-

The rating agency cited state budget volatility that affects local government aid.

July 20 -

S&P dropped Alaska to AA amid dwindling budget reserves.

July 18 -

Fitch took Illinois off negative watch, while keeping a negative outlook on its BBB rating.

July 17 -

The state's Supreme Court may order state lawmakers to increase K-12 spending.

July 17 -

Pension funding woes drove the downgrade and continued negative outlook.

July 14 -

Three major rating agencies have reaffirmed Norwalk, Conn.'s top-notch credit rating in advance of a $35 million bond sale next week.

July 14 -

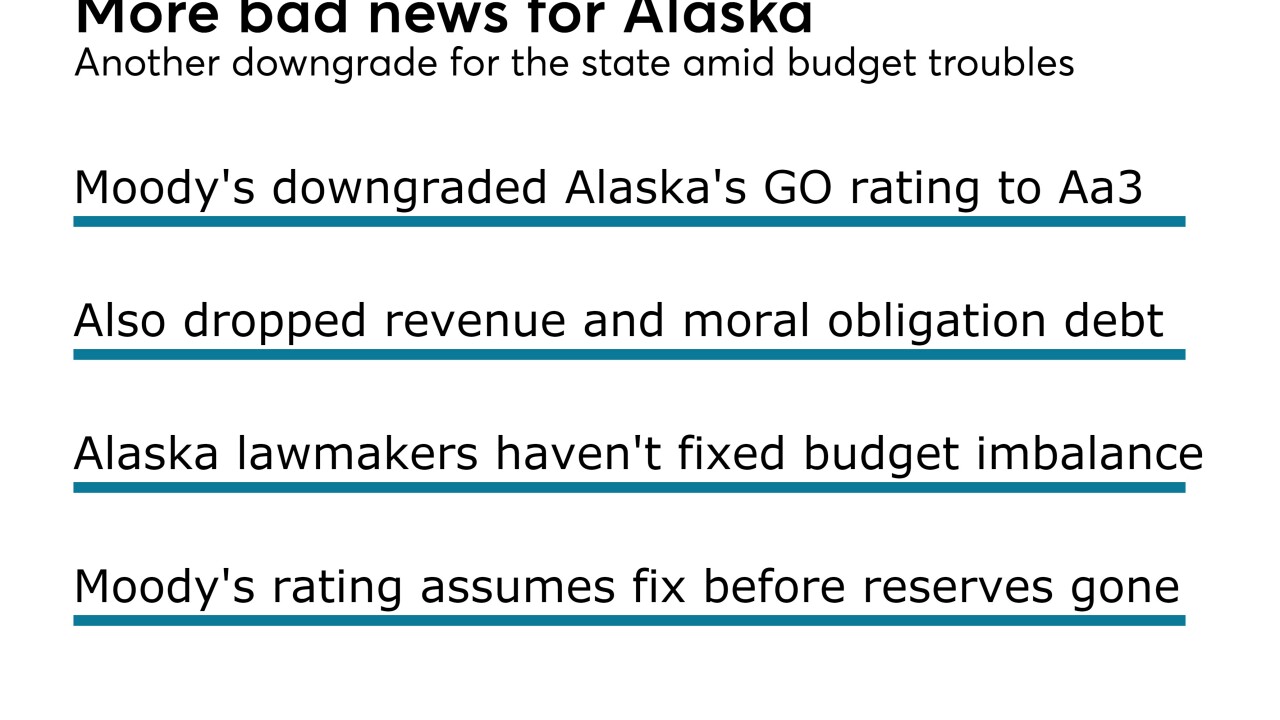

Alaska, unable to agree on budget stability, is blowing through its reserves.

July 14 -

Rating pressures eased on the healthcare system's low investment grade rating.

July 13 -

The downgrade affected $38.4 million of general obligation debt.

