-

Despite higher yields, muni to UST ratios remain rich. Ratios look "progressively richer" moving into the five- to 10-year part on the curve, with the 10-year spot "still far more attractive in taxables versus tax-exempts," J.P. Morgan said.

April 17 -

The growing federal debt level may pressure lawmakers to retract or reduce the tax-exemption for munis to generate revenue, some market participants argue.

April 17 -

"April has been one of the worst-performing months over the past five years, which we believe warrants continued caution," BlackRock strategists said.

April 16 -

Barclays' Mikhail Foux talks shifting demand, BABs refundings, election effects and what it means for the asset class in a volatile market.

April 16 -

The firm said Saporito's hiring is among several other additions made to beef up Wells Fargo's commitment to munis.

April 16 -

April continues to be "harsh" for munis as the asset class has given up roughly 72 basis points in the first two weeks of the month, said Jason Wong, vice president of municipals at AmeriVet Securities.

April 15 -

Duluth-based St. Luke's affiliation with Aspirus Inc. has lifted the prospects for its speculative-grade bonds; S&P placed the hospital on CreditWatch positive.

April 15 -

In a week marked by inflation and jobs data that made clearer the Federal Reserve will not be cutting rates nearly as much or as many times as some had expected even a week ago, Friday's headlines further complicated the landscape for investors and munis have had little choice but to go along for the ride.

April 12 -

BABs can offer value for investors who can stomach the call risk, said municipal strategists.

April 12 -

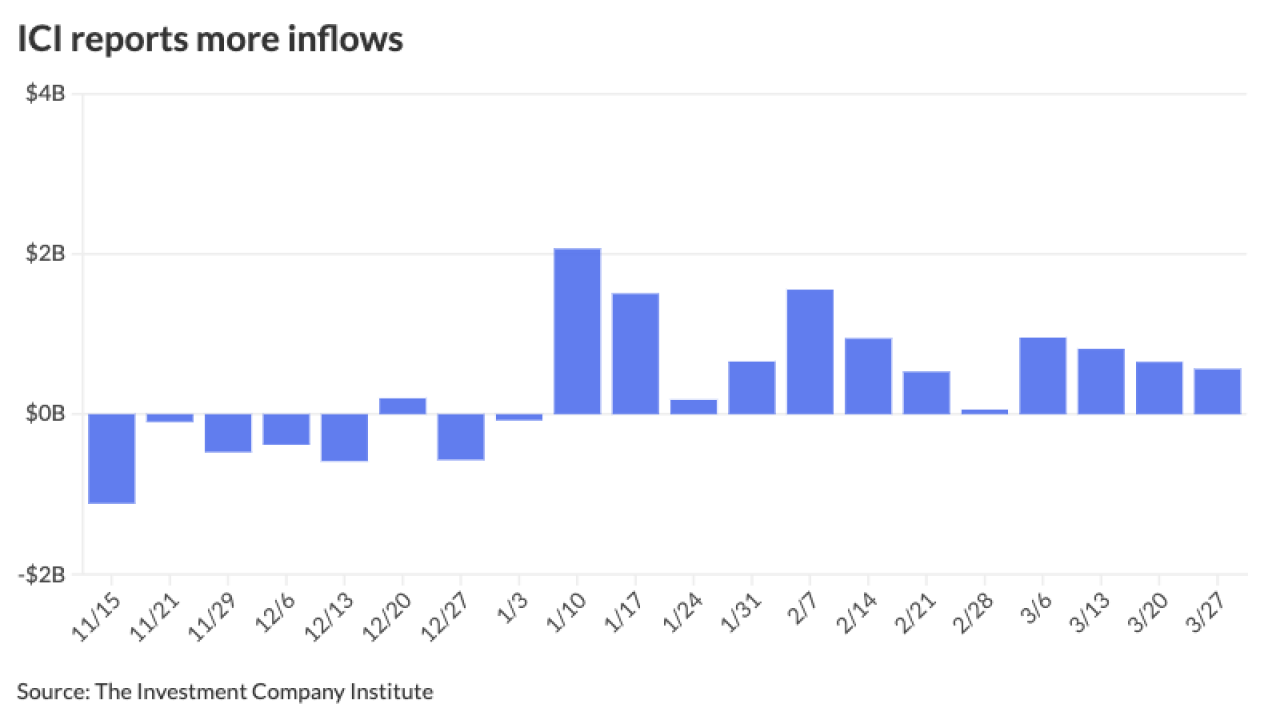

Municipal bond mutual funds saw the seventh consecutive week of inflows and the 14th week of inflows for high-yield funds.

April 11 -

S&P's upgrade to BBB from BB-plus follows a March upgrade from Moody's Ratings, bringing the city to investment grade a decade after its historic bankruptcy.

April 10 -

"The news is sparking an equity market selloff while sending bond yields to the stars as investors dial down their Fed easing expectations again, this time to only two rate cuts this year," said José Torres, senior economist at Interactive Brokers.

April 10 -

Wednesday's CPI report will "shed more light on the path of inflation and the potential timing for rate cuts this year," said Cooper Howard, a fixed income strategist at Charles Schwab.

April 9 -

The deal comes amid market inflows and a dearth of high-yield supply, but demand will depend, as always, on the price, investors said.

April 9 -

Muni to UST ratios also continue to rise across the curve, inching closer to more normal averages.

April 8 -

As another economic indicator pushed investors closer toward the assumption that rate cuts are farther away, the relationship between munis, USTs and the vast amount of capital sitting on the sidelines becomes more challenging to navigate, particularly ahead of the tax-filing deadline and growing new-issue calendar.

April 5 -

The criteria should result in a nearly equal number of upgrades and downgrades in the next half year, according to the rating agency.

April 4 -

Some buying returned to the market Thursday from the buy-side and asset managers as dealers attempted to sell bonds, said Chris Brigati, senior vice president and director of strategic planning and fixed income research at SWBC.

April 4 -

Two mega deals recently priced with make-whole calls for bonds due in 2034 and shorter where the market does not appear "to be penalizing issuers for including an optional make whole call feature in the short maturity tax-exempt bonds," said Pat Luby, head of Municipal Strategy at CreditSights, in a report.

April 4 -

"Most spots on the muni AAA HG curve are at or near year-to-date highs, and the muni HG curve showed significant underperformance across the curve in March, relative to the broader fixed income market, after sizable muni outperformance in February," said J.P. Morgan strategists.

April 3