-

The primary and secondary markets were slow on Monday morning, anticipating the week's larger deals. Meanwhile, the Treasury market continued to firm, promising tight spreads this week.

By Kate SmithOctober 6 -

As the market digests rebounding supply, traders expect demand to stay high until more weeks of consistently healthy issuance occur.

By Kate SmithOctober 3 -

Against declining inflows, primary volume will increase slightly for the week of October 6th, according to data provided by The Bond Buyer.

By Kate SmithOctober 3 -

An eventful week will draw to a close on Friday, with light primary and secondary activity expected.

By Kate SmithOctober 3 -

Municipal veteran Thomas Weyl will be joining National Public Finance Guarantee Corp., an indirect subsidiary of MBIA Inc. as a managing director and head of new business development, the insurer said in a press release.

By Kate SmithOctober 2 -

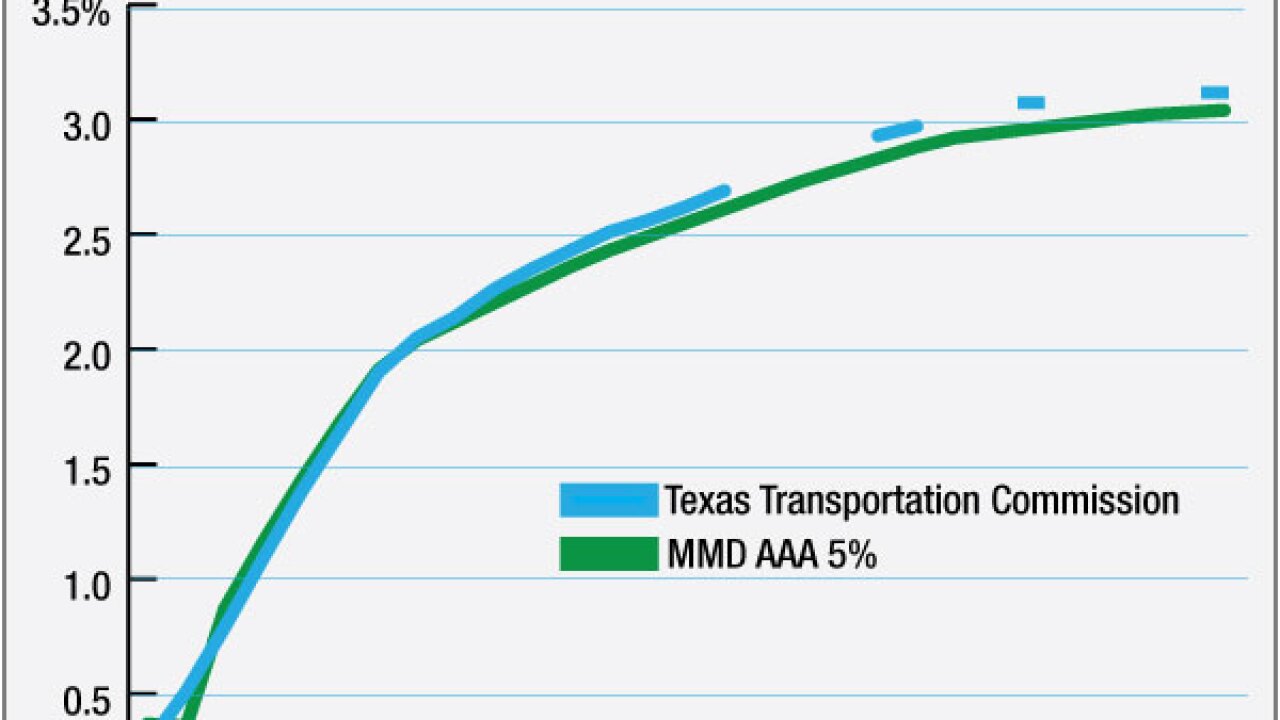

A repriced Texas Transportation Commission deal beat trader expectations, pricing at even slimmer spreads than the market anticipated.

By Kate SmithOctober 2 -

Orders for the Texas Transportation deal have come in slim, giving traders only a 10 basis point spread to MMD on the 10-year. Final pricing has not yet been determined.

By Kate SmithOctober 2 -

The much anticipated Texas Transportation Commission deal is expected to price Thursday with spreads investors are certain will be slim.

By Kate SmithOctober 2 -

A handful of smaller, regional deal priced successfully on Wednesday, as traders waited for the week's headline deal, the Texas Transportation Commission, to price on Thursday.

By Kate SmithOctober 1 -

Wednesday's primary calendar promises high-grade issuance that traders anticipate will impact municipal scales and elongate the yield rally.

By Kate SmithOctober 1 -

Iowa Fertilizer bonds have enjoyed a month-long rally as trading volumes have rebounded from a slow summer. The recent activity has left traders wondering if it is market or event driven.

By Kate SmithSeptember 30 -

The municipal market will start to bounce back on Tuesday, after a sleepy Monday and Friday. Below, the highlights of the day.

By Kate SmithSeptember 30 -

Kroll Bond Rating Agency's public finance ratings are now available on Municipal Securities Rulemaking Board's disclosure website EMMA, adding to the existing information from Standard & Poor's and Fitch Ratings.

By Kate SmithSeptember 29 -

Increased supply has not muted the insatiable appetite for municipal bonds, thanks to months of impressive gains. The abnormally long positive performance has left traders wondering when the music stops.

By Kate SmithSeptember 26 -

Secondary market trading saw yields strengthen on Friday morning as traded shirted their focus away from the primary markets temporarily.

By Kate SmithSeptember 26 -

The newly issued New York City Sales Tax Asset Receivable Corporation topped trading lists by midday Thursday, driving yields down as much as 14 basis points from their original yield offerings.

By Kate SmithSeptember 25 -

The newly issued New York City Sales Tax Asset Receivable Corporation topped trading lists by midday Thursday, indicating the deal's intense popularity.

By Kate SmithSeptember 25 -

The newly issued New York City Sales Tax Asset Receivable Corporation deal strengthened in trading on Thursday morning, leading most-traded security lists.

By Kate SmithSeptember 25 -

Tuesday's strength in the primary market spread into pricing on Wednesday as issuers picked up aggressive bids and netted cheap borrowing costs.

By Kate SmithSeptember 24 -

New York issuers particularly the Triborough Bridge and Tunnel Authority and the New York City Municipal Water Financing Authority led trading on Wednesday morning as fund managers positioned themselves to welcome the newly issued New York City sales tax asset revenue deal.

By Kate SmithSeptember 24