Lynne Funk is Senior Director, Strategy and Content, Live Media - Municipal Finance. She leads and shapes The Bond Buyer's six major events, serving as host, moderator, thought leader and brand ambassador. Lynne also is charged with creating innovative live media formats, including new conferences, virtual summits and podcasts to help serve our municipal finance community. Lynne has nearly two decades of experience in the public finance industry. She was most recently Executive Editor of The Bond Buyer. Previously, she was a director at Municipal Market Analytics, Inc., and in the Policy and Public Advocacy for the Municipal Securities Division at the Securities Industry and Financial Markets Association.

-

More of the same from the FOMC did little to move UST or munis. ICI reported the 17th consecutive week of inflows at $1.98 billion. July is looking good for municipal issuers.

By Lynne FunkJuly 7 -

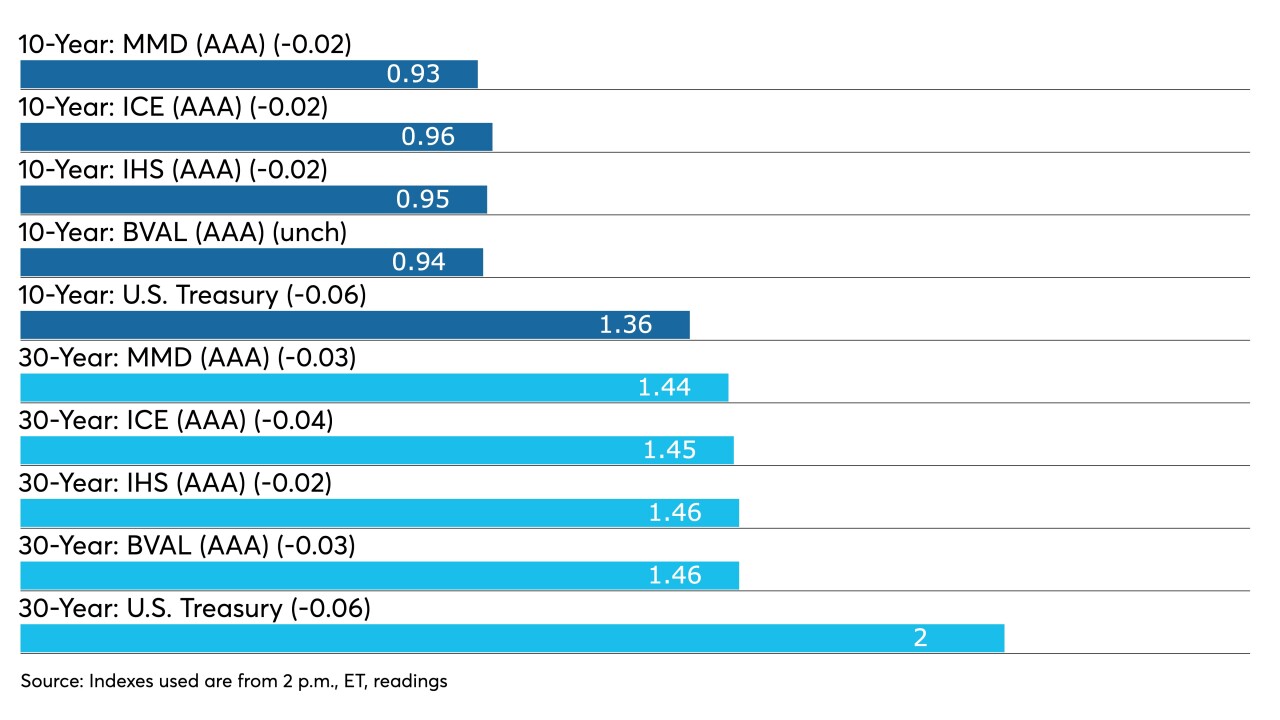

U.S. Treasury 10- and 30-year yields hit February lows. Large blocks of high-grades in secondary trading led triple-A benchmarks to lower yields by two to four basis points across the curve.

By Lynne FunkJuly 6 -

High-yield municipal bond returns are more than 6% so far in the year as Nuveen expands its reach in the sector with a new "interval" high-yield fund.

By Lynne FunkJuly 6 -

With better-than-expected payrolls, economists still caution full recovery is a ways away. Muni participants are closely following how the Fed's action — or inaction — will affect the municipal market going forward.

