-

Market reaction to inflation numbers was "tempered," said Richard Flax, chief investment officer at Moneyfarm. But should inflationary pressures hold in 2025, "markets may anticipate that further rate cuts could be limited in scope, suggesting a more cautious investment outlook."

November 13 -

KBRA has placed Chicago's general obligation bond rating on watch for downgrade as the City Council prepares to vote tomorrow on a proposed property tax increase.

November 13 -

Municipals ignored USTs losses, leading to lower muni to UST ratios and adding to the better performance across the curve and credit spectrum.

November 12 -

The focus: municipal advisors — part of your regulatory responsibilities and duties (if you don't agree to evaluate pricing and/or structure, you must expressly disclose it to the client) and broker-dealers (fair dealing).

November 11 SOLVE

SOLVE -

Tax-exempt money market funds reached a 2024 high of assets under management at $136.84 billion for the week ending Wednesday, according to the Investment Company Institute.

November 11 -

"A sharply lower new-issuance calendar, peak yields, large redemption money and mutual funds inflows are all positive performance factors for the market," BofA strategists said.

November 8 -

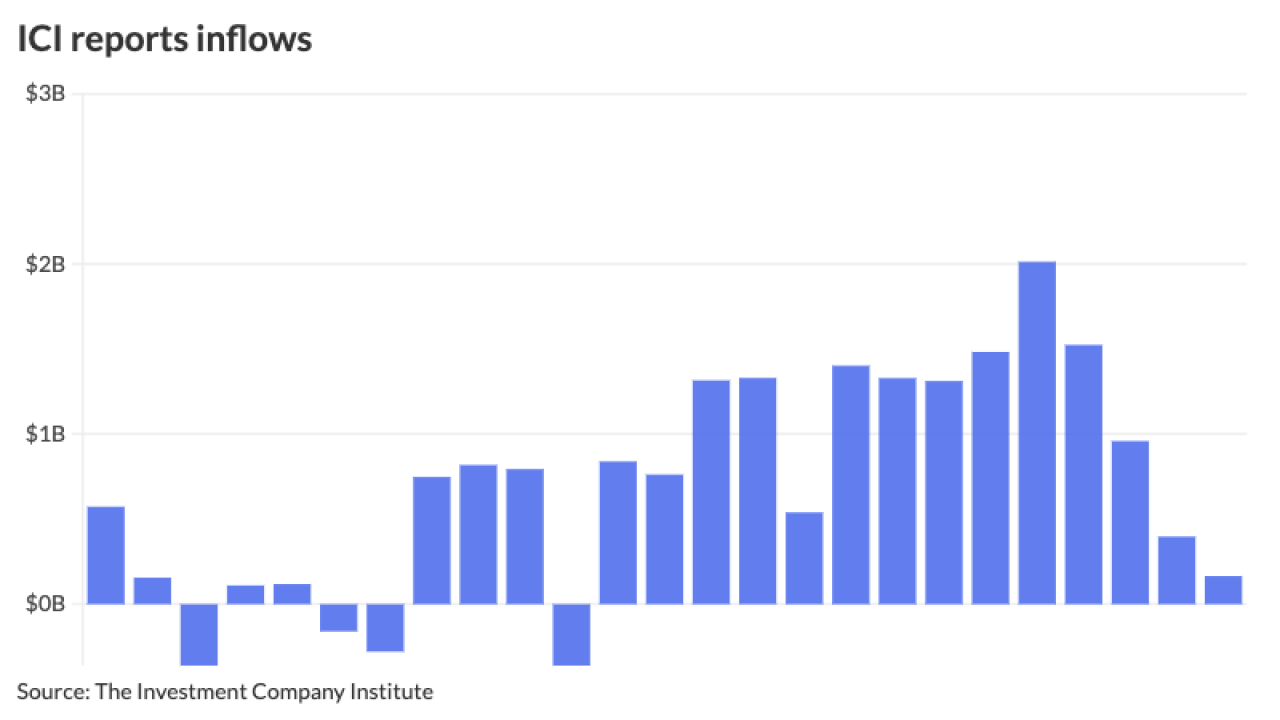

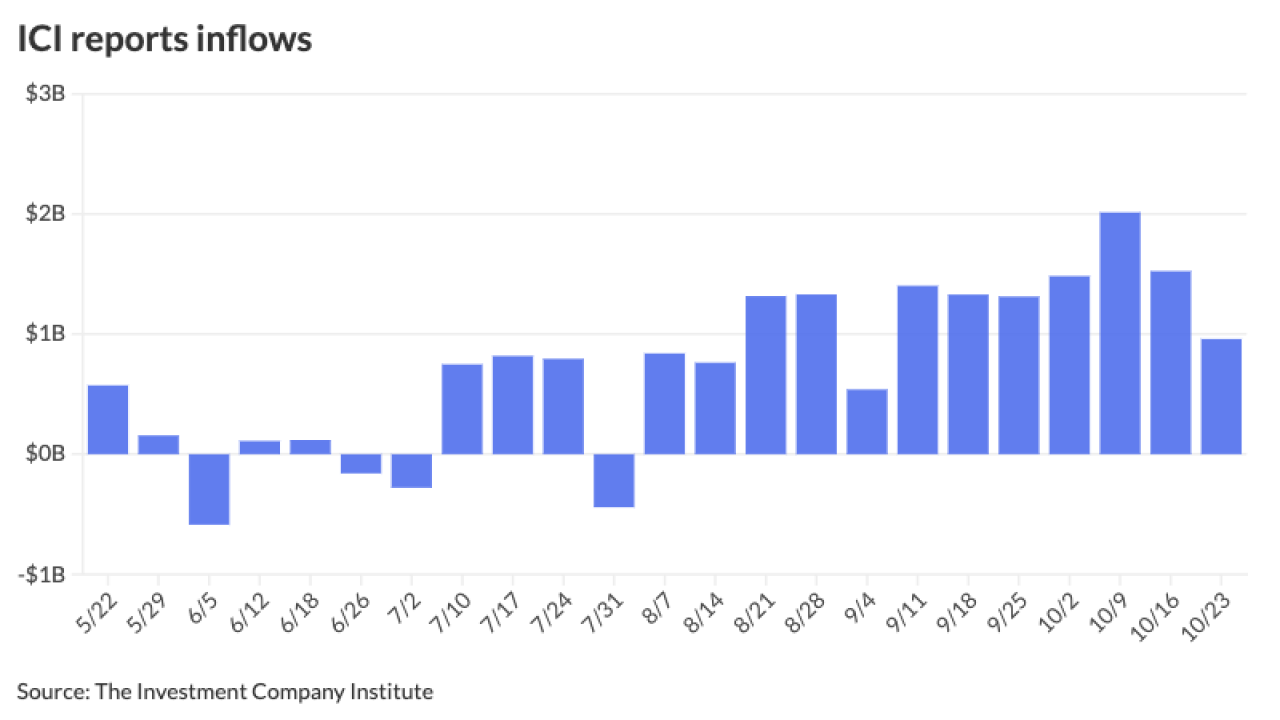

Despite the post-election selloff, inflows continued this week as LSEG Lipper reported investors added $1.263 billion to municipal bond mutual funds for the week ending Wednesday, compared to $658.5 million of inflows the prior week. High-yield inflows returned.

November 7 -

The red wave that took the presidency and the Senate — along with increased odds of a Republican victory in the House — was hanging heavily over fixed income markets Wednesday, with munis and UST yields rising up to 17 basis points, with the largest losses out long.

November 6 -

The University of Texas at Austin's Center on Municipal Capital Markets will provide graduate and continuing education programs, research reports, and public outreach.

November 6 -

