-

"The trend of heavy issuance that began last year has continued in the first half of 2025, surpassing even our rather optimistic expectations," said Barclays strategists Mikhail Foux, Grace Cen and Francisco San Emeterio.

June 24 -

The selloff highlights the lack of accurate pricing and credit information across the speculative-grade muni market.

June 24 -

So far, the financial market reaction has been limited, said Paul Christopher, head of global investment strategy at Wells Fargo Investment Institute.

June 23 -

"The market itself should want to look at this because no one wants to give the perception of impropriety," said an investor of Stefanik's allegation that Harvard withheld material information regarding its ongoing conflict with the Trump administration.

June 23 -

With one full week of June left and the end of the second quarter approaching, the week was "a sort of Groundhog Day for municipal yields," said Kim Olsan, senior fixed income portfolio manager at NewSquare Capital.

June 20 -

The FOMC's decision to "hold rates steady while signaling only two cuts this year was a subtle but powerful shift," said James Pruskowski, CIO at 16Rock Asset Management.

June 18 -

The rock-bottom prices show the risks of a high-yield market where liquidity is famously limited.

June 18 -

A growing rainy-day fund helped Alaska win a Moody's Ratings upgrade, bringing the state's issuer and general obligation bond ratings to Aa2 from Aa3.

June 18 -

"We expect no change to rates but [for the Federal Open Market Committee] to continue to signal that rate cuts should still be expected," said Cooper Howard, a fixed income strategist at Charles Schwab.

June 17 -

K-12 public schools get a $55 per-student increase in the state basic allotment, while other funding is allocated to specific purposes.

June 17 -

After two weeks of a deluge of issuance, supply drops off "given the FOMC meeting and Juneteenth holiday, so we expect investors will refocus on the secondary market and look to scoop up any value left behind in the wake of the issuance onslaught," said Birch Creek strategists.

June 16 -

Issuance takes a bit of a breather due to the Juneteenth holiday and the Federal Open Market Committee meeting, Barclays strategists said.

June 13 -

BlackRock strategists are "constructive" on munis for multiple reasons and think the current market environment presents itself as a buying opportunity, especially as issuance continues to be elevated and provides "ample ability" to source bonds in the primary market.

June 12 -

A "lighter-than-anticipated CPI report" led to UST firmness, as it "quelled fears about tariff-related inflation and boosted enthusiasm that the Fed will cut rates in the next two or three meetings," said José Torres, senior economist at Interactive Brokers.

June 11 -

The elevated new-issue market comes on the heels of one of the largest weeks of issuance.

June 10 -

After the University of Idaho canceled plans to buy the for-profit online University of Phoenix, Moody's Ratings removed the school from watch for downgrade.

June 10 -

The software uses pre-trade quote data to help predict the next trade level of bonds.

June 10 -

However, the new-issue calendar may not be "absorbed as easily, given valuations have grown less compelling after this week's performance," said Birch Creek strategists.

June 9 -

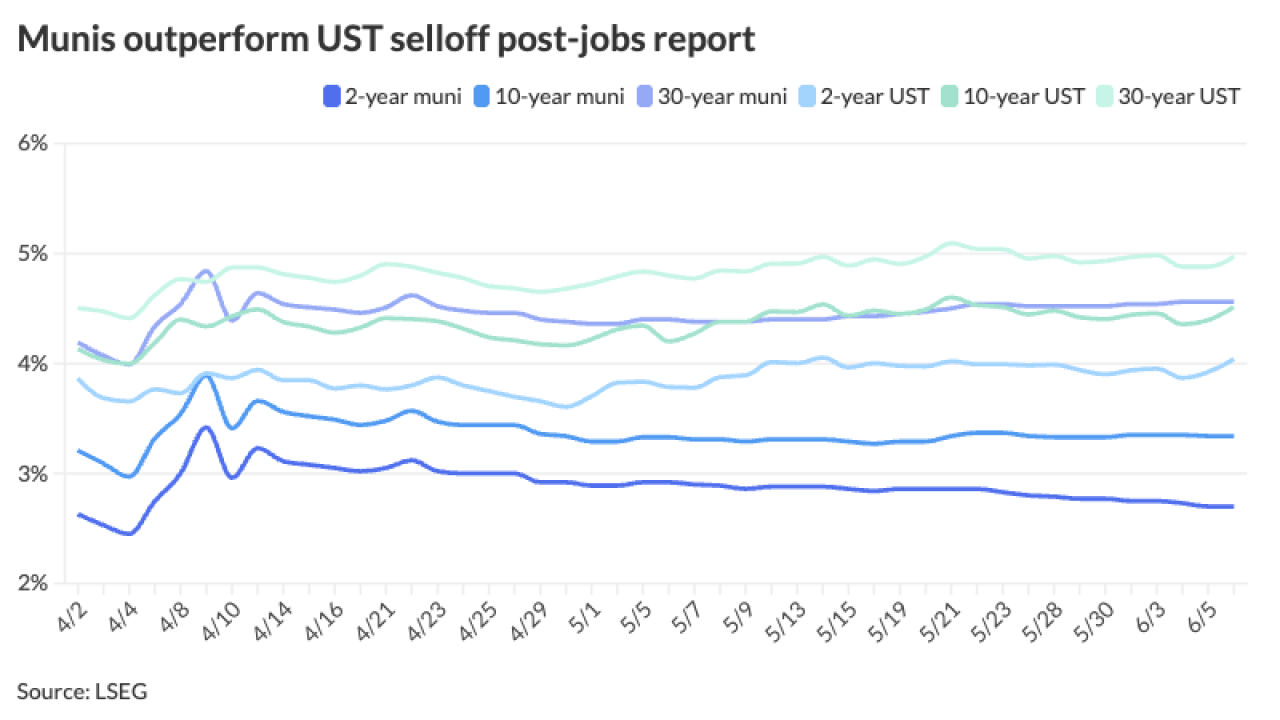

The nonfarm payrolls report shows the economy is "hanging in there," though it is slowing, said Jeff MacDonald of Fiduciary Trust International.

June 6 -

This week the market has performed "exceedingly well" with the tailwind of June 1 reinvestment capital, said J.P. Morgan strategists led by Peter DeGroot.

June 5