-

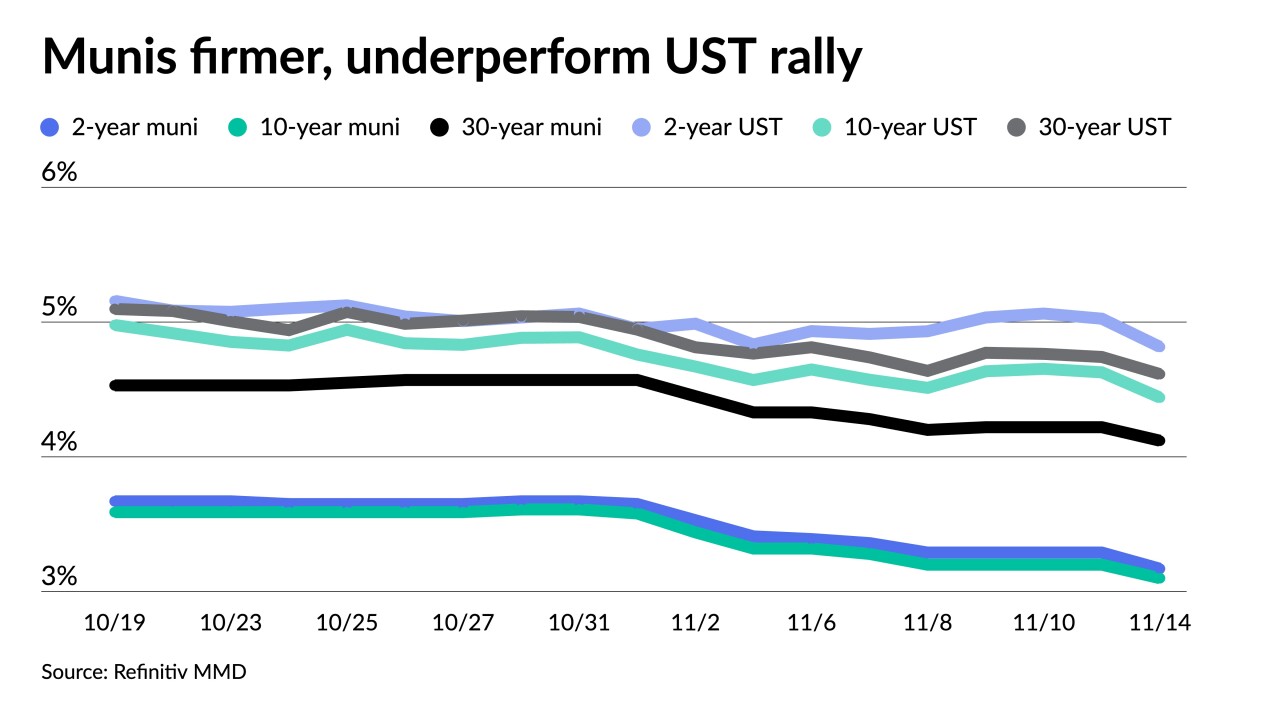

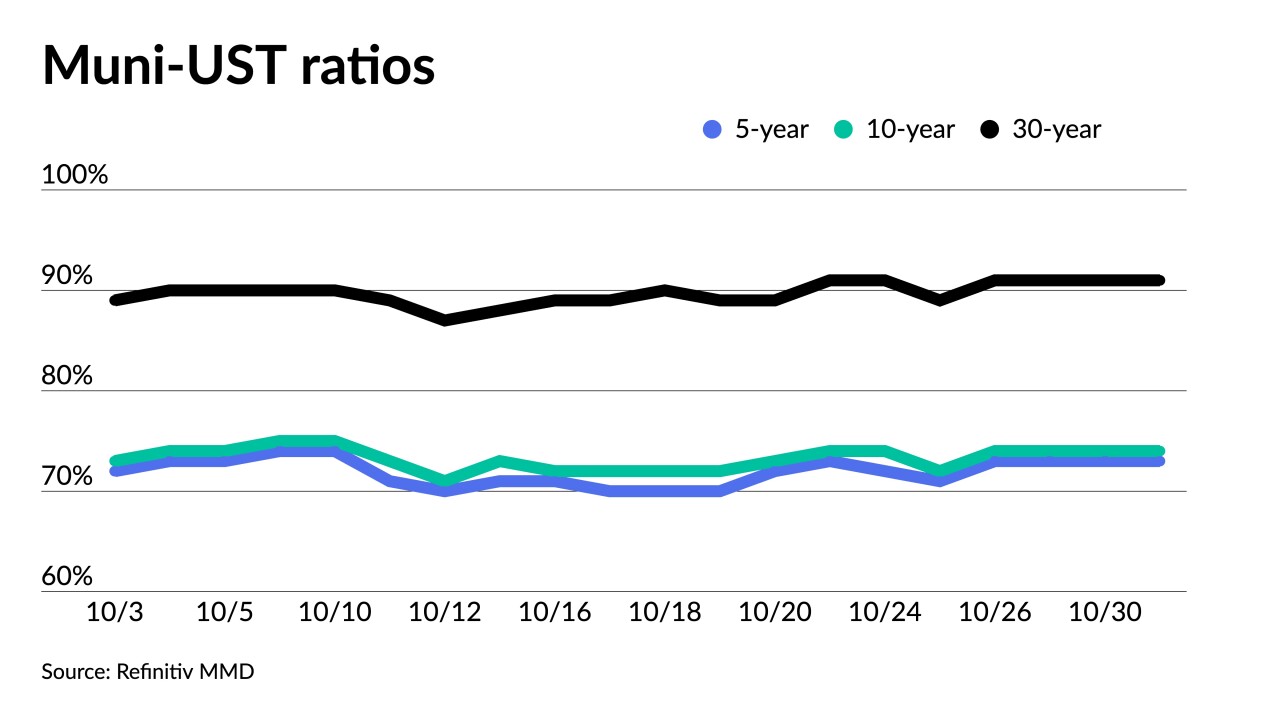

Munis yields fell nine to 12 basis points, depending on the curve, but underperformed larger gains along the UST curve. Large new-issues began pricing.

November 14 -

Moody's kept stable rating outlooks on Florida, Maryland and Virginia after moving the United States to negative. D.C.'s outlook was cut.

