-

High-yield and taxable munis continue to outperform, supply grows but concentrates in larger deals led by $3 billion of state personal income tax revenue bonds from the Dormitory Authority of the State of New York next week.

March 8 -

The market is being led more by supply and demand than ratios or even rates. As ratios sit at extremely tight levels, there are buyers engaging at these levels, but large amounts of cash continue to sit on the sidelines.

March 7 -

Costanzo is only the fourth woman to lead a municipal banking division. Huntington has hired Citi's entire Midwest public finance banking group, and Costanzo said the firm intends to further grow its footprint in the municipal space.

March 7 -

Cabrera Capital Markets is welcoming three new public finance hires who are joining the firm from UBS: Shawn Dralle, Shawnell Holman and Chris Bergstrom.

March 7 -

It was a good day for munis with larger deals clearing the primary and secondary trading showing a more constructive tone with triple-A yields falling a few basis points amid a stronger session for all markets.

March 6 -

Harvard and Princeton coming to market is a "huge sign of confidence," said Clare Pickering, a Barclays strategist.

March 6 -

Large deals were repriced to lower yields while the secondary market was lightly traded, leading to little changed triple-A yield curves and underperformance to Treasury market gains. Despite a growing calendar, the supply demand imbalance remains with much cash on the sidelines.

March 5 -

The rating agency cited the university's structural budget imbalance and management turnover among factors that drove the outlook revision to negative from stable.

March 5 -

The muni market "exhibited similar themes from the past few weeks as extremely rich valuations and the upcoming unfavorable supply/demand picture have led to a measured buyer base," said Birch Creek Capital strategists in a report.

March 4 -

The San Diego Community College District is among those joining the trend of buying back bonds in a tender to refund for savings.

March 4 -

The bank has also hired some analysts to its infrastructure group over the past several weeks as it plans to beef up its muni team.

March 4 -

The negotiated calendar is led by the Regents of the University of California with nearly $1 billion of general revenue bonds.

March 1 -

The new guidance modifies rules that stretch back to 2005.

March 1 -

High rates and high inflation, coupled with rich reserves, pushed off or delayed issuers coming to market in 2023, noted James Pruskowski, chief investment officer at 16Rock Asset Management.

March 1 -

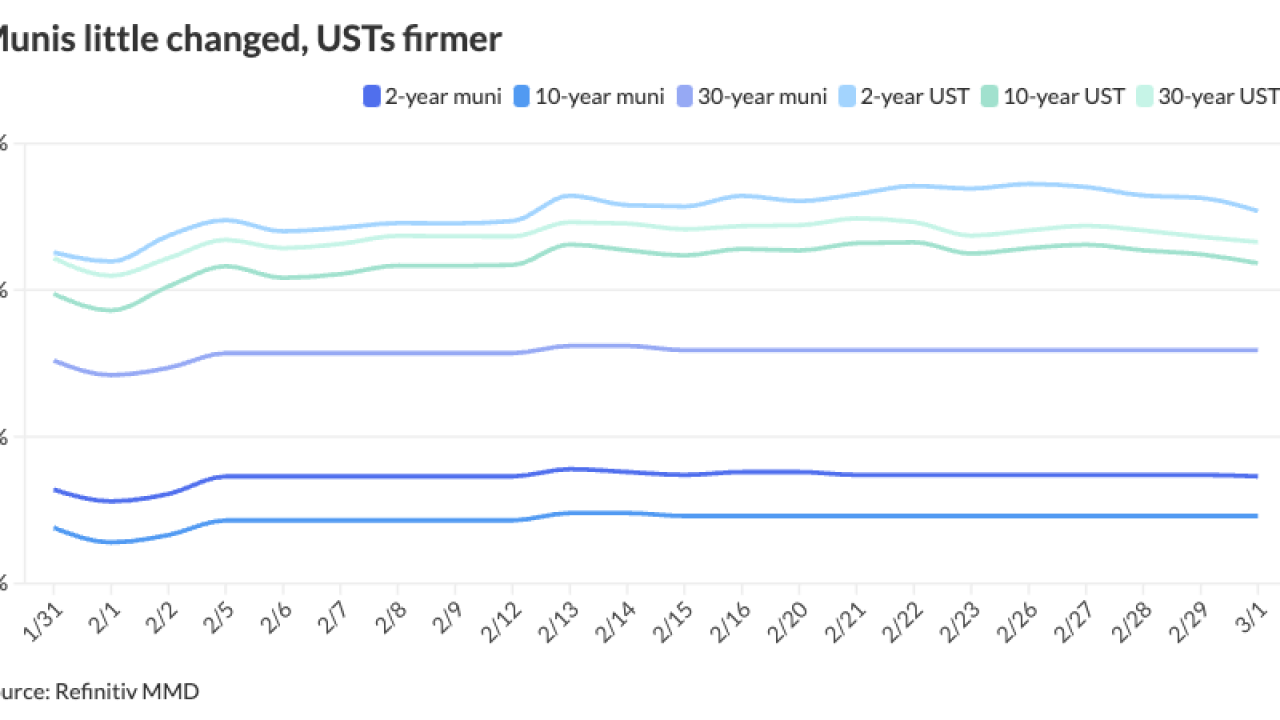

Municipals look poised to close out February a touch in the black following a more constructive tone Thursday after being in a 'holding pattern' for much of the past two weeks.

February 29 -

Analysts say states can avoid short-term issues as a result of strong reserves but some may face challenges over the longer term.

February 29 -

Issuance is already slated to be healthy next week, with some large deals on the calendar.

February 28 -

Three of the hires are group heads in public sector and structured finance businesses at the firm.

February 28 -

Extreme weather could aggravate growing property insurance pressures on governments.

February 28 -

Munis should remain well bid until issuance picks up "dramatically," said Nuveen's Anders S. Persson and Daniel J. Close.

February 27