BRADENTON, Fla. — Broward County is launching a $2 billion capital improvement program for Fort Lauderdale-Hollywood International Airport Wednesday with the sale of $636 million of new-money revenue bonds.

It is the first all-new money offering for the South Florida airport in eight years.

The bulk of the proceeds, $544 million, will go toward the initial phase of the airport’s long-planned runway extension project, which is expected to cost nearly $800 million. Completion bonds for the project will be sold next year.

Another $111.3 million of bonds subject to the alternative minimum tax will pay for terminal renovations, land acquisition and various CIP projects.

About $83 million of the proceeds will reimburse the county for project costs that already have been incurred.

Citi will lead a single-order period on Wednesday with certain bonds reserved for retail priority.

The offering is expected to be structured with 20-year serial bonds as well as term bonds in 2037 and 2042 to provide level debt service.

As potentially one of the largest negotiated deals next week, Broward County Administrator Bertha Henry said underwriters have seen strong investor interest during pre-marketing efforts for the Fort Lauderdale-Hollywood airport, which is designated FLL.

“Our lead underwriter is encouraged that we will have a very successful transaction,” Henry said.

The bonds have been rated A by Fitch Ratings, A1 by Moody’s Investors Service, and A-plus by Standard & Poor’s.

The three agencies also confirmed their ratings on $580 million of outstanding senior-lien bonds.

Fitch and S&P maintained stable outlooks on the airport bonds.

Moody’s maintained a negative outlook reflecting the size and complexity of the capital expansion plan, lower coverage ratios, and limited financial flexibility based on projections that assume higher growth levels, according to analyst Jennifer Chang.

FLL is an origination & destination airport that captures a major portion of South Florida’s domestic passenger traffic because of its diverse fleet of low-cost carriers and low cost per emplaned passenger, which was $5 in 2011 compared to Miami’s CPE at $16.83, Moody’s said. Fort Lauderdale’s CPE is forecast to increase to $6.13 by 2019.

All three major rating agencies cited FLL for its competitive risk due to its proximity to the larger Miami International Airport, a hub facility 23 miles to the south with a large concentration of legacy airlines, including bankrupt American Airlines.

American has not announced major reduction plans at Miami, its primary hub for long-distance services to Latin America.

Fort Lauderdale and Miami compete with each other, though they serve different niches, according to analyst Rachel Barkely, who covers the Miami airport and muni research for Morningstar Inc.

While FLL captures more domestic traffic, Miami’s market as a hub for American is about half domestic and half international since it is a gateway to Latin America, Barkely said. Miami also has a large cargo component.

In total passenger loads, both airports appear to be benefitting from the slowly improving economy.

Last year, Miami International was the 12th-busiest airport in North America with 38.3 million passengers, an increase of 7.3% over 2010, according to the Airports Council International-North America.

Fort Lauderdale-Hollywood was the 22nd-busiest airport with 23.3 million passengers, up 4.2% over 2010.

In addition to domestic traffic, both airports compete for travelers who are headed for major cruise line facilities at Port Everglades and Port Miami, though Barkely said flights for domestic cruisers tend to cost more at Miami than Fort Lauderdale-Hollywood.

Barkley also pointed out that Miami has largely completed a multibillion dollar capital improvement plan while FLL is just beginning work that could result in improvements that make it more competitive.

“While the two airports do compete, and expansion at Fort Lauderdale might take away some of the origination-and-destination market, I think we expect Miami to remain strong in terms of scope of operations,” she said.

County officials have said that low costs have led to Fort Lauderdale’s success in attracting low-cost carriers.

Planning for the current runway extension to fight the pains of congestion began nearly two decades ago.

The runway will be lengthened to 8,600 feet from its current 5,275. The plan will require the new runway to be elevated by 64 feet to extend over a railway and the famous U.S. 1 highway.

It is expected to open in September 2014, and in addition to relieving flight delays the longer runway can be used by larger aircraft.

Along with the runway work, the CIP projects receiving some of next week’s financing include the acquisition of additional land, constructing a taxiway and an instrument landing system, related terminal renovations, and a substantial noise-mitigation program for area neighborhoods.

“The county considers the airport project to be vital to the region’s economic future, and we look forward to completing this financing so the project can move forward,” said Henry, the county administrator.

About $221.5 million of completion bonds for the south runway expansion project are expected to be issued in September 2013.

To finance a portion of the remaining $2 billion CIP, the county also expects to issue $605 million of bonds between 2014 and 2017.

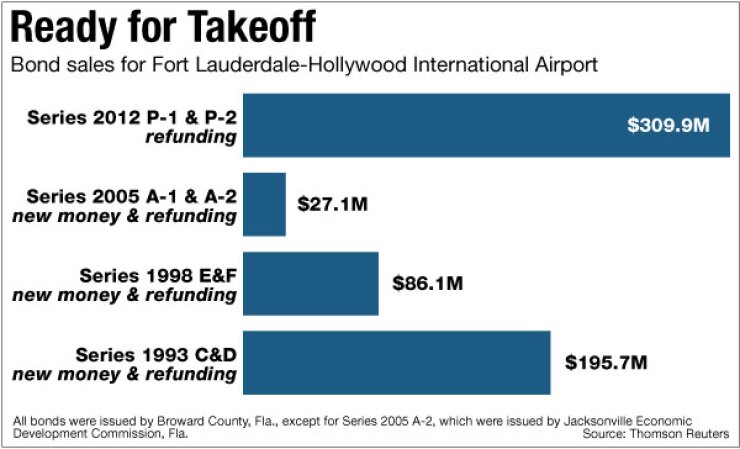

In May, the county sold $310 million of refunding revenue bonds subject to the AMT at a true interest cost of 3.2% for debt-service savings, and to eliminate all of the airport’s convertible-lien bonds.

The refunding brought a net present-value savings of $40 million, or 10.9% of the par amount refunded.

Jefferies & Co. and Omni Consulting Services are financial advisers for next week’s transaction.

In addition to Citi as book-runner, the syndicate includes Bank of America Merrill Lynch, Blaylock Robert Van LLC, Goldman, Sachs & Co., JPMorgan, Morgan Stanley, Ramirez & Co., Raymond James | Morgan Keegan and Siebert Brandford Shank & Co.

Squire Sanders LLP and Perry E. Thurston PA are co-bond counsel. Edwards Wildman Palmer LLP and Carol D. Ellis PA are co-disclosure counsel. Underwriters’ counsel is GrayRobinson PA.