-

The legislature addressed the cost of a $329 million property tax refund in the state's largest county as well as passed a fiscal 2025 budget.

June 18 -

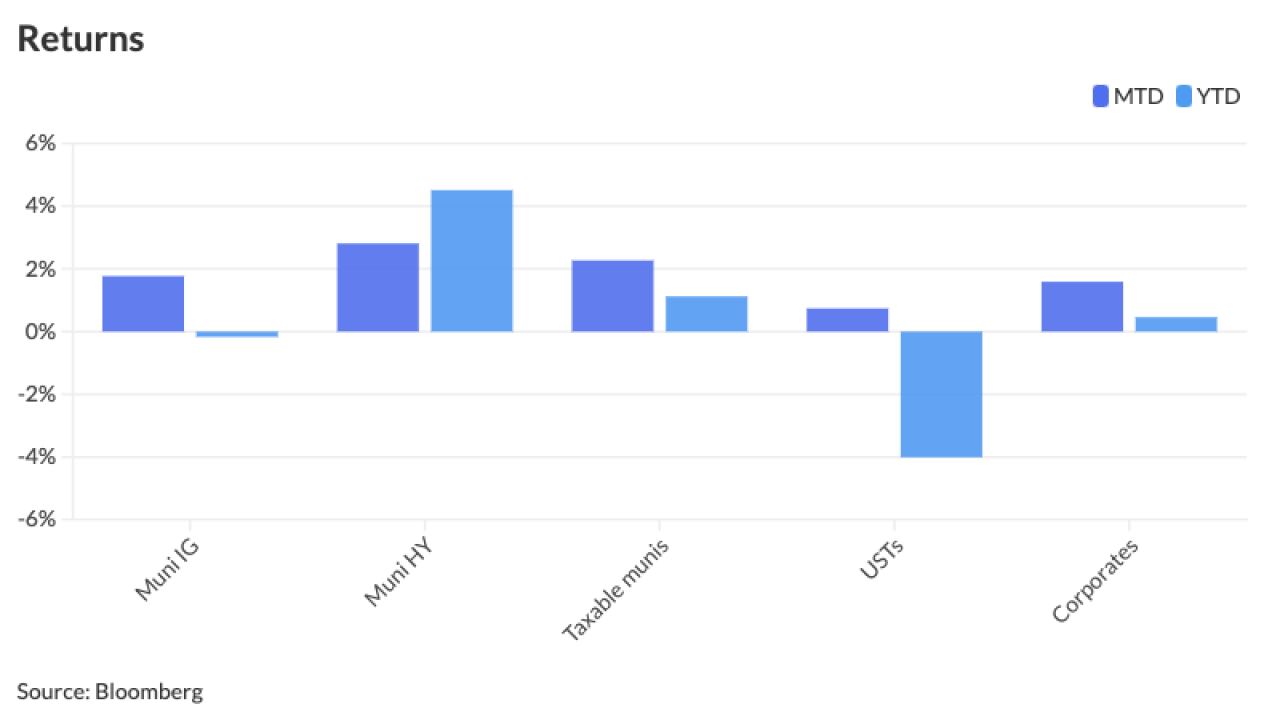

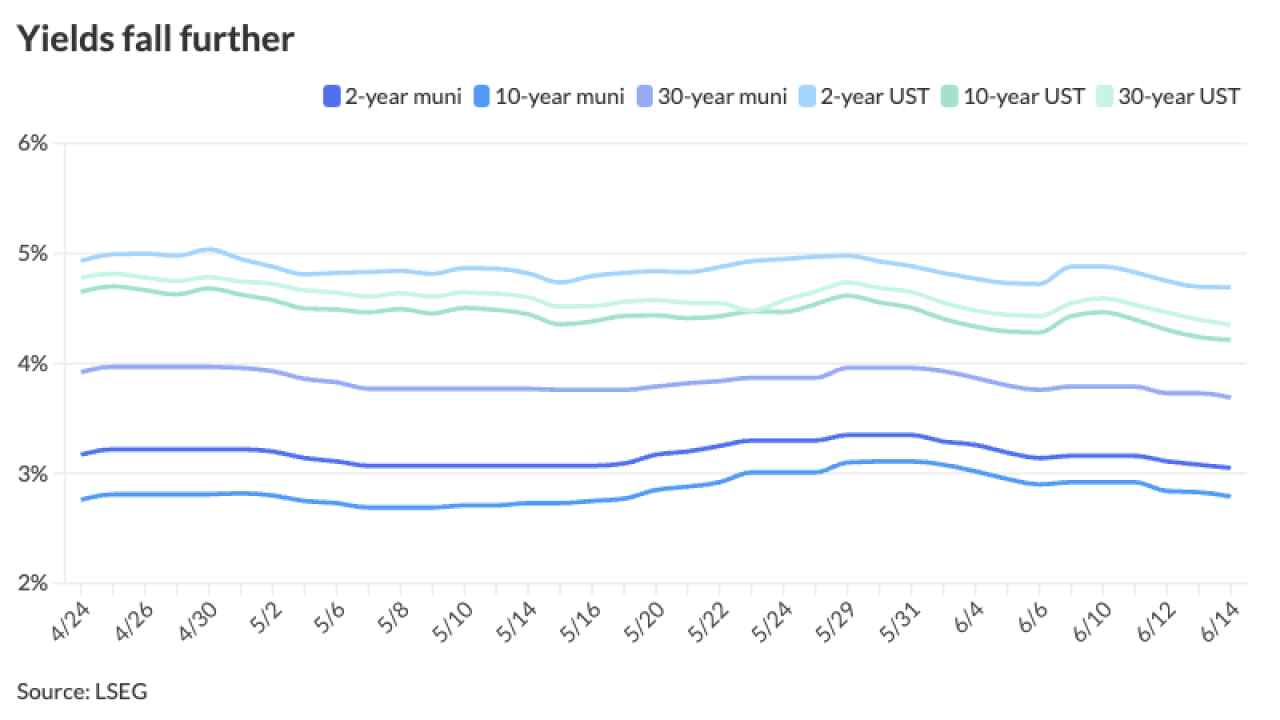

Despite some slight weakness Monday, munis continued an "impressive start to June," with yields falling 10 to 13 basis points last week, Birch Creek strategists said.

June 17 -

The City of Angels is the latest in recent days to score a ratings upgrade as Fitch reviews its local government ratings using amended criteria.

June 17 -

According to the board, the addition is an important means to enhance market transparency and is in line with its FY24 priority to expand the EMMA platform.

June 17 -

The Philadelphia Fed president said there can be as few as no cuts or as many as two this year, but if his projections are accurate, one decrease would be appropriate this year.

June 17 -

"We need to see more evidence to convince us that inflation is well on our way back down to 2%," Federal Reserve Bank of Minneapolis President Neel Kashkari said.

June 17 -

Laura Allen, former president of the Government Finance Officers Association, hands the baton off to Tanya Garost at a time when the group is taking new steps to recruit and engage with its members.

June 17 -

The county hopes one-time revenues will help it "live to fight another day" as it awaits a state-assisted financial plan.

June 17 -

The new-issue calendar is led by the New York Transportation Development Corp. with $1.5 billion of green AMT special facilities revenue bonds for the John F. Kennedy International Airport New Terminal One project,

June 14 -

"I think the risks to inflation are still on the upside," Federal Reserve Bank of Cleveland President Loretta Mester said. "I think the risk to the labor market is dual-sided."

June 14