November 13 -

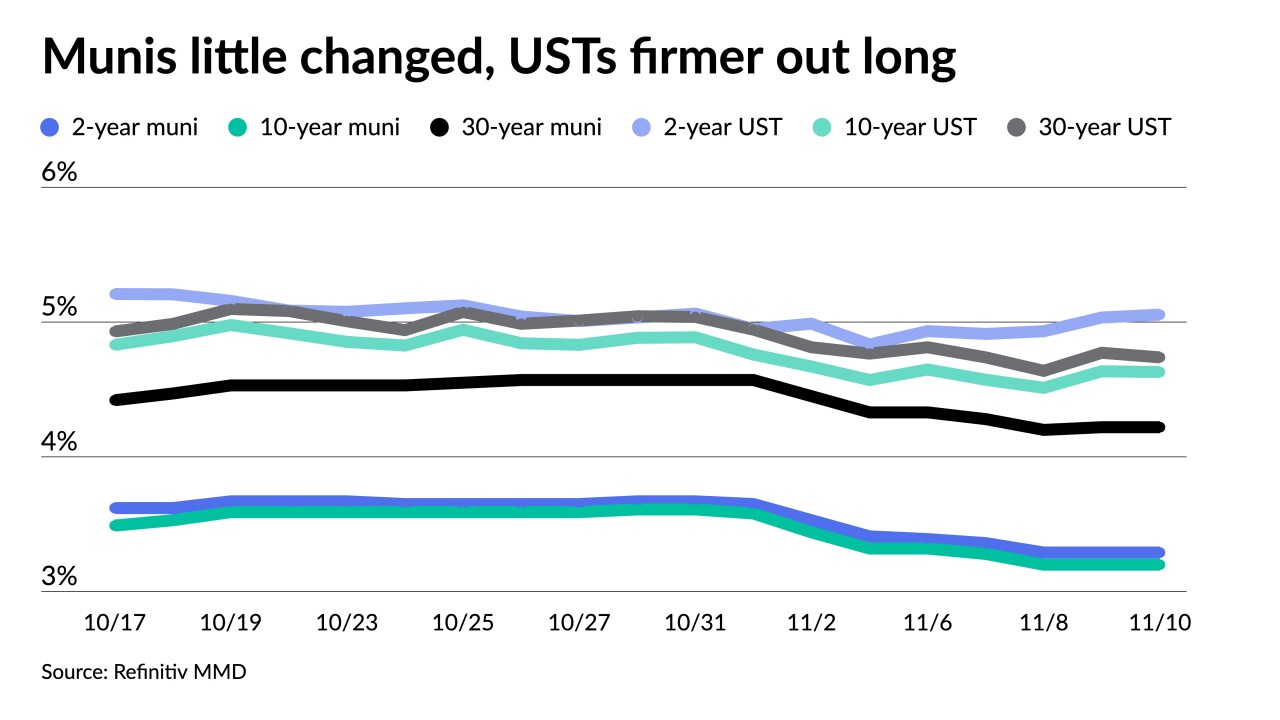

November "continues to be off to a strong start as yields have fallen an average of 34 basis points across the curve since the start of the month," said Jason Wong, vice president of municipals at AmeriVet Securities.

November 13 -

"As with most fast rallies there are sessions when the market pauses to assess where fair value should play out," said Kim Olsan, senior vice president of municipal bond trading at FHN Financial.

November 10 -

The rating agency expects that an uptick in revenues will outpace expenses as the not-for-profit hospital industry gets a handle on labor costs.

November 9 -

A subpoena sent to the Oklahoma Corporation Commission this week seeks communications related to 2021's Winter Storm Uri and nearly $3 billion of utility securitizations that priced in 2022.

