-

The risk Brightline Florida poses to the rest of the high-yield market may manifest in fund flows, investors said.

August 6 -

Over the past three trading sessions, MMD yields have been bumped nine to 12 basis points, while UST yields have fallen over 20 basis points on the front of the curve.

August 5 -

Some bondholders have retained legal counsel while others are in the dark about the company's plans.

August 5 -

"If the narrative takes hold that the Fed is behind the eight ball and will need to cut rates several times in the coming months to catch up to the realities of a weaker economy, we expect muni yields will drift lower alongside treasuries," Birch Creek strategists said.

August 4 -

Municipal yields fell four to seven basis points, depending on the curve, while UST yields rallied nine to 30 basis points, with the largest gains on the front end.

August 1 -

Tax-exempt munis have underperformed year-to-date, said David Hammer, a managing director and portfolio manager at PIMCO.

July 31 -

The FOMC held rates steady at the conclusion of its meeting Wednesday and offered no hints regarding a September move.

July 30 -

The muni market has "cheapened and steepened," which is a great opportunity for people still on the sidelines to get into the market again, said Jennifer Johnston, director of municipal bonds research at Franklin Templeton.

July 29 -

School districts are facing many challenges, including less federal funding, increased competition, declining enrollment and inflating costs.

July 29 -

The asset class got a "much-needed boost" from inflows into muni mutual funds last week, said Birch Creek strategists.

July 28 -

The port, which operates Seattle-Tacoma International Airport, received a Moody's Ratings upgrade ahead of a $761 million revenue bond deal slated for next week.

July 28 -

Issuance for the week of July 28 is estimated at $11.035 billion, with $9.018 billion of negotiated deals and $2.017 billion of competitive deals on tap, according to LSEG.

July 25 -

Columbia College Chicago was lowered one notch to BB-plus from BBB-minus by S&P Global Ratings, citing the school's falling headcount and diminished demand.

July 25 -

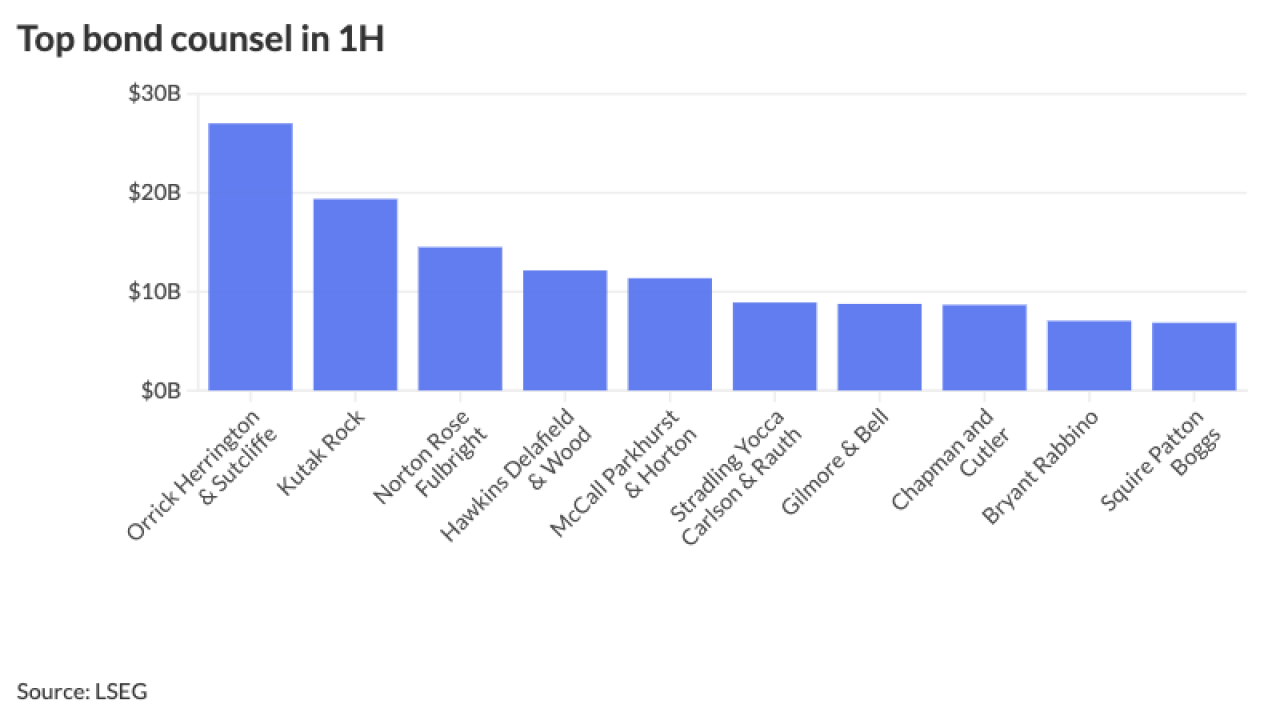

The top five featured in the ranking handled deals totalling more than $84 billion in par value.

July 25 -

The airport, also selling $412.8 million of new money, will join a bevy of issuers who have deployed a tender offer in the hope of realizing refunding savings.

July 25 -

Investors added $571.5 million from municipal bond mutual funds in the week ended Wednesday, following $224.6 million of outflows the prior week, according to LSEG Lipper data.

July 24 -

Port Freeport's decision to go property tax-free resulted in a revenue bond rating downgrade from S&P and raised disclosure questions.

July 24 -

The fund's sell-off in June shows the challenges of accurate pricing in the high-yield muni market.

July 24 -

Larger dealer networks lead to lower markups, but smaller networks show evidence of potential collusion and market manipulation, the paper said.

July 24 -

Longer-term munis have become more attractive, said Cooper Howard, a fixed income strategist at Charles Schwab.

July 23