-

Some participants on the Street estimate that SMAs hold as much as $1.5 trillion of munis while others peg it closer to $1 trillion to $1.3 trillion.

February 8 -

The SIFMA Swap Index fell to 3.24% Wednesday, down 50 basis points from 3.74% from the week prior, and 131 basis points from 4.55% it hit on Jan. 24 as swings continued in the VRDO market. Tax-exempt money market funds reversed course to see inflows of almost $4 billion.

February 7 -

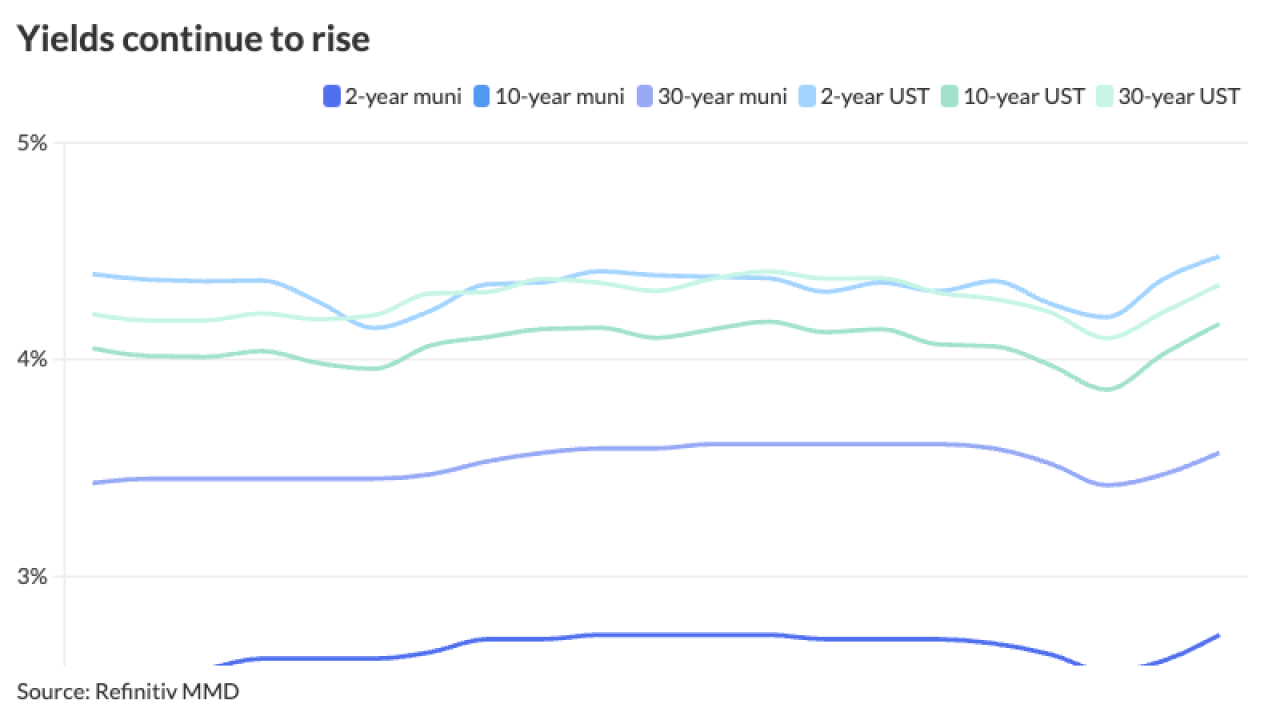

The volatility in USTs is giving municipals a difficult run to start February. The asset class lagged the selloff and outperformed the recent rally, which points to its resiliency — but those moves do not come without challenges.

February 6 -

Chad Wildman, executive director, Quantitative Strategies at FMSbonds, and Matthew Smith, founder and CEO of Spline Data, discuss how automation has repositioned the muni market and where participants can find value by using technology tools. Lynne Funk hosts. (45 minutes)

February 6 -

The top three co-managers have an average dollar volume of more than $11.7 billion as of the end of December 2023.

February 6 -

Triple-A scales saw yields rise 10 to 13 basis points following a second day of UST losses as muni investors await a robust new-issue calendar.

February 5 -

Higher interest rates, inflation and slower economic growth could create headwinds for the U.S. public finance sector, S&P Global Ratings said.

February 5 -

Munis saw smaller losses, outperforming a UST sell-off after the employment report came in stronger than expected, leading analysts to suggest Federal Reserve rate cuts may come later than anticipated.

February 2 -

The goal behind SOLVE's new product is to turn raw data into data-driven insights through AI, with munis being the first step before expanding to other key asset classes in fixed income, said Eugene Grinberg, co-founder and CEO of SOLVE.

February 2 -

The primary saw strong demand with the Triborough Bridge and Tunnel Authority doubling the size of its deal to $1.6 billion.

February 1