November 9 -

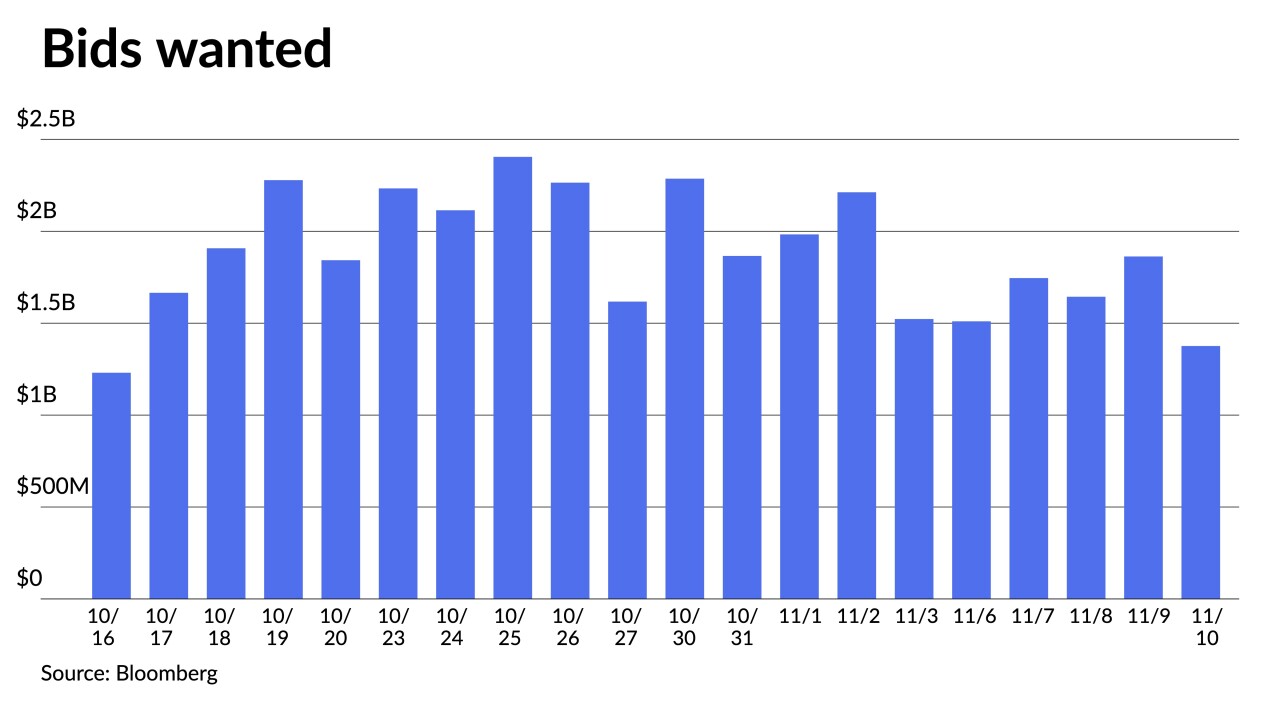

A constructive trading session in the secondary aided a busy primary once again as investors appear to be more engaged in the asset class.

November 8 -

California and Washington sold four large refunding GO deals in the competitive market while several deals of size priced in the negotiated market led by a $650 million for Arizona's Salt River Project. A constructive secondary led yields to fall three to five basis points.

November 7 -

The upgrade brings Illinois up to the A-minus level across the board. The state had three BBB-minus or equivalent ratings as recently as July 2021.

