-

The Aa2 rating was affirmed, but the negative outlook could raise the stakes as New York lawmakers debate the city's budget gap.

March 11 -

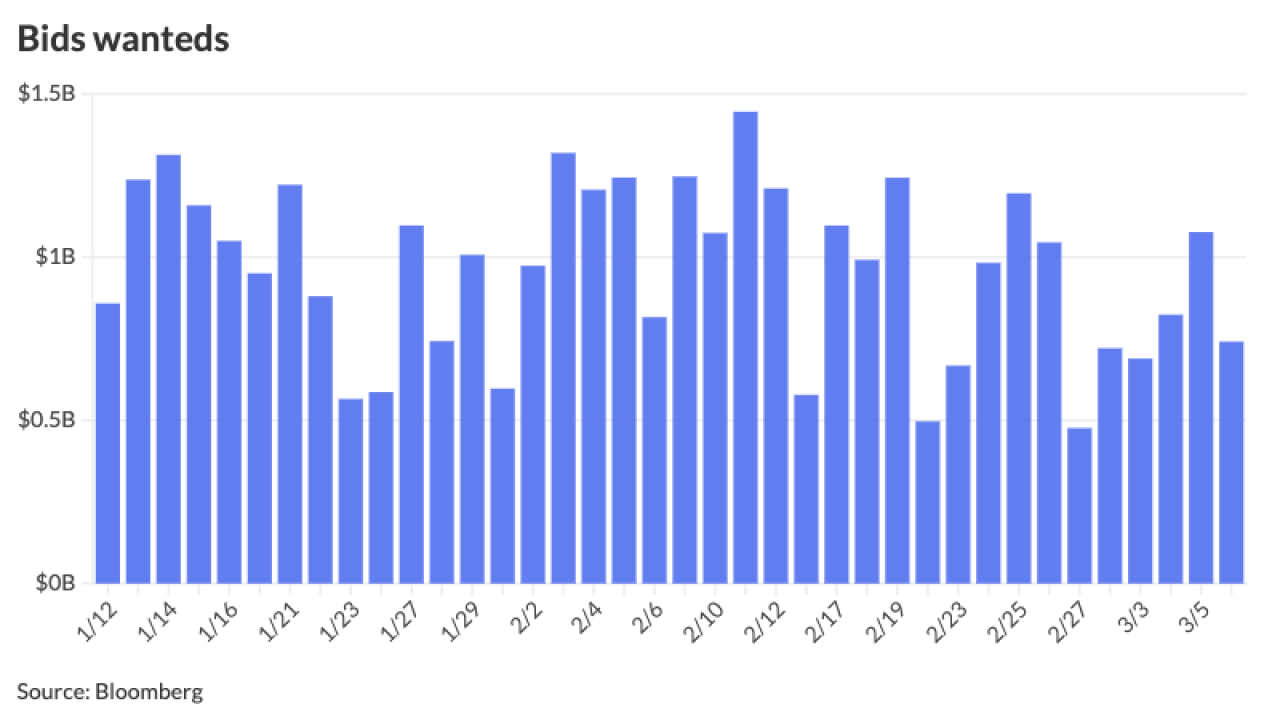

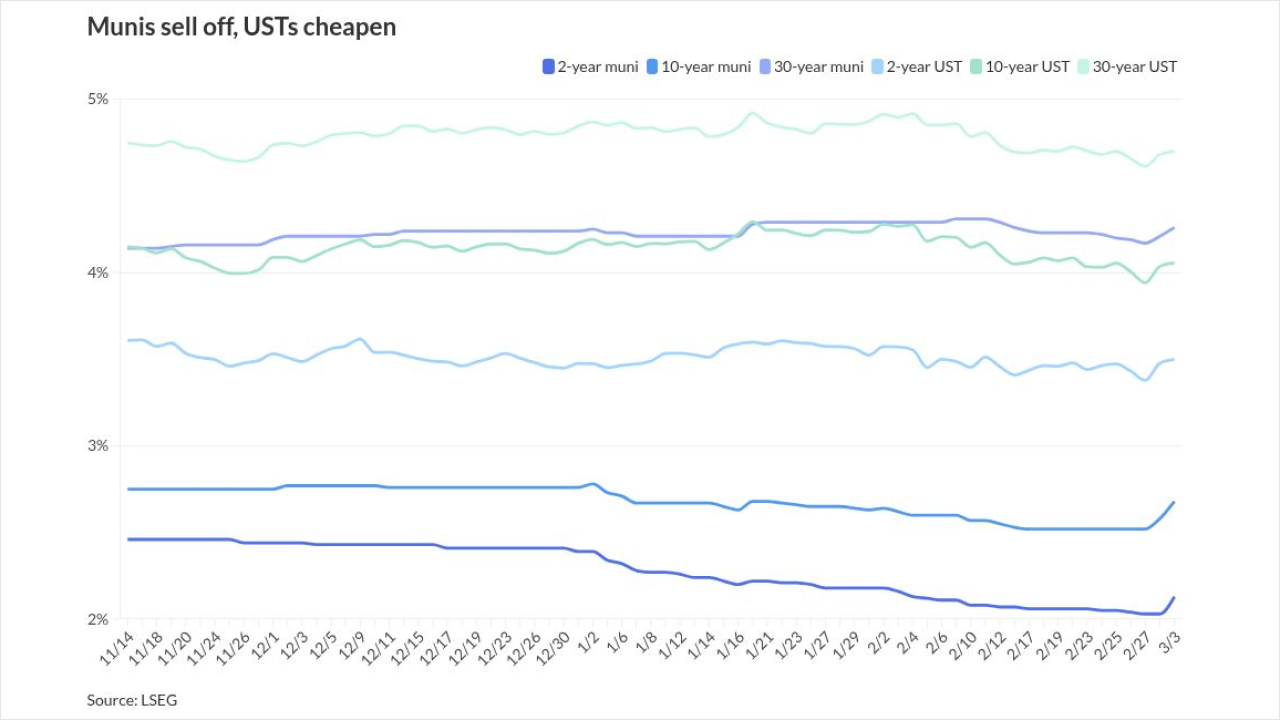

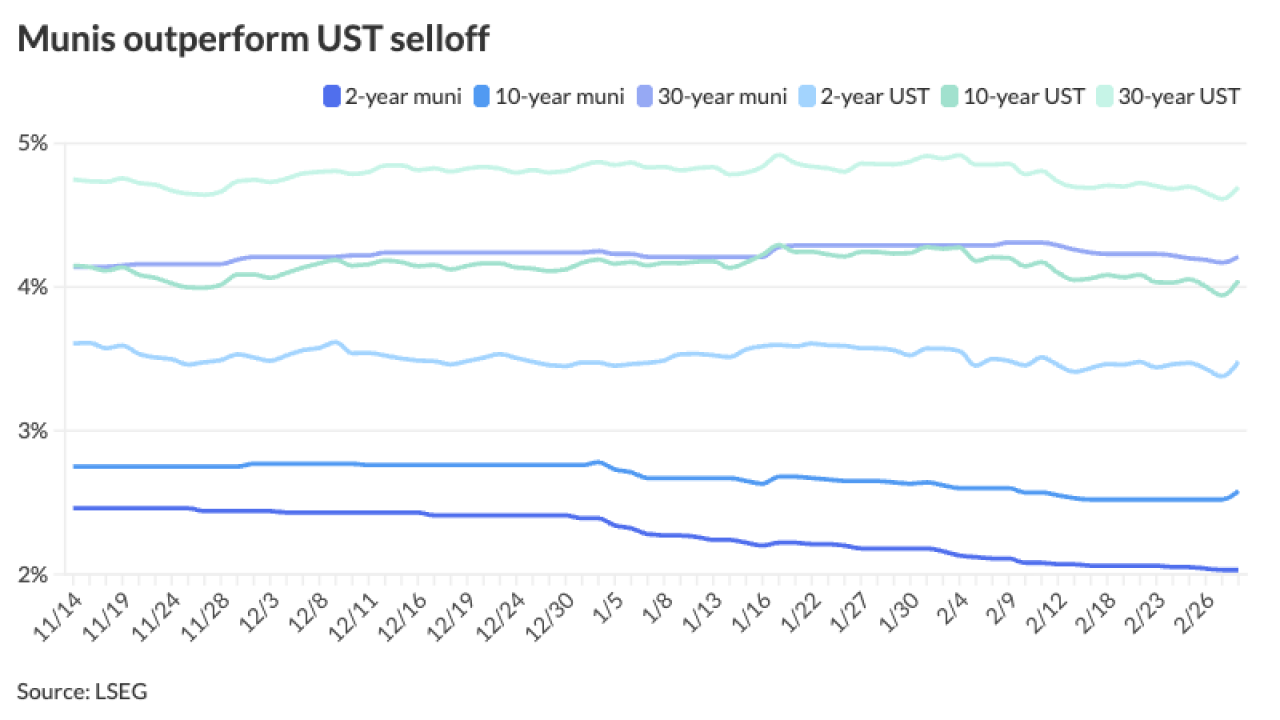

"There was a certain amount of resilience munis had in the last week, comfortable enough with distribution," said Kim