-

Muni mutual funds saw outflows after 23 weeks of inflows as LSEG Lipper reported investors pulled $316.2 million for the week ending Dec. 11. High-yield municipal bond funds, though, saw inflows of $192.3 million.

December 12 -

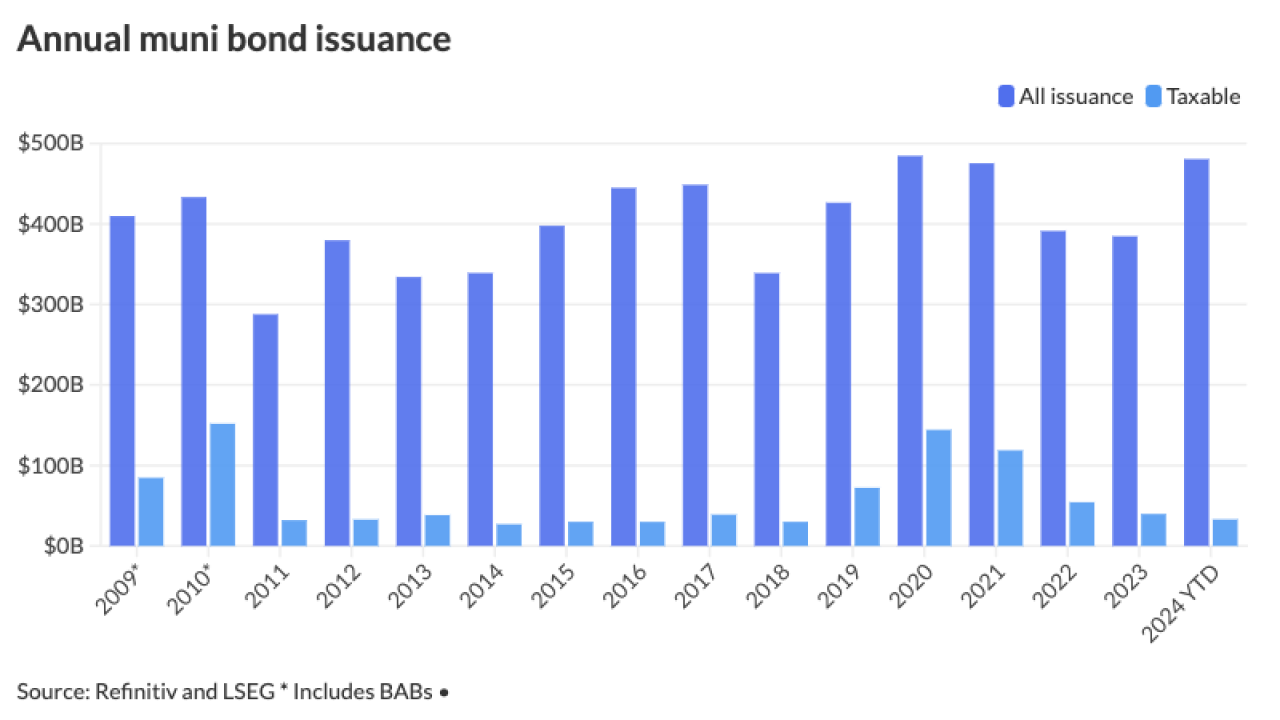

Most on the Street expect issuance to come in around $500 billion, but a few think volume will be much higher, primarily because of potential changes to the tax exemption. Most firms expect refunding volumes to also grow in 2025.