November 7 -

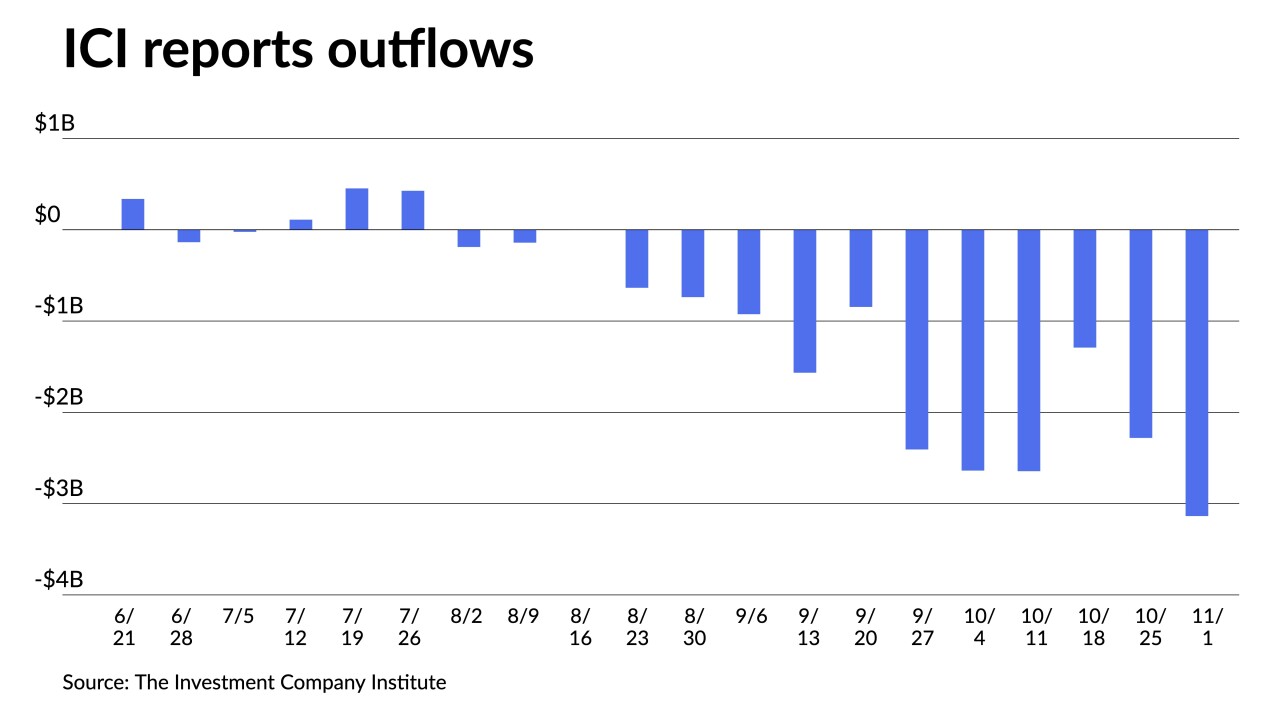

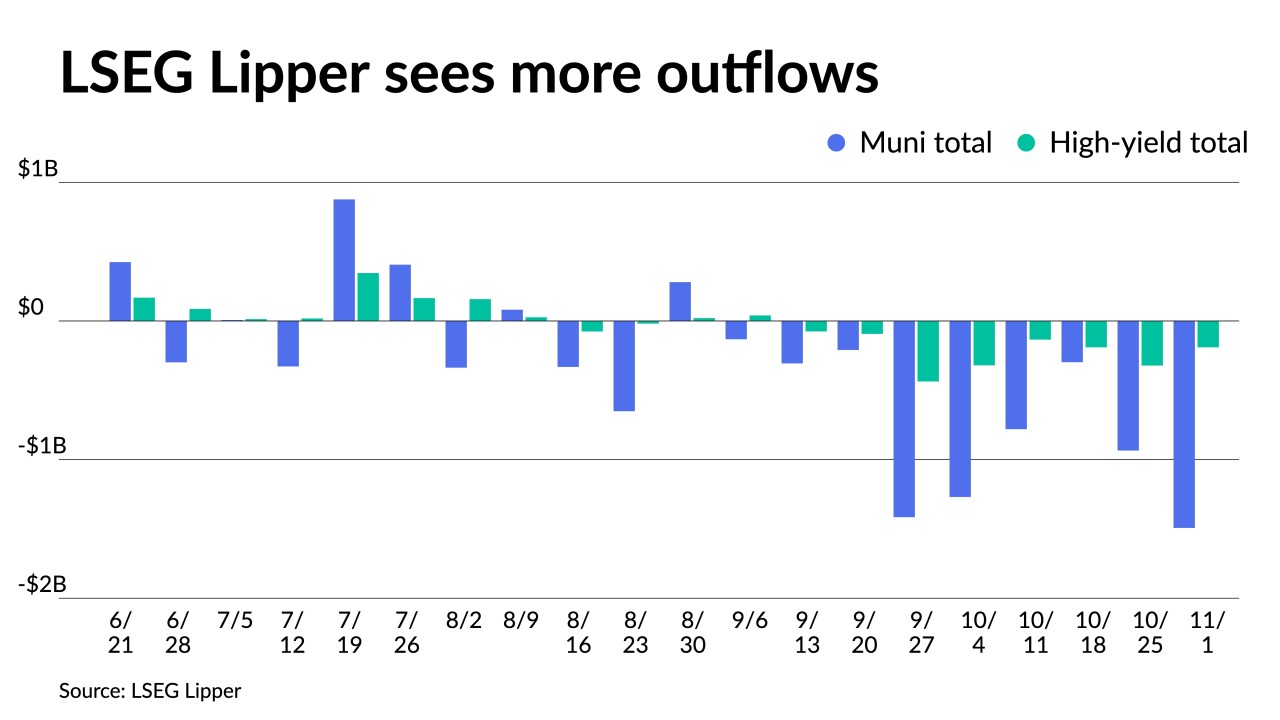

The recent rally is good news for munis, which have "posted a total-negative return loss for three straight months," said Jason Wong, vice president of municipals at AmeriVet Securities.

November 6 -

Attorney General Ken Paxton put several big banks under a review last month, raising concerns more municipal bond underwriters could be driven out of the state.

November 6 -

Teacher shortages and enrollment declines due to growing charter and private schools are two of the problems affecting school financing.