Olsan, senior fixed income portfolio manager at NewSquare Capital Markets. "But the 10-year Treasury backing up behind 4.20%, it proved to be the catalyst for adjusted bid-sides."

March 11 -

At least two local agencies missed debt service payments after the Cook County, Illinois, treasurer's office was unable to issue property tax bills on time.

March 11 -

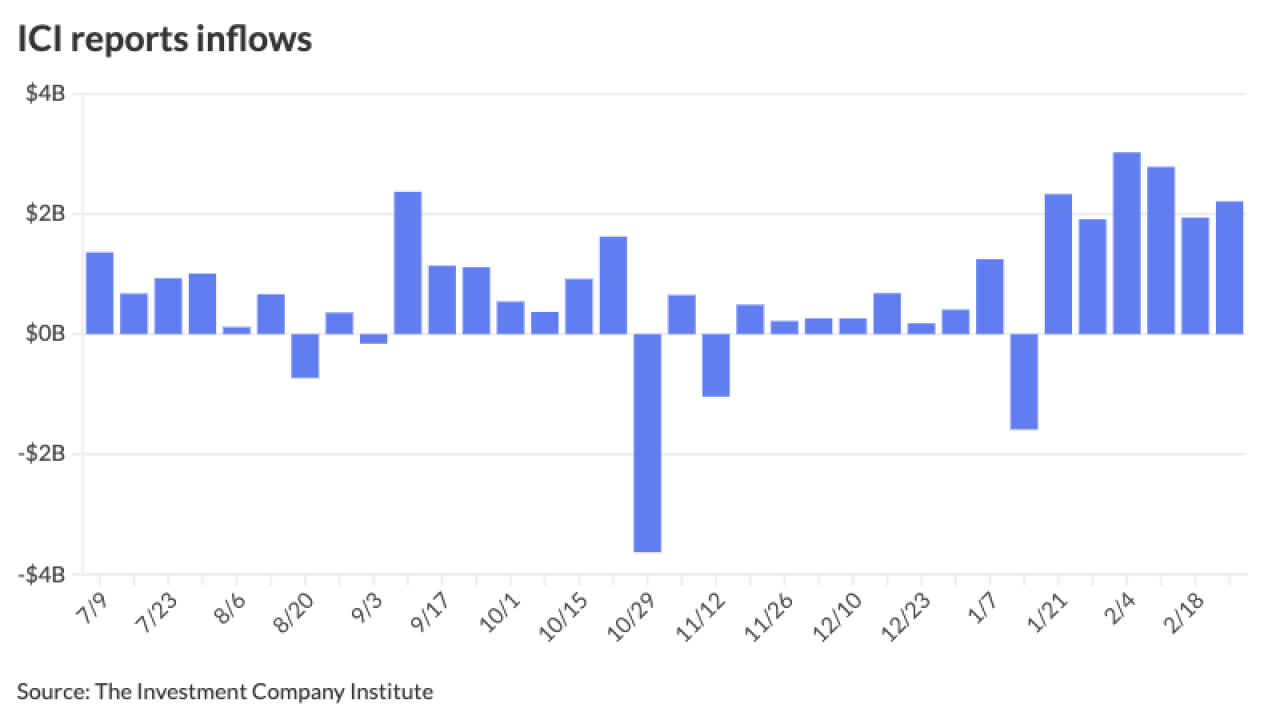

This week, "look for deals to get priced to attract demand," said Pat Luby, head of municipal strategy at CreditSights, and Wilson Lees, an analyst at the firm.

March 10 -

Many muni participants stayed on the sidelines to start last week due to "the sudden about-face in the Treasury market and uncertainty over how long-lasting the incursion would be," Birch Creek strategists said.

