-

Muni investors hope "any move toward higher yields is steady, even dignified, such that it doesn't catalyze an outflow cycle that would countervail year-to-date total returns just before we close out the year," said Vikram Rai, head of municipal strategy at Wells Fargo.

December 3 -

Munis ended November in the black with the asset class seeing gains of 1.73% for the month, pushing year-to-date returns to 2.55%.

December 2 -

With an estimated $13 billion calendar on tap, demand for paper will be bolstered by the $16 billion of redemptions coming Monday while mutual fund inflows, this week at about $560 million and concentrated in the long-end, signal solid investor support. Munis are returning 1.73% in November as of Friday.

November 29 -

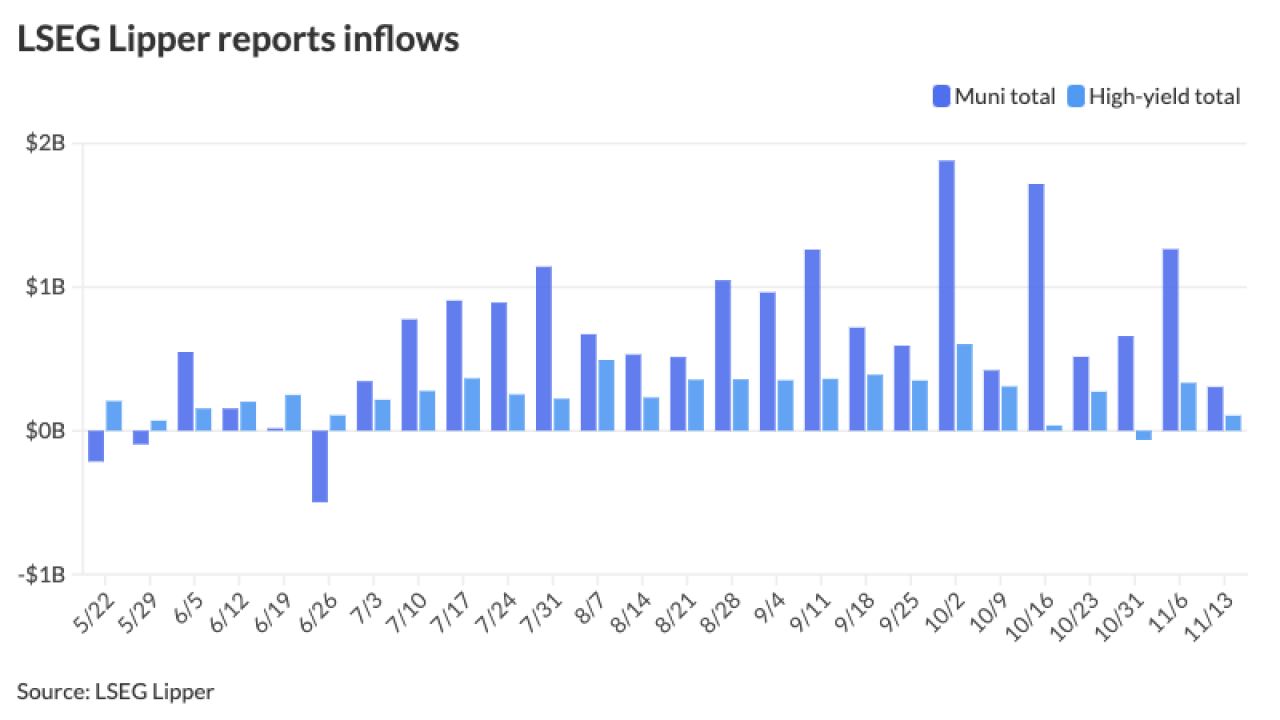

The Investment Company Institute reported $1.221 billion of inflows into municipal bond mutual funds for the week ending Nov. 20. Exchange-traded funds saw inflows of $836 million.