"If the GOP wins the House, the specter of risk to the municipal bond tax-exemption will increase," said Edwin Oswald, a tax partner at Orrick Herrington & Sutcliffe in Washington D.C.

November 6 -

"A victory for former President Trump is likely to be viewed as ushering in a more inflationary environment, whereas a win for Vice President Harris will probably be seen as closer to the status quo," said Erik Weisman, chief economist and portfolio manager at MFS Investment Management."

November 5 -

Investors should "brace themselves" for further volatility, as uncertainty is likely to remain, said Tom Kozlik, managing director and head of public policy and municipal strategy at HilltopSecurities.

November 4 -

The Philadelphia-based university straddles the higher education and healthcare sectors, but market demand suggests it's greater than the sum of its parts.

November 4 -

Issuance will "not completely disappear, but will adjust to its seasonal norm from the record-breaking pace of the past several months," said Barclays' Mikhail Foux.

November 1 -

Observers say the decision may be a credit positive for the financially struggling utility

November 1 -

October's "price path has created wider spreads but also brought higher yields that are now in the range where a broader audience may begin to take notice," said NewSquare Capital Senior Fixed Income Portfolio Manager Kim Olsan, noting higher taxable equivalent yields for different tenors of the yield curve.

October 31 -

Wittstruck takes over the S&P role previously held by Robin Prunty, who retired in August.

October 31 -

Municipals largely stayed in their own lane Wednesday, digesting the large slate of new issues as supply dwindles heading into election week, with Bond Buyer 30-day visible supply falling to $5.56 billion.

October 30 -

California sold tax-exempt and taxable GOs, the University of Miami priced a refunding deal while the Harris County-Houston Sports Authority came with a refunding and tender offer.

October 29 -

The key question for municipal market investors is less about who wins the races for the White House and Congress and more about by how much.

October 29