March 9 -

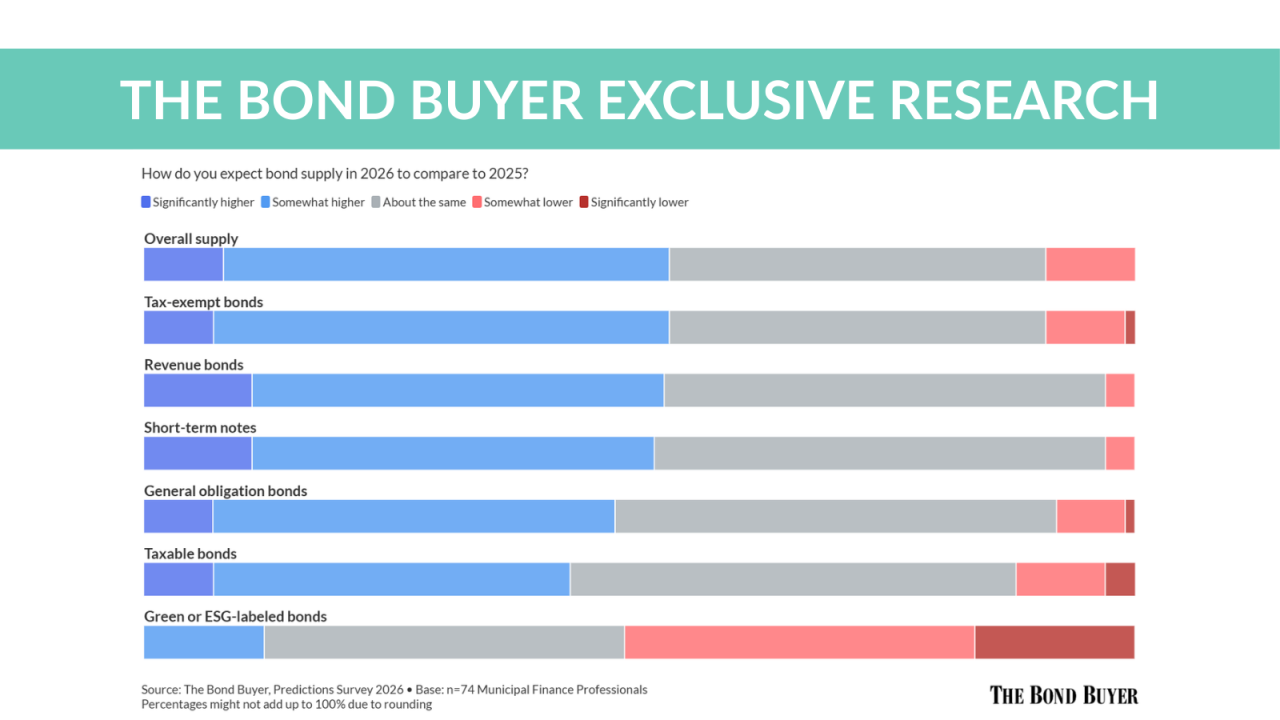

The latest research from The Bond Buyer predicts supply and issuance volume will grow in the months ahead.

March 9 -

"We are still not overly concerned about the effect of the geopolitical concerns on municipals — in our view, the muni market is well insulated," said Barclays strategists.

March 6 -

Brightline asked S&P to withdraw its rating after the latest downgrade.

March 6 -

Market technicals should weaken this month in line with seasonal expectations, with estimated redemption capital of $32 billion compared to estimated supply of $41 billion, said Appleton Partners strategists.

March 5 -

Market Intelligence analyst Jeff Lipton distills what he heard onstage and in the hallways at The Bond Buyer's 2026 National Outlook, from policy uncertainty and the muni tax exemption to AI's growing role and credit risk hotspots.

