-

Attorney General Ken Paxton put several big banks under a review last month, raising concerns more municipal bond underwriters could be driven out of the state.

November 6 -

Teacher shortages and enrollment declines due to growing charter and private schools are two of the problems affecting school financing.

November 6 -

Friday's employment report was good news for the Federal Reserve, with fewer jobs created and a smaller rise in earnings, leading analysts to cautiously increase expectations that the hiking cycle is over.

November 3 -

Washington will auction $483 million in two tranches on Tuesday.

November 3 -

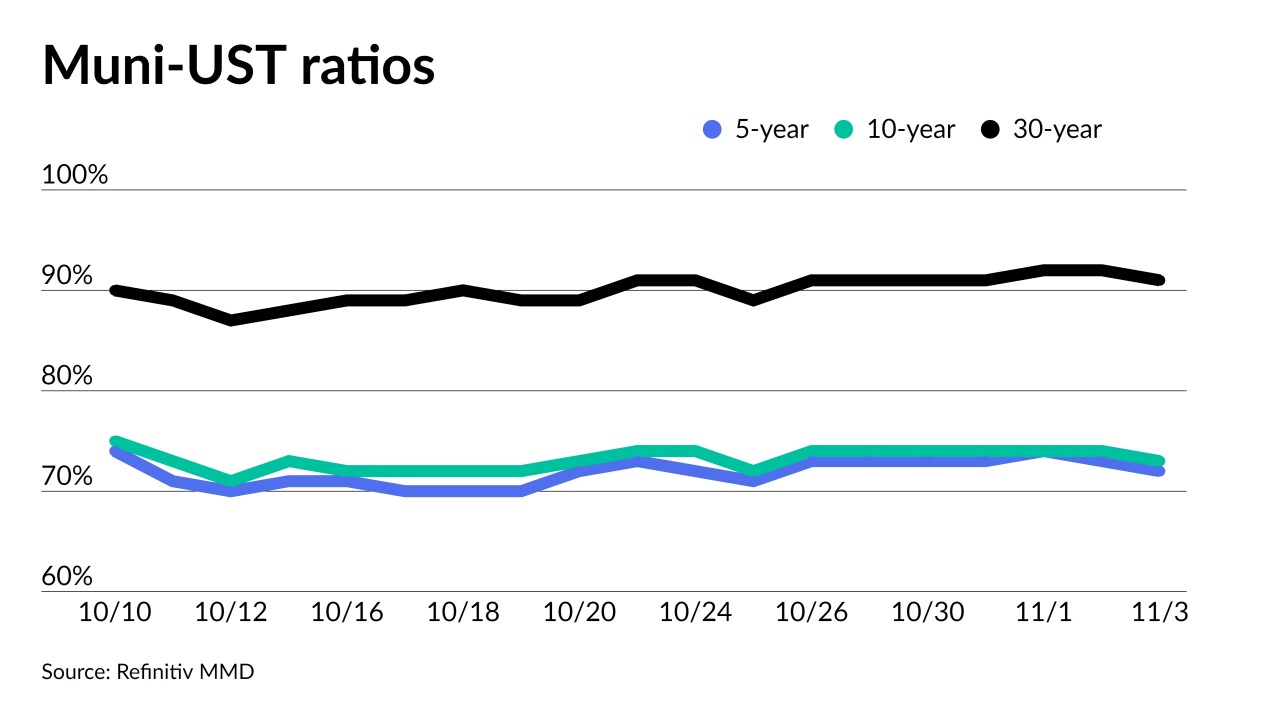

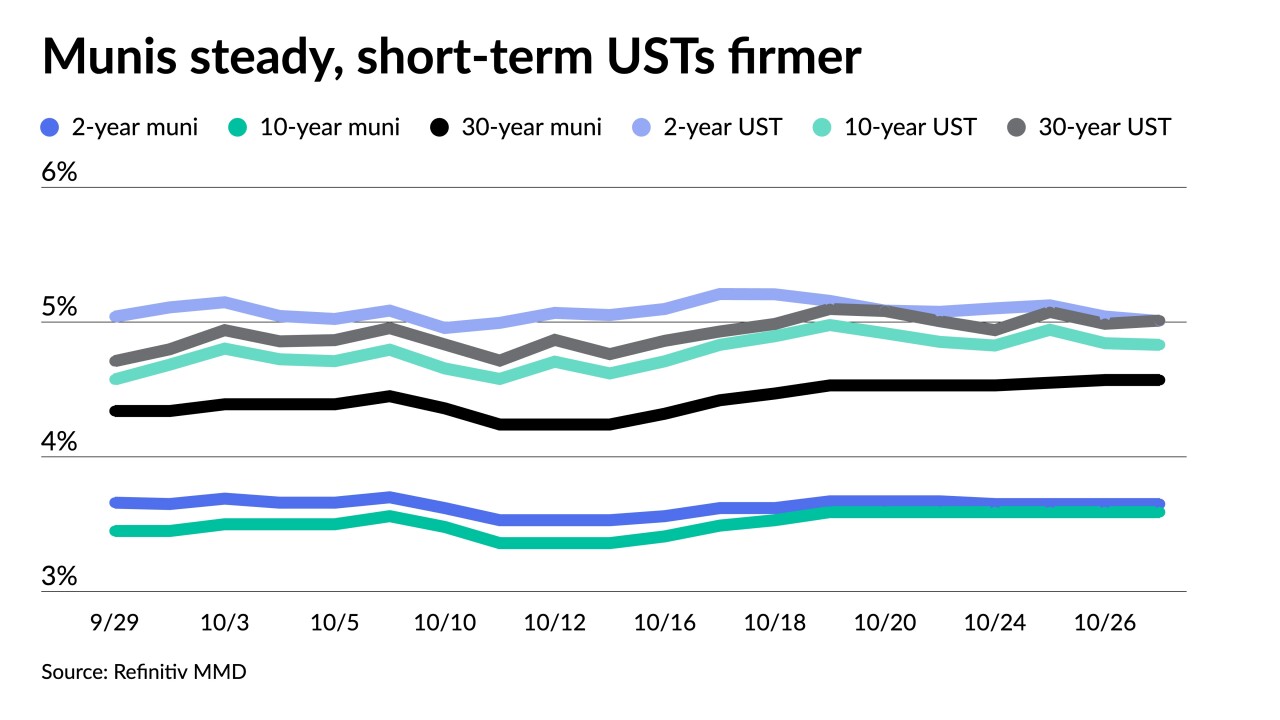

