipals came under pressure from all sides in 2018, as issuers adjusted to an unfavorable tax law in Washington, state and local governments battled credit challenges, and Puerto Rico's debt restructuring sent shock waves to the mainland. Here's how The Bond Buyer covered the challenges.

Advance refundings mourned, market adjusts

How advance refundings can be

February

How the loss of advance refundings is

Natural disasters

How munis could

Wildfires

Podcast:

Chicago and Illinois, the wrecks of the Midwest

Mayor's exit from race puts Chicago's

A narrow win for bondholders still sets an

The biggest municipal debt restructuring ensnared in litigation

Puerto Rico bondholders

Why the Puerto Rico

Legal opinion raises prospect of

Connecticut: a tough nutmeg to crack

Connecticut assumption of Hartford debt pays

How governor's plan could trigger

Hartford

Will nuclear construction woes lead to a muni meltdown?

South Carolina Supreme Court asked if Santee Cooper must pay

Agreement to finish Georgia reactors

With vote on Georgia

Crime and punishment

Ex-Ramapo official hit with

Why a muni advisor

FINRA fines firm for

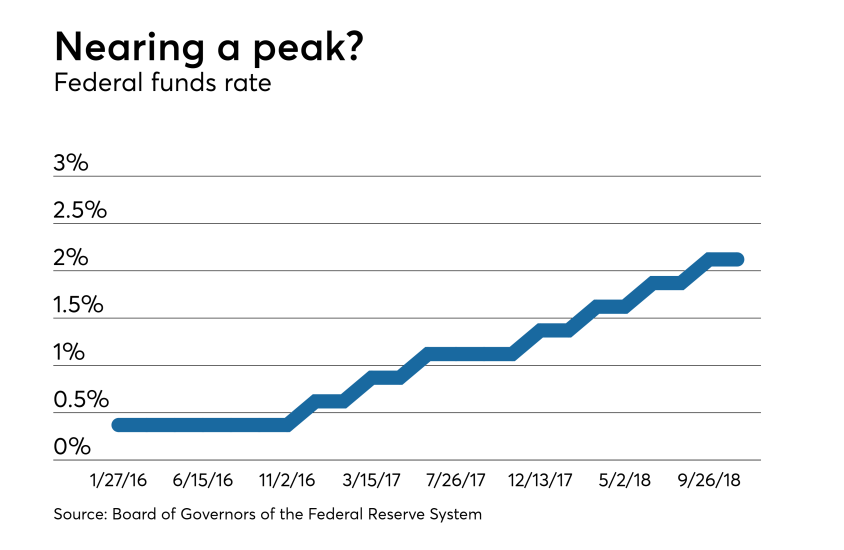

Rising rates and retrenchment

Market reacts to downsizing: U.S. Bank was

Why retail is

Muni strategists see a

Podcast: Is yield curve