March 5 The Bond Buyer

The Bond Buyer -

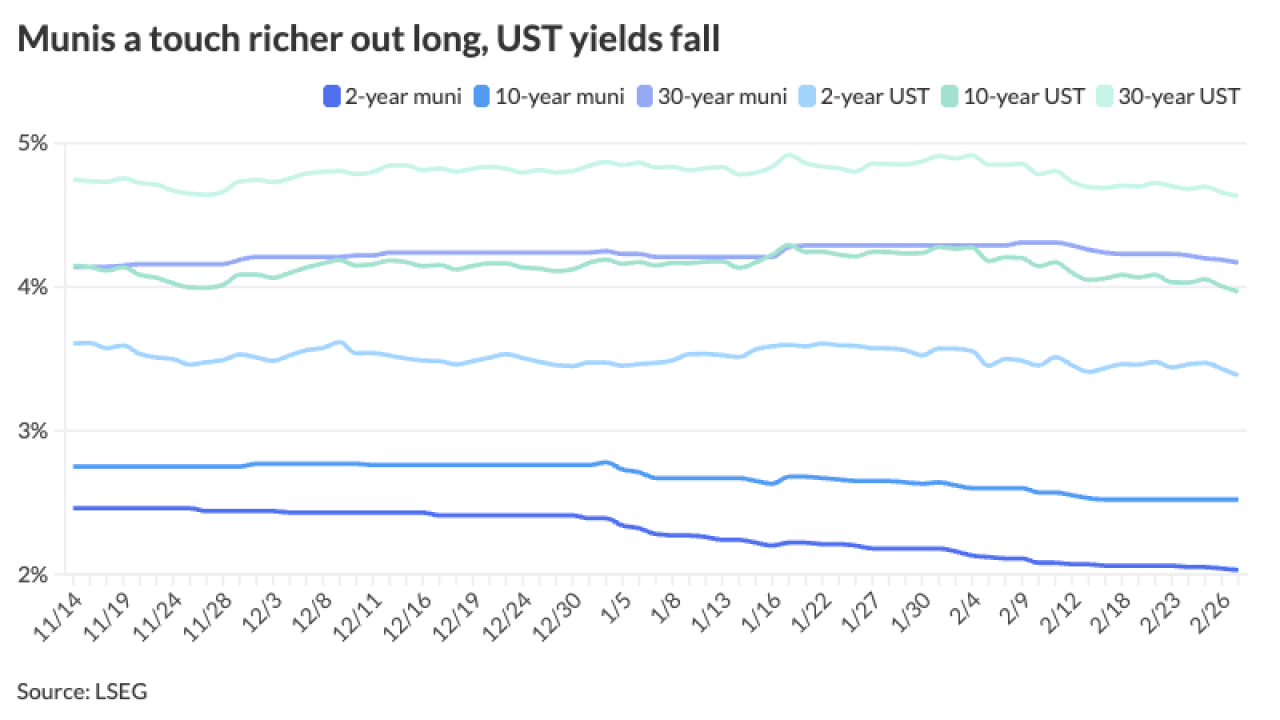

With USTs stable and the "snoozer" of economic data Wednesday morning, the muni market has settled, with muni yields little, said Jeff MacDonald, EVP and head of fixed income strategies at Fiduciary Trust International.

March 4 -

Los Angeles' weakening fiscal picture and the city utility's exposure to lawsuit liability from the 2025 Palisades fire were cited for the downgrades.

March 4 -

"Once the damage is done, it takes a little longer for it to come back," said Elaine Brennan, executive director of the public finance department at Roosevelt and Cross, of the muni market.

March 3 -

Chicago returns to market March 10 with $800.29 million of general obligation bonds, following bond rating downgrades from Fitch Ratings and KBRA.

March 3 -

A recent report from The Bond Buyer found that data quality and accuracy was the top concern among AI skeptics in the industry.

March 3 -

Major Texas cities are prepping big bond issues to finance convention center expansions, with Houston hitting the market this week with $1.425 billion of debt.

March 3 -

First thing this morning, there wasn't much action as market participants waited to see what would happen, but as the day went on, munis got progressively weaker, said Kyle Gerberding, director of trading, a portfolio manager and partner at Asset Preservation Advisors.

March 2 -

Market Intelligence analyst Jeff Lipton assesses the early impacts of Operation Epic Fury on rates, spreads, shifting inflation expectations, and flows, arguing that elevated tax-exempt income, disciplined sector allocation and a quality bias can help muni investors navigate headline-driven volatility.

March 2 The Bond Buyer

The Bond Buyer -

On the week, the muni market performed well, with most investor action happening in the longer half of the curve, said BofA strategists.

February 27 -

The ratings agency cited improved operating performance.

February 27