Triple-A muni yields fell 10 to 14 basis points while UST saw gains of up to 16bps out long as market participants consider a potential end to Fed rate hikes.

November 2 -

"The big question is: who's next? I don't think UBS is the end," said a veteran sellside market participant.

November 2 -

Large reserves will insulate states against downgrades in the near future, one rating agency says.

November 2 -

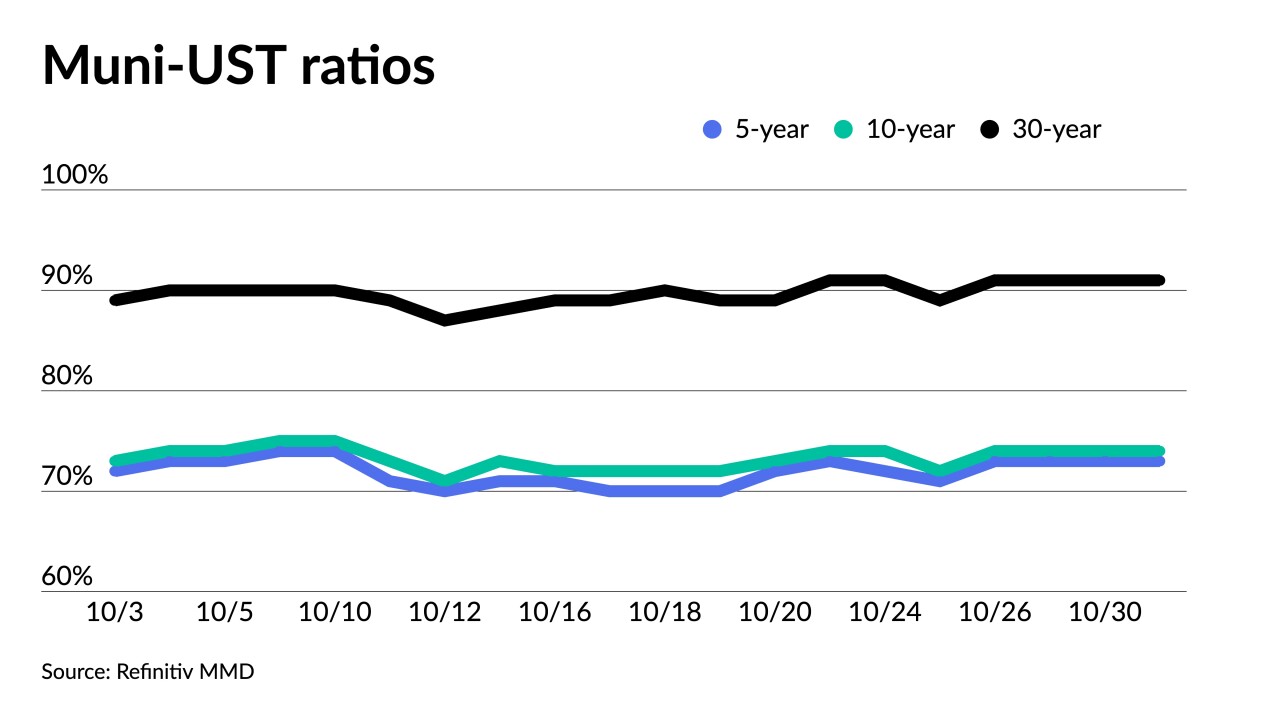

Municipals closed out October in the red, the third consecutive month of losses for the asset class.

November 1 -

While the FOMC statement will likely have very few changes, the post-minutes release press conference will be the wildcard.