By Lynne FunkJuly 2 -

The broader market awaits Friday’s nonfarm payrolls report, but Thursday brought some helpful labor news — unemployment claims dropped to the lowest since before the pandemic-caused economic shutdowns and layoffs plunged in June.

By Lynne FunkJuly 1 -

While June was lower than 2020 in par, pandemic-related factors skewed last year's issuance totals, making the $42 billion issued this month high on a historical basis. Outside factors, such as federal aid and potential infrastructure plans, may affect issuance going forward.

By Lynne FunkJune 30 -

A majority of the week's largest new issues priced at yields mostly at or around benchmarks as secondary trading did little to move scales. In economic data released Tuesday, the June consumer confidence index climbed, suggesting spending will rebound.

By Lynne FunkJune 29 -

With various Federal Reserve officials airing their views since the Federal Open Market Committee’s latest meeting, it may take a while for members to reach agreement on tapering, a boon for municipals.

By Lynne FunkJune 28 -

Making it a summer Friday, munis were quiet. Participants contemplate why the market underperformed taxables to the degree they did when fundamentals are objectively strong and little has changed since before the FOMC.

By Lynne FunkJune 25 -

The final new issues of the week close with some bumps in repricings while the secondary was quiet.

By Lynne FunkJune 24 -

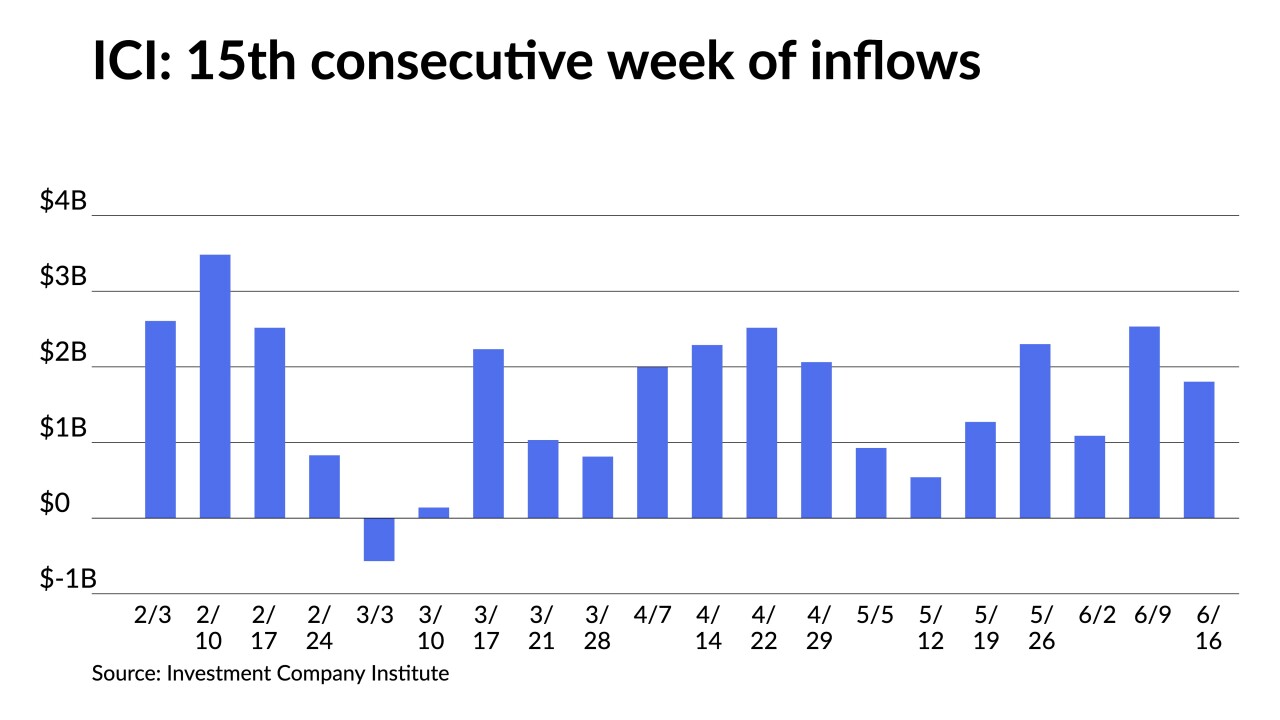

Triple-A benchmark yields moved higher by as much as five basis points while ICI reported another $1.8 billion of inflows and ETFs increase their share by $841 million.

By Lynne FunkJune 23 -

As infrastructure talks unfold in Washington, the likelihood of higher taxes may be waning, at least in the short run.

