-

Despite losses, munis are still outperforming USTs and corporates on a month-to-date and year-to-date basis, noted Cooper Howard, a fixed-income strategist at Charles Schwab.

February 14 -

The consumer price index number further complicates market expectations of Fed rate cuts and muni investors may want "to keep their powder dry" until they have a better idea of the Fed's timing, said CreditSights' Pat Luby.

February 13 -

The muni market will see "continued strength," said Wesly Pate, senior portfolio manager at Income Research + Management, largely due to a a dearth of new-issue supply.

February 12 -

Oklahoma is on a roll, notching its third positive rating outlook since July with the latest move coming from Fitch Ratings.

February 12 -

"Even though it is hard to see the market falling out of bed and underperforming in the near term, we are more cautious going into March," Barclays PLC said in a report.

February 9 -

A majority of those polled at The Bond Buyer's 2024 National Outlook Conference also felt issuance would increase moderately this year, to between $400 billion and $450 billion.

February 9 -

Ex-IFS Securities head of fixed income Keith Wakefield committed criminal securities and wire fraud from 2017 to 2019, a federal jury in Illinois found.

February 8 -

Municipals were steady to improved in spots in secondary trading as another day of sizable new-issues were well-received in the primary market.

February 8 -

"Jason has a proven record as an outstanding leader who brings clarity, decisiveness and expertise to his role with our Fixed Income Capital Markets division," said HilltopSecurities CEO Brad Winges.

February 8 -

"The debt afforablity study was just released. In this study we outlined how state debt is going to be falling by 60% over an eight year period," state Treasurer Dale Folwell said Tuesday.

February 8 -

Some participants on the Street estimate that SMAs hold as much as $1.5 trillion of munis while others peg it closer to $1 trillion to $1.3 trillion.

February 8 -

The SIFMA Swap Index fell to 3.24% Wednesday, down 50 basis points from 3.74% from the week prior, and 131 basis points from 4.55% it hit on Jan. 24 as swings continued in the VRDO market. Tax-exempt money market funds reversed course to see inflows of almost $4 billion.

