Lynne Funk is Senior Director, Strategy and Content, Live Media - Municipal Finance. She leads and shapes The Bond Buyer's six major events, serving as host, moderator, thought leader and brand ambassador. Lynne also is charged with creating innovative live media formats, including new conferences, virtual summits and podcasts to help serve our municipal finance community. Lynne has nearly two decades of experience in the public finance industry. She was most recently Executive Editor of The Bond Buyer. Previously, she was a director at Municipal Market Analytics, Inc., and in the Policy and Public Advocacy for the Municipal Securities Division at the Securities Industry and Financial Markets Association.

-

The Investment Company Institute reported investors poured in $1.589 billion into muni bond mutual funds in the week ending August 3, the highest level since November.

By Lynne FunkAugust 10 -

Several large new issues priced. Municipal yields were little changed, U.S. Treasuries were weaker on the short end and stocks ended in the red ahead of the much-anticipated July inflation figure.

By Lynne FunkAugust 9 -

Weekly supply is holding below $5 billion, reinvestment needs are still in effect from large redemptions and fund flows are leaning more positive, noted FHN Financial's Kim Olsan.

By Lynne FunkAugust 8 -

With the Fed committed to fighting inflation with aggressive rate hikes, fewer issuers want to take the risk with taxable advance refundings.

By Lynne FunkJuly 27 -

Munis are improving, but positive second-half municipal returns likely won’t be enough to offset the major losses of the first half of the year.

July 18 -

Investors pulled more from municipal bond mutual funds, with Refinitiv Lipper reporting $1.3 billion of outflows, down from the $1.6 billion the week prior and bringing the total to $47 billion year-to-date.

June 30 - Muni asset managers are seeking more data from issuers on ESG, yet no agreed-upon set of standards exists, complicating the industry’s relationship with the growing sector.Sponsored by Assured Guaranty

-

Municipals posted gains for the first time in 2022 in May, outperforming U.S. Treasuries on the month. The Bloomberg Muni Index posted a 1.49% return in May bringing losses down to 7.47% year to date.

June 1 -

June redemptions will be the highest of the year at $50.6 billion. New-issue supply — 30-day visible is currently at $15.5 billion — is unlikely to keep up.

May 31 -

The rapid swing to lower yields over the past week has led to a sunnier outlook for the summer reinvestment season, but uncertainties on the economic front, rate volatility, and supply questions hang overhead.

By Lynne FunkMay 27 -

Given the volatility of risk assets is likely to remain high, and the focus on the flight to safety increases, all fixed-income assets could benefit as a result, including municipals, Barclays strategists say.

May 20 -

Refinitiv Lipper reported $2.712 billion of outflows, bringing the total outflows so far in 2022 to $65.8 billion, surpassing the last largest annual outflows of $63.5 billion during the Taper Tantrum in 2013.

May 19 -

Investors pulled $7.270 billion from muni bond mutual funds in the week ending May 11, per ICI data, while exchange-traded funds saw $1.756 billion of inflows, the fourth week of record inflows.

May 18 -

Deep-in-the-red municipal returns are not helping assuage investor concerns, creating a negative feedback loop that has yet to see a pause.

May 16 -

Despite compelling yields and ratios, buyers continue to be selective. Even if rates stabilize, municipal investors will likely be cautious for some time, waiting for fund outflows to abate, strategists said.

By Lynne FunkMay 13 -

New York Dormitory Authority school bonds and Northwell Health priced and upsized, while Wisconsin and Oregon offered general obligation bonds. Analysts say municipal curves are oversold, creating a buying opportunity.

May 10 -

How technology, data and transparency can aid in rough markets. Lynne Funk talks with Stephanie Sparvero of Bloomberg BVAL. (21 minutes)

By Lynne FunkMay 10 -

Despite outsized volatility and liquidity challenges ahead, the possibility of relief for munis is not too far off, analysts say, but USTs lead the way for exempts.

May 9 -

Municipal returns in April were deeply negative, bringing the year-to-date figure to near 9% losses, the largest posted on the Bloomberg Muni Index since its inception in the 1980s.

May 2 -

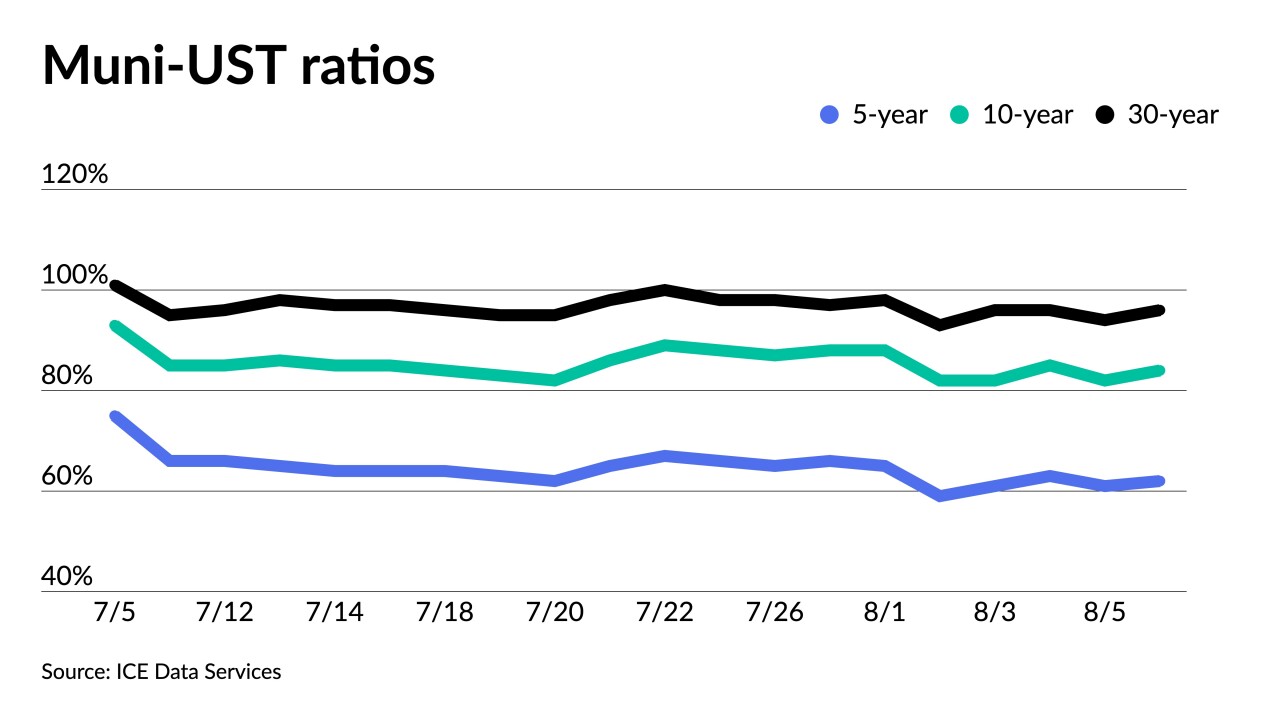

Another swing in U.S. Treasury market pushes muni to UST ratios out long even cheaper.

April 25