November 27 -

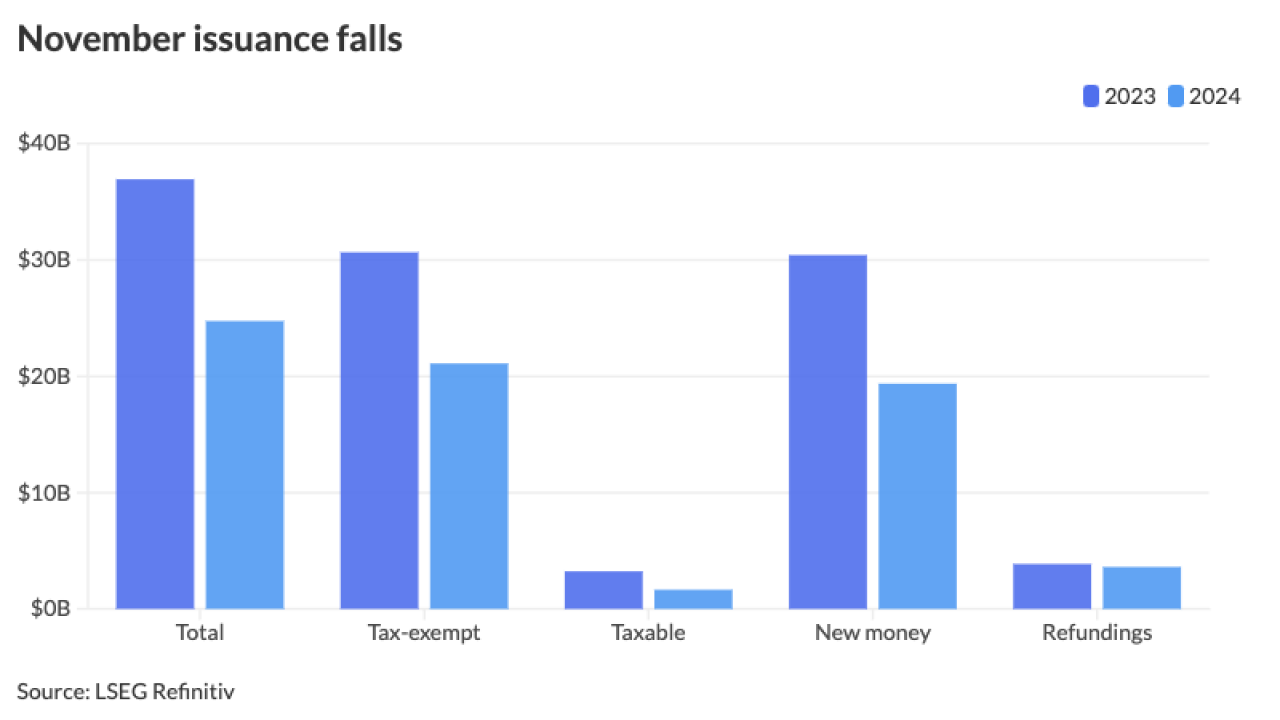

November's total is below the 10-year average of $32.278 billion and is the lowest monthly total this year. The year's total is about $25 billion short of $500 billion.

November 27 -

"Earlier this month, Chair [Jerome] Powell noted that there was no 'hurry' to cut rates," noted BMO Senior Economist Priscilla Thiagamoorthy. The minutes, she noted, "confirm a broad support for taking a more cautious approach in easing monetary policy."

November 26 -

Markets could see that "the risks of higher inflation and interest rates are implicit constraints on the Trump policy agenda, with the eventual policy outcomes potentially less inflationary than some investors previously feared," UBS strategists noted.

November 25 -

Supply has "declined materially, allowing dealers to take a breather, with their inventories dropping significantly, while retail investors do not seem to be spooked by rate volatility, lower taxes and possible threats to the tax-exempts, and continued putting money into tax-exempts at a brisk pace," said Mikhail Foux, managing director and head municipal research and strategy at Barclays.

November 22 -

George Joseph McLiney, Jr. founded municipal bond underwriting firm McLiney and Company. He was devoted to his family and small issuer clients.

November 22 -

High-yield funds saw $608.9 million of inflows compared with inflows of $150.3 million the week prior.

November 21 -

"Volatility creates all kinds of opportunities in the municipal space, not just for tax-loss harvesting, but for positioning and parts of the yield curve that might be undervalued or certain sectors or states that are poised to perform well going into yearend," said Tim McGregor, a managing partner at Riverbend Capital Advisors.