February 7 -

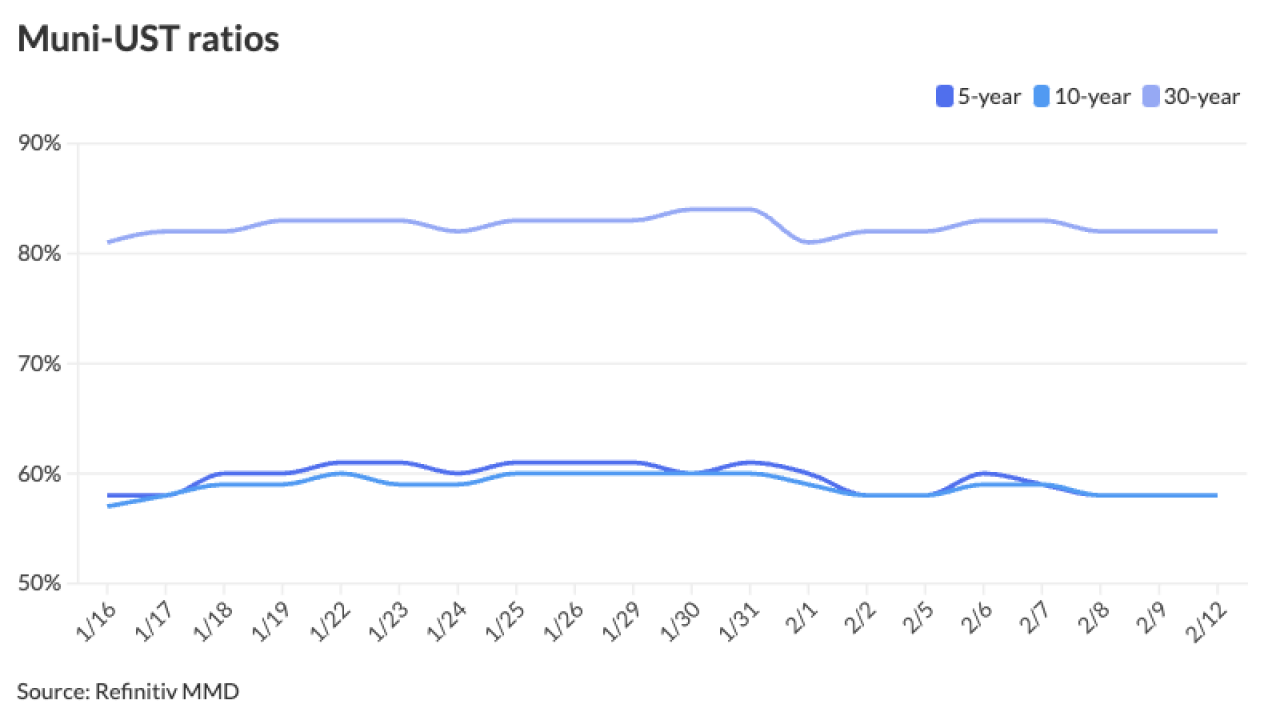

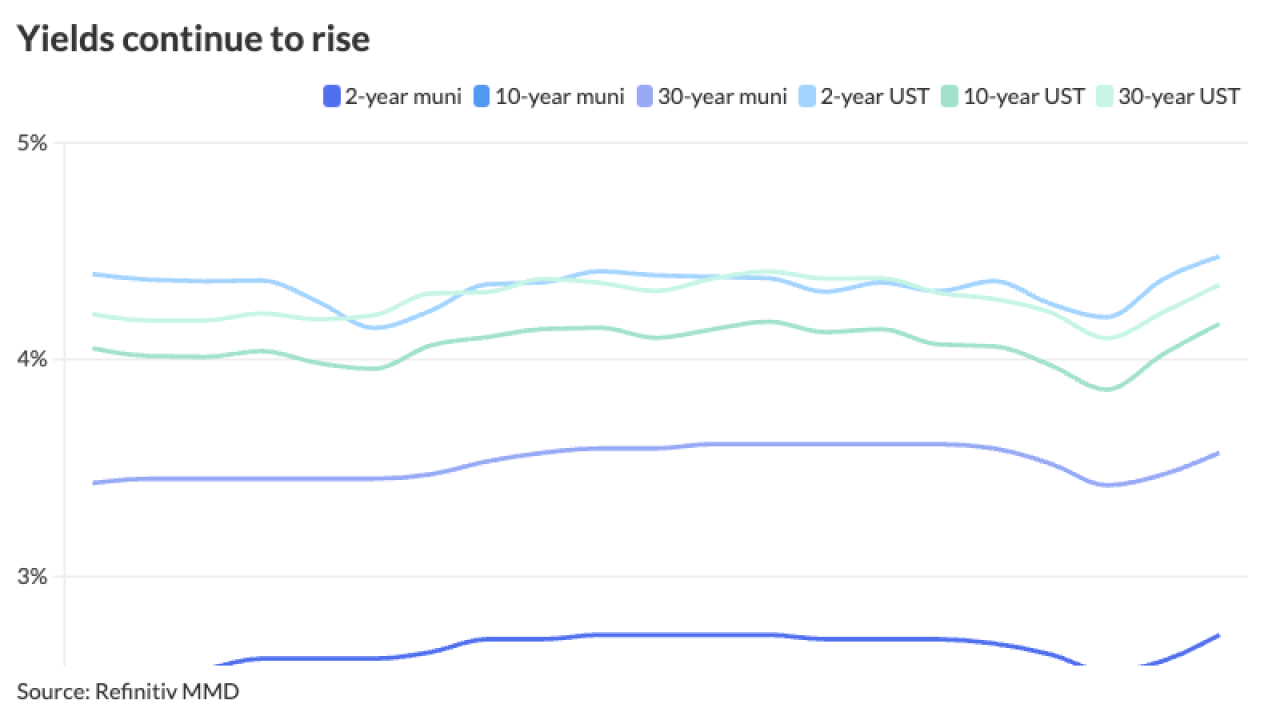

The volatility in USTs is giving municipals a difficult run to start February. The asset class lagged the selloff and outperformed the recent rally, which points to its resiliency — but those moves do not come without challenges.

February 6 -

Chad Wildman, executive director, Quantitative Strategies at FMSbonds, and Matthew Smith, founder and CEO of Spline Data, discuss how automation has repositioned the muni market and where participants can find value by using technology tools. Lynne Funk hosts. (45 minutes)

February 6 -

The top three co-managers have an average dollar volume of more than $11.7 billion as of the end of December 2023.

February 6 -

Triple-A scales saw yields rise 10 to 13 basis points following a second day of UST losses as muni investors await a robust new-issue calendar.

February 5 -

Higher interest rates, inflation and slower economic growth could create headwinds for the U.S. public finance sector, S&P Global Ratings said.

February 5 -

Munis saw smaller losses, outperforming a UST sell-off after the employment report came in stronger than expected, leading analysts to suggest Federal Reserve rate cuts may come later than anticipated.

February 2 -

The goal behind SOLVE's new product is to turn raw data into data-driven insights through AI, with munis being the first step before expanding to other key asset classes in fixed income, said Eugene Grinberg, co-founder and CEO of SOLVE.

February 2 -

The primary saw strong demand with the Triborough Bridge and Tunnel Authority doubling the size of its deal to $1.6 billion.

February 1