By Kyle GlazierJune 23 -

A volatile U.S. Treasury market and month-end positioning are pressuring municipal yield curves.

By Lynne FunkJune 22 -

The Federal Reserve must be prepared to move if inflation continues to surprise to the upside, according to one Fed president, while another again stated a desire for the Fed to pull back on its accommodation.

By Lynne FunkJune 21 -

The short end of the yield curve faced pressure from a cheaper UST five-year. As the flattening trend in UST takes hold, demand for duration will also spill over into the tax-exempt space, with long-dated munis continuing to outperform, analysts say.

By Lynne FunkJune 18 -

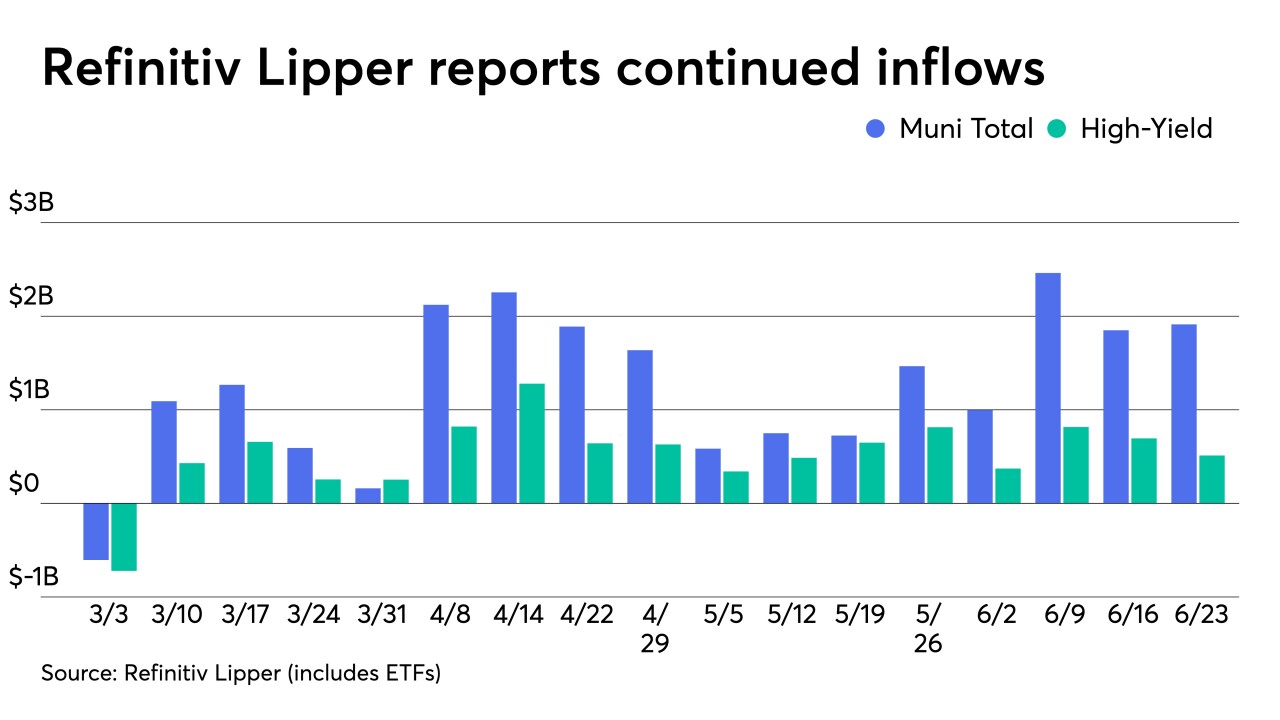

Refinitiv Lipper's $1.85 billion of inflows say investors aren't going anywhere.

By Lynne FunkJune 17 -

The Investment Company Institute on Wednesday reported $2.533 billion of inflows into municipal bond mutual funds, the highest since February.

By Lynne FunkJune 16 -

Tuesday’s data may not be indicative of where the economy is going and will likely be written off by the Federal Open Market Committee at its meeting, analysts say.

By Lynne FunkJune 15 -

Most analysts expect the Federal Open Market Committee will alter its Summary of Economic Projections and perhaps begin to talk about tapering, without offering clues when they'll begin cutting back on asset purchases.

By Lynne FunkJune 14 -

Now the fifth largest bank in the U.S., PNC will expand its banking and capital markets activities across the Southwest and Western regions.

By Lynne FunkJune 14