-

"The forward calendar shows issuance will be above average over the next few weeks, while reinvestment cash is set to drop off," Birch Creek strategists said.

August 26 -

The Fed's expected September rate cut will "make market conditions more conducive to moving projects forward" said Dodge Construction Network's chief economist Richard Branch.

August 26 -

The calendar next week largely continues "the elevated pace of primary market volume seen since May, against a backdrop of broadly supportive fund flows (LSEG inflows for eight consecutive weeks), somewhat better dealer positions (although still heavy), mid-August reinvestment to spend, but lighter late summer attendance," said J.P. Morgan strategists led by Peter DeGroot.

August 23 -

Along with the influx of supply, the muni market remains "constructive" due to attractive yields, said Catherine Stienstra, head of municipal bond investments at Columbia Threadneedle Investments.

August 22 -

New Jersey is poised to sell up to $2.4 billion of bonds for its transportation infrastructure, according to a report from Fitch Ratings.

August 22 -

All eyes are on Jackson Hole and Fed Chairman Jerome Powell's speech this week, noted Cooper Howard, a fixed-income strategist at Charles Schwab.

August 21 -

"Investor reception will remain the ultimate arbiter of muni performance and … the current state of the tax-exempt space to be well-positioned, even though munis are likely to continue to underperform USTs," said Jeff Lipton, a research analyst and market strategist.

August 20 -

Clyde, Texas, missed payments on certificates of participation due Aug. 1, the same day it declared a water emergency. Bond insurers are paying the holders.

August 20 -

As investors contemplate rate policy for the remainder of 2024, "there have been a few strategies from which to choose to boost yield — short positioning, curve extension and credit quality," noted Kim Olsan, senior fixed-income portfolio manager at NewSquare Capital.

August 19 -

New York state's issuers topped the Northeast charts as issuance rose in nearly every sector of the market during the first half of 2024.

August 19 -

Barclays rate strategists believe the 10-year part of the Treasury curve has room to cheapen. "In that case, tax-exempts will likely not only follow, but underperform."

August 16 -

Municipal bond mutual funds saw inflows as investors added $528.7 million to funds after $674.1 million of inflows the week prior, according to LSEG Lipper. This marks seven straight weeks of inflows.

August 15 -

Long-term liabilities have gone down and revenues have gone up, Fitch said.

August 15 -

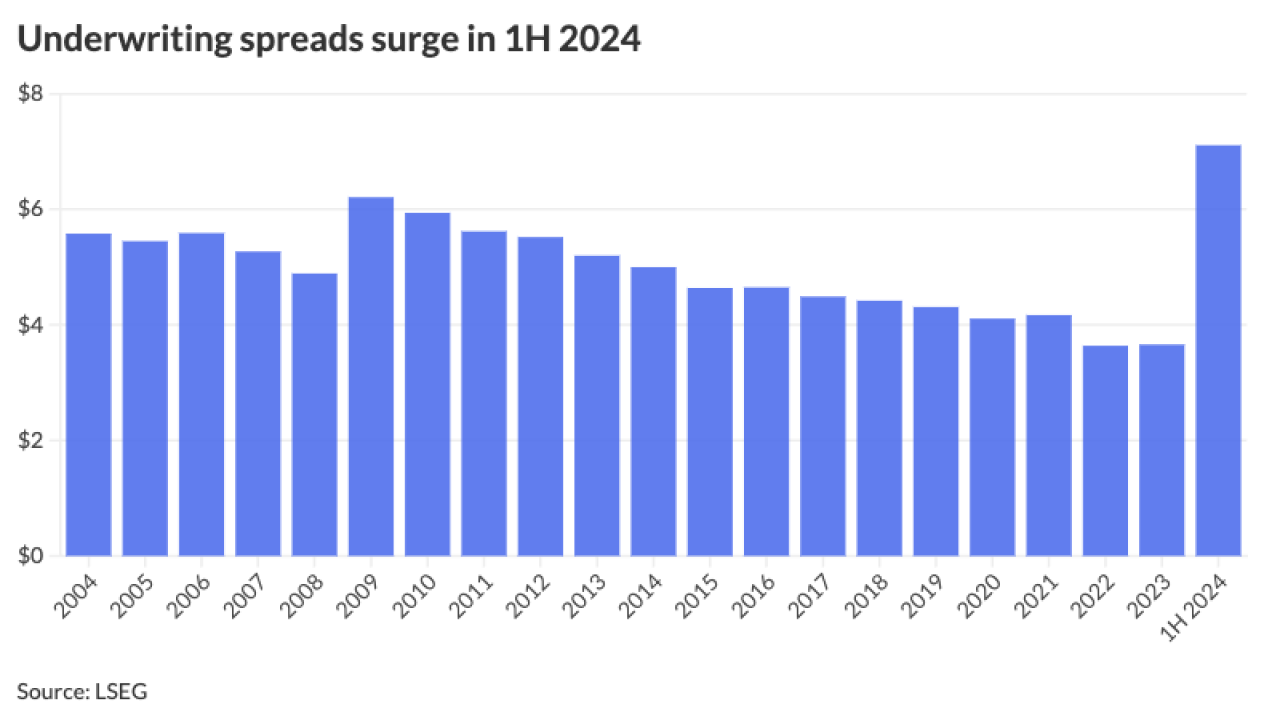

Underwriting spreads rose to $7.11 in the first half of 2024 from $3.70 in the first half of 2023.

August 15 -

The Investment Company Institute reported $839 million of inflows into municipal bond mutual funds for the week ending Aug. 7 after $442 million of outflows the week prior. Exchange-traded funds saw $680 million of inflows after $950 million of inflows the previous week.

August 14 -

Moody's sees strength in New Jersey's economy and governance.

August 14 -

"There's an important 'date certain' the market may overreact to, but by and large, [this] week is looking positive given a lighter new- issue calendar," said AllianceBernstein strategists.

August 13 -

Dallas Fort Worth International Airport received a S&P rating upgrade and a positive rating outlook from Moody's ahead of a $750 million bond sale next week.

August 13 -

Detroit-based Wayne State University will return to market with $31.7 million of general revenue refunding bonds, with proceeds refunding outstanding bonds.

August 13 -

A new classification scheme would allow market participants, both on the buy and sell sides, to correctly identify the source and nature of credit risk in their holdings and to aggregate such risk into meaningful sectors that share common risk drivers.

August 13 DPC Data

DPC Data