-

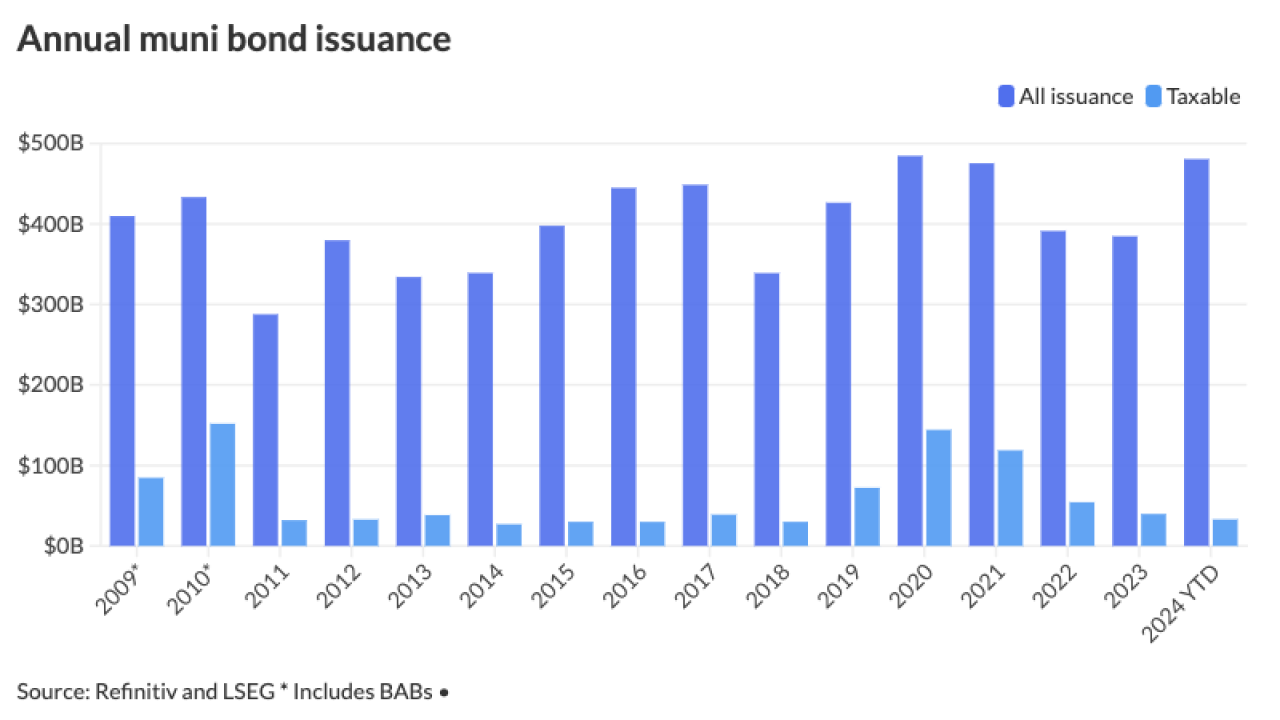

Supply falls ahead of the final Federal Open Market Committee meeting of 2024 and the holidays but issuance still breaks records. The lighter calendar should provide support for the secondary market in the final weeks of the year.

December 13 -

Muni mutual funds saw outflows after 23 weeks of inflows as LSEG Lipper reported investors pulled $316.2 million for the week ending Dec. 11. High-yield municipal bond funds, though, saw inflows of $192.3 million.

December 12 -

Most on the Street expect issuance to come in around $500 billion, but a few think volume will be much higher, primarily because of potential changes to the tax exemption. Most firms expect refunding volumes to also grow in 2025.

December 12 -

Municipal investors are more focused on the final new-issues coming down the pike and repositioning books as 2024 heads to a close. ICI reported another week of inflows into municipal bond mutual funds.

December 11 -

"With strong demand, rate cuts and favorable technicals, the muni market — outside of an unexpected shock — is set up to perform well over the next couple of months," said Daryl Clements, a municipal portfolio manager at AllianceBernstein.

December 10 -

The rating agency cited an easing of the state's fiscal challenges for lifting the outlook on the state's Aa2 rating to stable from negative.

December 10 -

Munis are in the black so far this month, with the Bloomberg Municipal Index at +0.33% in December and +2.88% year-to-date, the high-yield index is at +0.27% in December and returning 8.41% in 2024, while taxable munis are returning 0.43% so far this month and 4.58% in 2024.

December 9 -

Investors will be greeted with a diverse new-issue slate the week of Dec. 9, led by bellwether names. If all the deals price, 2024's total should break 2020's record by the end of the week. Despite rich valuations, demand has remained strong as the year winds down.

December 6 -

S&P Global Ratings released a report this week warning that the credit trajectory of the Chicago Board of Education will hinge on several contested factors.

December 6 -

High-yield municipal bond funds saw inflows of $534.1 million compared to $300.6 million compared the previous week, per LSEG Lipper data.

December 5