-

Siebert Williams Shank's Giles Nicholson breaks down the year's biggest trends in the muni market, from tax exemption fears to technological transformation, and what to expect in 2026.

January 6 -

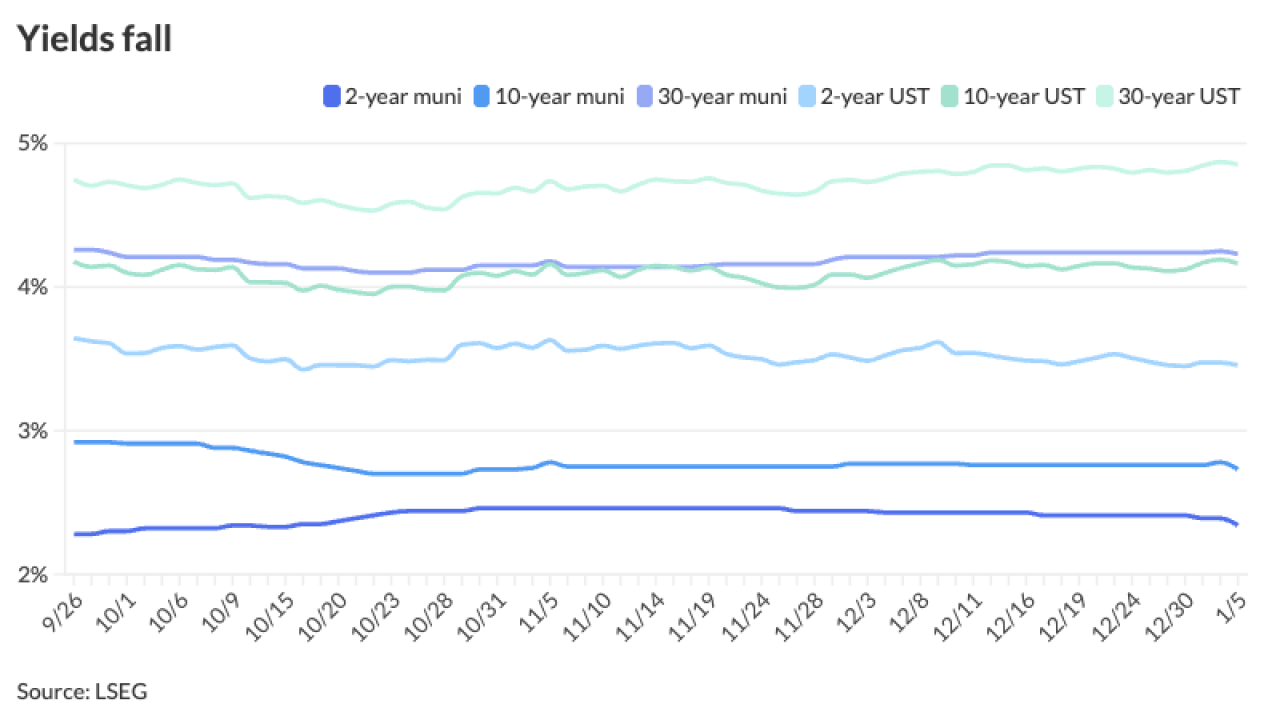

In the first of his three-part 2026 municipal outlook series, Market Intelligence analyst Jeff Lipton forecasts for sub-5% returns, continued demand, possibly more curve steepening as the Fed eases slowly, the economy skirts recession, and AI, tariffs and midterm politics potentially reshaping risks across public finance sectors.

January 6 The Bond Buyer

The Bond Buyer -

The 'minibus' avoids the deep cuts recommended in President Trump's budget.

January 6 -

Federal Reserve Bank of Richmond President Tom Barkin said economic uncertainty should ease in the coming year as businesses gain confidence in sustained demand and adapt to the new policy environment.

January 6 -

Bond sales by Texas issuers rose 21% to $82.52 billion, putting the state in second place behind California and well ahead of third-place New York.

January 6 -

Improved risk sentiment after the capture of Venezuelan President Nicolás Maduro helped pull investors into all markets and munis are a "beneficiary" of that shift, said James Pruskowski, an investor and market strategist.

January 5 -

Late last month, PureCycle Technologies amended the indenture and loan agreement for the bonds issued for its Ironton, Ohio, project.

January 5 -

"The new office will be smaller, more efficient, and right sized for our future needs," an MSRB spokesperson said.

January 5 -

Kutak Rock is promoting several members of their public finance and tax teams as part of a move that sees 28 attorneys move into partnership roles in eleven offices.

January 5 -

Minneapolis Federal Reserve President Neel Kashkari said on CNBC that both sides of the central bank's dual mandate show signs of imbalance, with the labor market appearing more vulnerable.

January 5