July 13 -

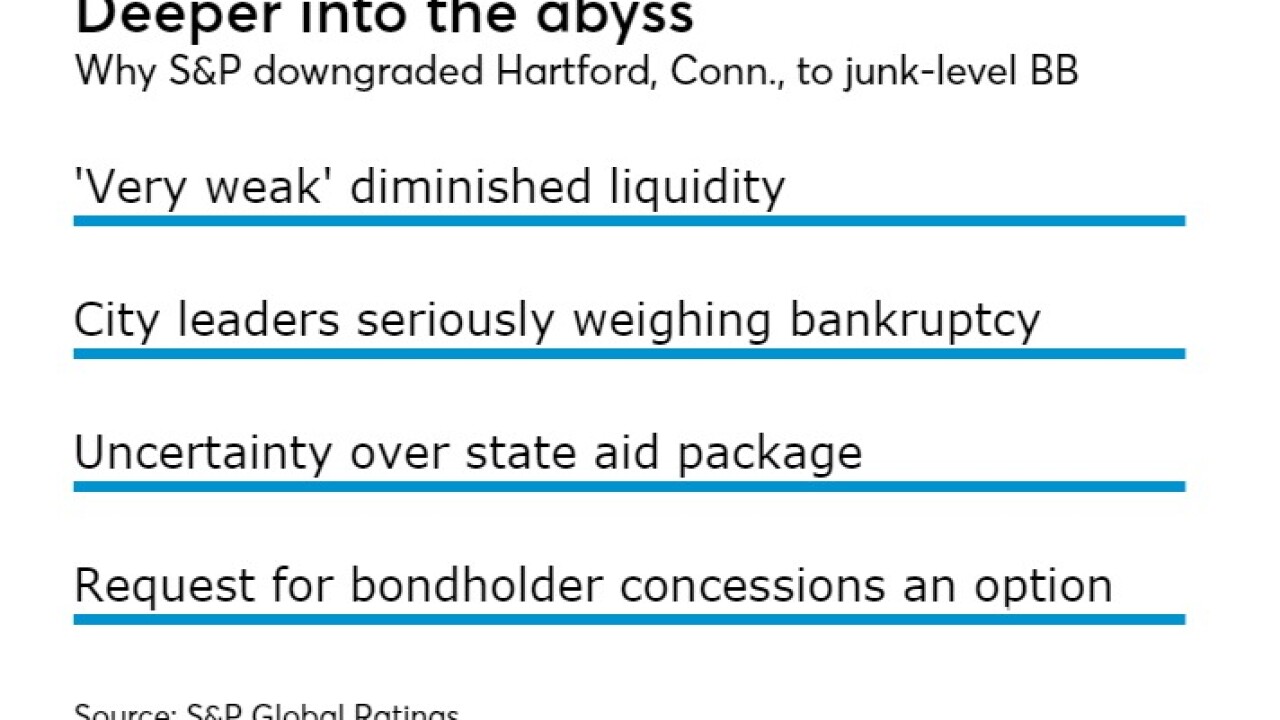

It's two downgrades this week for Connecticut's troubled capital city.

July 13 -

The end of a two-year old budget impasse led S&P to affirm Illinois and assign a stable outlook.

July 12 -

A merger between Philadelphia University and Thomas Jefferson University will have no immediate credit impact , according to Moody’s Investors Service.

July 12 -

S&P Global Ratings said it affirmed its BBB-minus rating on Illinois' general obligation bonds, and the BB-plus ratings on the state's appropriation-backed debt, which includes Chicago's outstanding motor fuel tax (MFT) revenue bonds.

July 12 -

Struggles with tuition revenue growth landed a junk rating for Hartwick College in Oneonta, N.Y.

July 12 -

Gov. Tom Wolf and Pennsylvania lawmakers must still agree on a revenue package

July 12 -

Junk status underscores the need for a 'far-sighted restructuring,' according to Luke Bronin.

July 12 -

Fitch Ratings lowered the Sooner State to AA from AA-plus.

July 11 -

Gov. Tom Wolf bought time to pass the bills necessary to fund Pennsylvania's $32.2 billion spending plan.

July 11 -

Allegations of fiscal mismanagement landed a California school district on negative watch.

July 10 -

Moody's Investors Service said it has placed Chicago's Ba1 general obligation rating under review for possible downgrade.

July 7