-

Representatives from the Securities and Exchange Commission gathered Tuesday to discuss some of their examination priorities and some of the trends they're seeing outside of exams.

April 3 -

"What we saw in 2023 was a large surge of issuers coming back into the single-family bond market," said Kurt van Kuller of Sit Investment Associates.

April 3 -

The bankruptcy of Iowa City's Mercy Hospital is closer to an end with the resolution of a dispute between unsecured creditors and the trustee and bondholder.

April 2 -

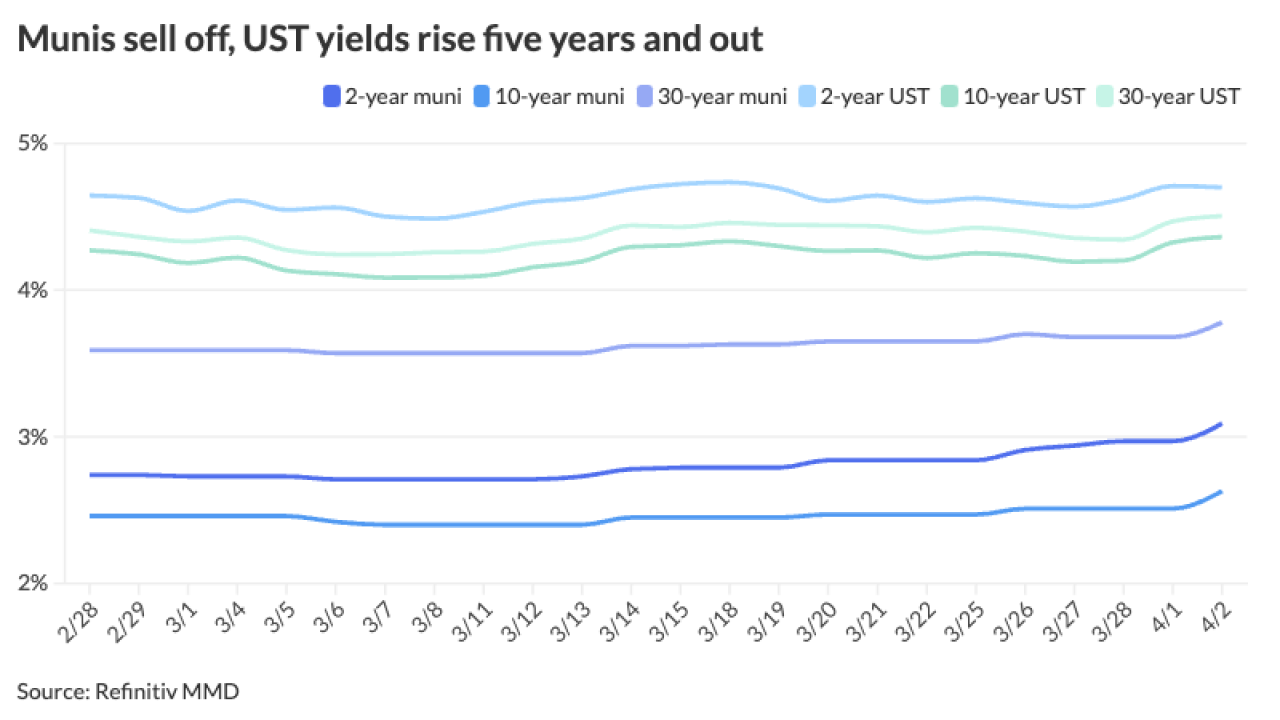

Before Tuesday's selloff, muni yields have been rising over the last several weeks due to "outsized" new-issue supply, said Anders S. Persson, Nuveen's chief investment officer for global fixed income, and Daniel J. Close, Nuveen's head of municipals.

April 2 -

With a dearth of taxable muni supply and Build America Bond refundings, the university should see strong demand for this week's $500 million taxable corporate CUSIP bonds.

April 2 -

The city is offering $567.6 million of debt in competitive sales Thursday as rating agencies keep a close eye on pension funding progress.

April 2 -

In "my nearly 50 years in finance, I've never seen more demand for energy infrastructure," BlackRock CEO Larry Fink said in his latest investor letter.

April 2 -

Christopher Perillo agreed to settle charges that he improperly had access to study materials during an examination.

April 2 -

Longtime San Francisco Bay Area bond attorney firm Quint & Thimmig is closed.

April 2 -

Austin Transit Partnership's ability under Texas law to seek expedited court validation for bonds to finance light rail is the subject of an April 25 hearing.

April 2