December 12 -

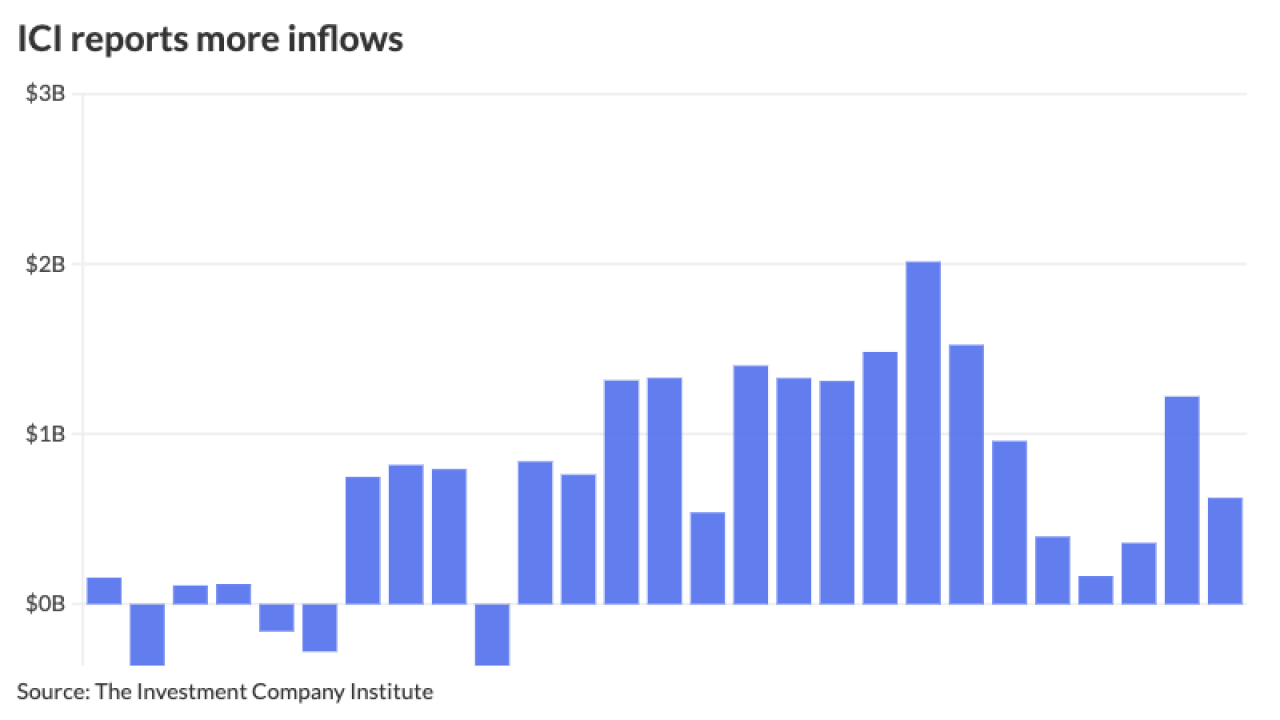

Municipal investors are more focused on the final new-issues coming down the pike and repositioning books as 2024 heads to a close. ICI reported another week of inflows into municipal bond mutual funds.

December 11 -

"With strong demand, rate cuts and favorable technicals, the muni market — outside of an unexpected shock — is set up to perform well over the next couple of months," said Daryl Clements, a municipal portfolio manager at AllianceBernstein.

December 10 -

The rating agency cited an easing of the state's fiscal challenges for lifting the outlook on the state's Aa2 rating to stable from negative.

December 10 -

Munis are in the black so far this month, with the Bloomberg Municipal Index at +0.33% in December and +2.88% year-to-date, the high-yield index is at +0.27% in December and returning 8.41% in 2024, while taxable munis are returning 0.43% so far this month and 4.58% in 2024.

December 9 -

Investors will be greeted with a diverse new-issue slate the week of Dec. 9, led by bellwether names. If all the deals price, 2024's total should break 2020's record by the end of the week. Despite rich valuations, demand has remained strong as the year winds down.

December 6 -

S&P Global Ratings released a report this week warning that the credit trajectory of the Chicago Board of Education will hinge on several contested factors.

December 6 -

High-yield municipal bond funds saw inflows of $534.1 million compared to $300.6 million compared the previous week, per LSEG Lipper data.

December 5 -

Technicals could "break down" if there is a potential decline in risk assets or rising unemployment, particularly in white-collar jobs, said Jeff Timlin, a managing partner at Sage Advisory.

December 4 -

Muni investors hope "any move toward higher yields is steady, even dignified, such that it doesn't catalyze an outflow cycle that would countervail year-to-date total returns just before we close out the year," said Vikram Rai, head of municipal strategy at Wells Fargo.

