-

Unless there is a massive selloff in the next two weeks, there will not be a major spike in market participants using tax-loss harvesting through year-end, said Ben Barber, director of municipal bonds at Franklin Templeton.

December 23 -

Following the September/October rally, munis have been relatively steady in November and December, with direction and magnitude of rate change in the UST market driving underperformance or outperformance, said J.P. Morgan strategists led by Peter DeGroot.

December 22 -

The dramatic downgrade projects a default by January 2027 on bonds issued to finance the Miami-to-Orlando passenger train service.

December 19 -

Supply for the final two weeks of the year will be virtually nonexistent, with only one deal, $24.46 million of taxable multi-family/project bonds from the Colorado Housing and Finance Authority, on the calendar for next week.

December 19 -

Muni yields were bumped a basis point, while UST yields fell two to four basis points.

December 18 -

"Once this week is done, that's it for the year. The following week is Christmas, and then after that, the new year," said Jeff Timlin, a partner at Sage Advisory.

December 17 -

Palomar Health's bond rating remains stuck at junk, but UCSD partnership offers a glimmer of hope.

December 17 -

The company has the option to defer interest payments three times without triggering a formal default.

December 17 -

Inflation reports may drive markets in 2026 since the labor market is "sending mixed messages," said Kevin O'Neil, associate portfolio manager and senior research analyst at Brandywine Global.

December 16 -

Next year, the "muni market could see stable to improving returns depending on yield curve positioning, with better performance possible at the long end of the curve," said Jonathan Rocafort, managing director and head of fixed income solutions at Parametric.

December 15 -

The New York City Transitional Finance Authority leads the new-issue calendar with $2 billion of future tax-secured subordinate refunding bonds.

December 12 -

The well-regarded pediatric hospital system is not alone in facing downgrades amid the myriad challenges healthcare has experienced in recent years.

December 12 -

Kansas City Federal Reserve President Jeffrey Schmid and Chicago Fed President Austan Goolsbee said in statements Friday that their dissents from this week's interest rate decision were spurred by inflation concerns and a lack of sufficient economic data.

December 12 -

Both Janney and Huntington are among the top 30 underwriters in the muni market and are neck in neck.

December 12 -

"With its third straight rate cut, the Fed is sending a clear message: it's no longer just watching inflation — it's managing risk," said Gina Bolvin, president of Bolvin Wealth Management Group.

December 11 -

Muni yields were little changed, and have barely moved over the past several trading sessions, said Kim Olsan, senior fixed income portfolio manager at NewSquare.

December 10 -

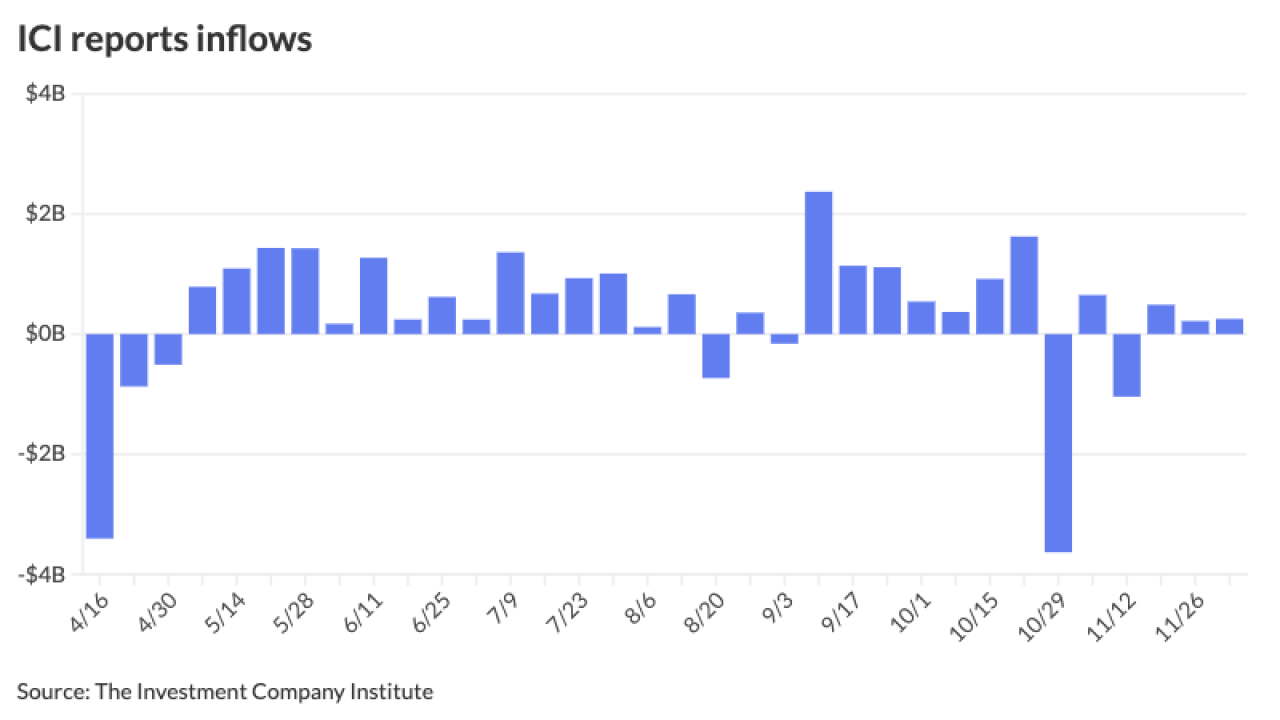

While muni returns moved lower last week, year-to-date returns still hover around 4%, said Jason Wong, vice president of municipals at AmeriVet Securities.

December 9 -

Concerns about Brightline have dragged down performance in the high yield sector this year.

December 9 -

Issuers mostly avoided pricing deals in the previous weeks the Fed met this year, but that's not the case this week, said Pat Luby, head of municipal strategy at CreditSights, and Wilson Lees, an analyst at the firm.

December 8 -

States face broadening credit challenges, and while local governments have shown resilience, school districts are more at risk, S&P Global Ratings said.

December 8