November 21 -

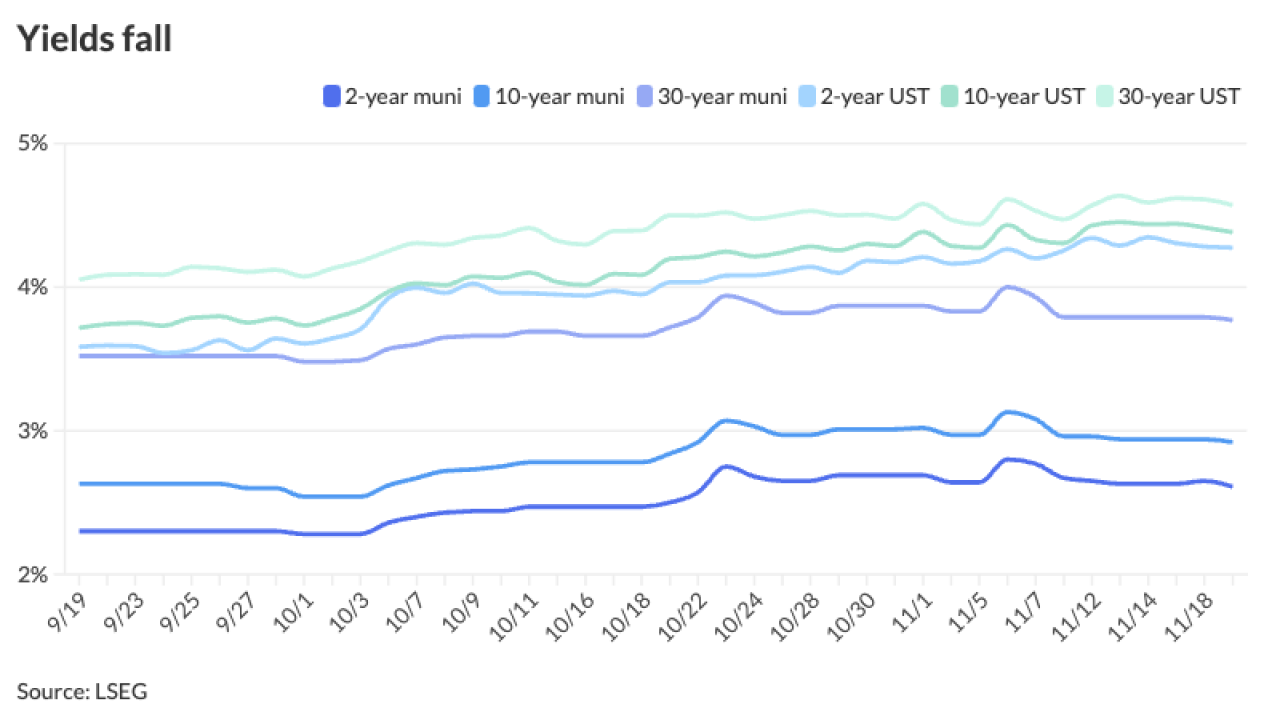

Municipals are outperforming USTs to a large degree this month, with investment grade munis seeing positive 0.81% returns in November and 1.63% year-to-date. USTs are in the red at -0.40% in November with only 0.96% positive returns in 2024.

November 20 -

JoAnne Carter, managing director and president of PFM, will succeed Hartman as CEO.

November 20 -

"This year, with the tax-exemption clearly threatened, primary calendars should (although, of course, might not) be larger, putting a $500 billion full-year supply total in range, with $451 billion already in the books through 46 weeks," said MMA's Matt Fabian.

November 19 -

Houston is set to price Tuesday $1 billion of United Airlines Terminal Improvement Projects AMT revenue bonds while the Public Finance Authority will bring $125 million of non-rated Million Air Three General Aviation Facilities Project revenue bonds.

November 18 -

As headline risk swirls around the Fed and the transition to the Trump administration, municipals have largely stayed in their own lane. November finds the municipal market "in far better technical shape, with an attractive backdrop through at least year-end," J.P. Morgan's Peter DeGroot said.

November 15 -

The Aloha State received three rating affirmations as it prepares to sell $750 million of taxable general obligation bonds.

November 15 -

The Federal Reserve chair said there are no economic indicators calling for rapid rate cuts. He also addressed Fed independence, the impact of Trump's economic agenda and more.

November 14 -

This month is experiencing similar volatility as 2016 when generic yields traded higher by 50 to 70 basis points during November of that year, said Kim Olsan, a senior fixed income portfolio manager at NewSquare Capital.

November 14 -

In a speech, Federal Reserve Gov. Adriana Kugler said sound monetary policy comes when electoral politics are kept out of central banking.

November 14