December 3 -

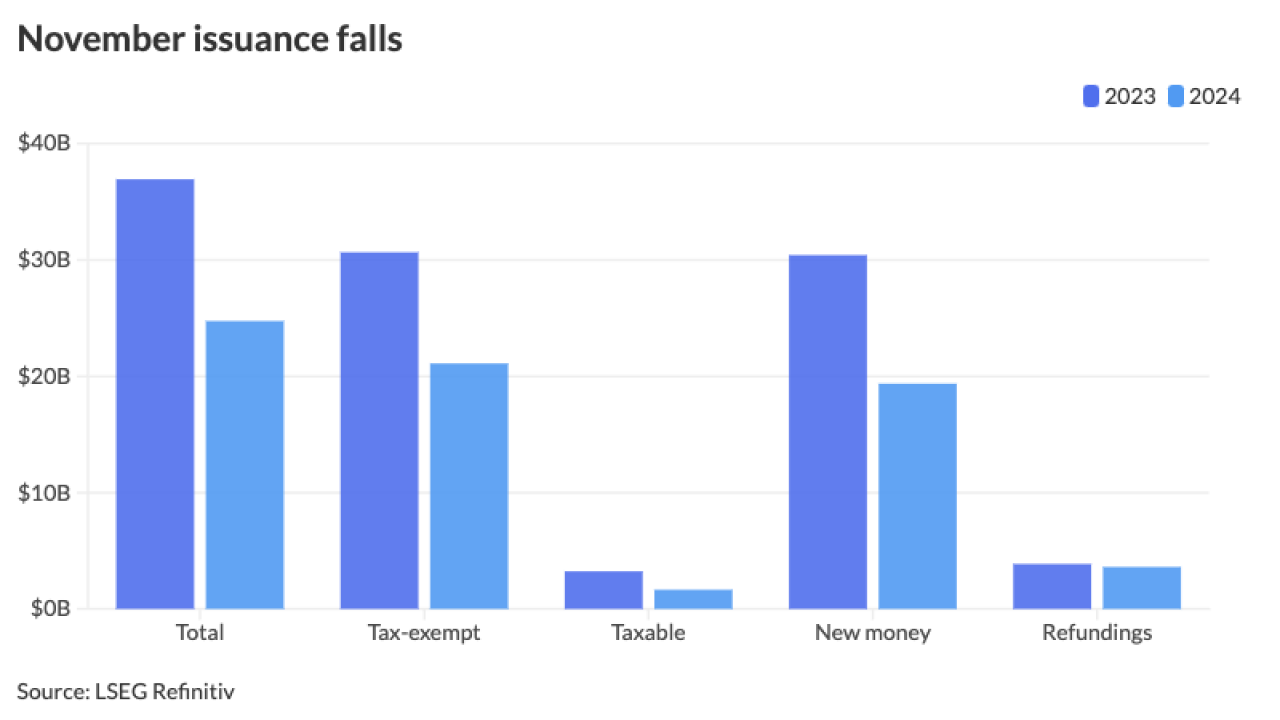

Munis ended November in the black with the asset class seeing gains of 1.73% for the month, pushing year-to-date returns to 2.55%.

December 2 -

With an estimated $13 billion calendar on tap, demand for paper will be bolstered by the $16 billion of redemptions coming Monday while mutual fund inflows, this week at about $560 million and concentrated in the long-end, signal solid investor support. Munis are returning 1.73% in November as of Friday.

November 29 -

The Investment Company Institute reported $1.221 billion of inflows into municipal bond mutual funds for the week ending Nov. 20. Exchange-traded funds saw inflows of $836 million.

November 27 -

November's total is below the 10-year average of $32.278 billion and is the lowest monthly total this year. The year's total is about $25 billion short of $500 billion.

November 27 -

"Earlier this month, Chair [Jerome] Powell noted that there was no 'hurry' to cut rates," noted BMO Senior Economist Priscilla Thiagamoorthy. The minutes, she noted, "confirm a broad support for taking a more cautious approach in easing monetary policy."

November 26 -

Markets could see that "the risks of higher inflation and interest rates are implicit constraints on the Trump policy agenda, with the eventual policy outcomes potentially less inflationary than some investors previously feared," UBS strategists noted.

November 25 -

Supply has "declined materially, allowing dealers to take a breather, with their inventories dropping significantly, while retail investors do not seem to be spooked by rate volatility, lower taxes and possible threats to the tax-exempts, and continued putting money into tax-exempts at a brisk pace," said Mikhail Foux, managing director and head municipal research and strategy at Barclays.

November 22 -

George Joseph McLiney, Jr. founded municipal bond underwriting firm McLiney and Company. He was devoted to his family and small issuer clients.

November 22 -

High-yield funds saw $608.9 million of inflows compared with inflows of $150.3 million the week prior.

November 21