November 6 -

Friday's employment report was good news for the Federal Reserve, with fewer jobs created and a smaller rise in earnings, leading analysts to cautiously increase expectations that the hiking cycle is over.

November 3 -

Washington will auction $483 million in two tranches on Tuesday.

November 3 -

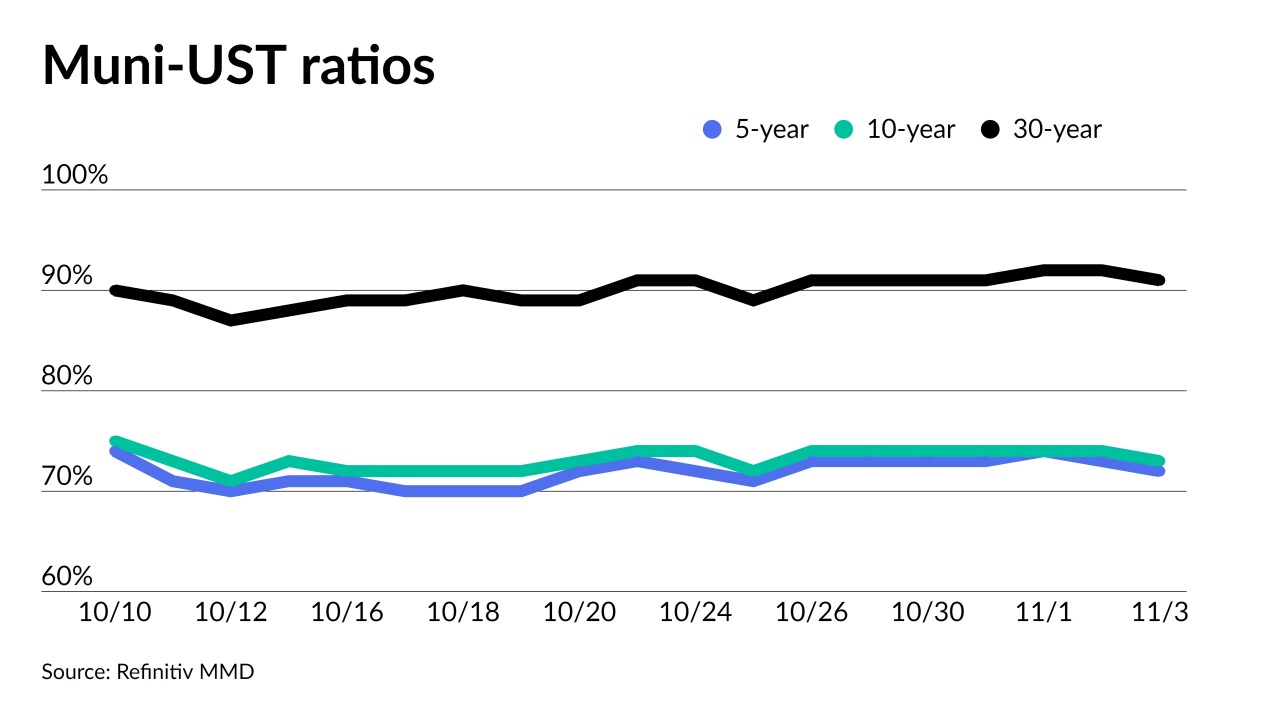

Triple-A muni yields fell 10 to 14 basis points while UST saw gains of up to 16bps out long as market participants consider a potential end to Fed rate hikes.

November 2 -

"The big question is: who's next? I don't think UBS is the end," said a veteran sellside market participant.

November 2 -

Large reserves will insulate states against downgrades in the near future, one rating agency says.

November 2 -

Municipals closed out October in the red, the third consecutive month of losses for the asset class.

November 1 -

While the FOMC statement will likely have very few changes, the post-minutes release press conference will be the wildcard.

October 31 -

The data indicates that 2023 could be "the potential start of a long-feared trend toward more higher ed impairments and, possibly, defaults," MMA's weekly Outlook report said.

October 31