October 31 -

The data indicates that 2023 could be "the potential start of a long-feared trend toward more higher ed impairments and, possibly, defaults," MMA's weekly Outlook report said.

October 31 -

Bond Buyer Senior Reporter Keeley Webster shares an interview with California Treasurer Fiona Ma on her run for lieutenant governor as a prelude to a fireside chat Wells Fargo Director Julia Kim conducted with the state treasurer at The Bond Buyer's California Public Finance conference.

October 31 -

Another month of muni losses "may spark additional sale pressure as some investors throw in the towel, but we suspect any further weakness would represent a strong entry point for [investment grade] buyers," Birch Creek Capital said in a weekly report.

October 30 -

If Treasury rates become "more stabilized," it provides "a good reason to be somewhat constructive on munis for a while," BofA Global Research said in a report.

October 27 -

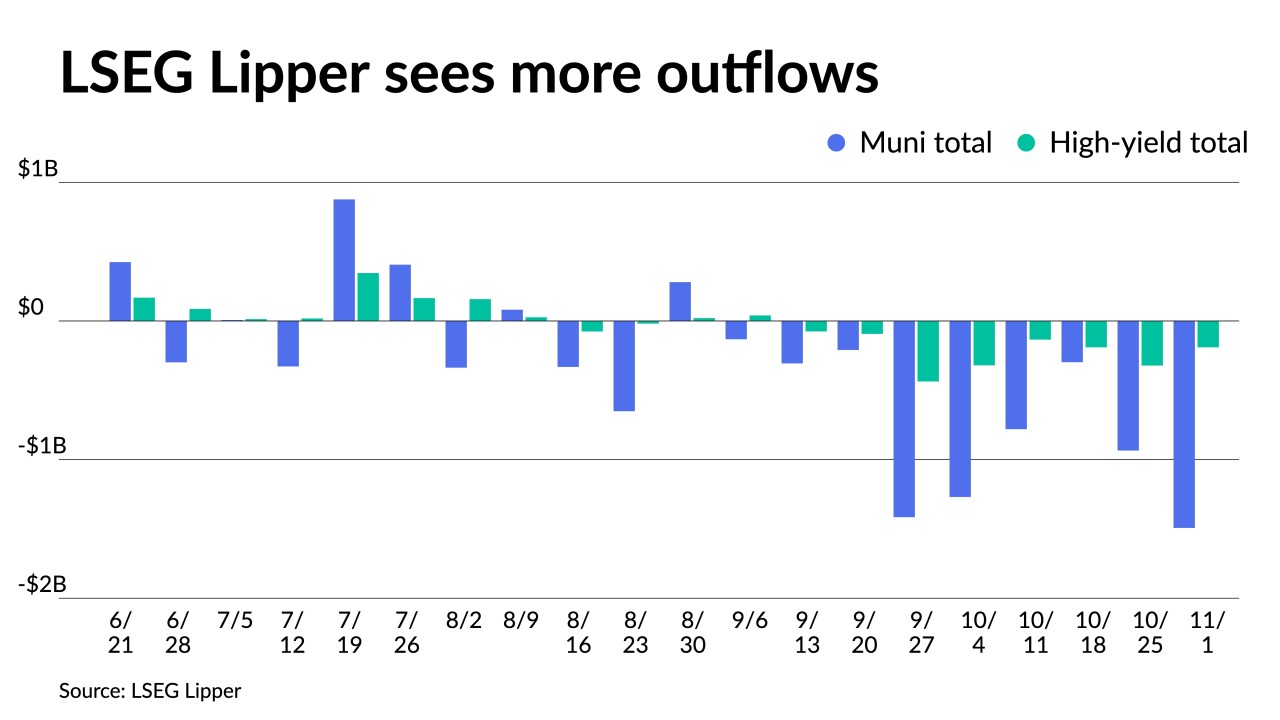

Investors continue to pull money from muni mutual funds with LSEG Lipper reporting $934.7 million of outflows for the week ending Wednesday after $297 million of outflows the week prior.

October 26 -

With nearly two years of volatility, The Bond Buyer wants to know your expectations for the year to come, from interest rates and bond volume to ESG and technology.

October 26 Arizent, The Bond Buyer

Arizent, The Bond Buyer -

Municipal mutual fund losses continued last week — but to a lesser extent — as the Investment Company Institute Wednesday reported investors pulled $1.291 billion from the funds in the week ending Oct. 18 after $2.645 million of outflows the previous week.

October 25 -

Munis experienced some firmness Tuesday, but "whether or not that's going to be for more than a nanosecond remains to be seen," said Jeff Lipton, managing director of credit research at Oppenheimer Inc.

October 24 -

An elevated new-issue market is on the horizon with $14.87 billion, per The Bond Buyer's 30-day visible supply.

October 23 -

The new-issue muni calendar is estimated at $8.522 billion next week with $6.075 billion of negotiated deals on tap and $2.446 billion on the competitive calendar, according to Ipreo and The Bond Buyer.

October 20 -

LSEG Lipper data Thursday showed $297 million of outflows from municipal bond mutual funds for the week ending Wednesday after $780.1 million of outflows the week prior.

October 19