Jessica Lerner is a senior reporter and buy-side specialist for Bond Buyer where she writes the daily market column, the monthly volume story and longer trend stories. Prior to this, she worked as a beat reporter at two Connecticut newspapers. She earned her master's in business and economics reporting from the Craig Newmark Graduate School of Journalism and her bachelor's in journalism and statistics from the University of Connecticut.

-

Munis were little changed while long UST improved and equities ended in the red after the FOMC raised the fed funds rate target 75bps to a range of 3% to 3.25% and members are leaning toward a rate of 4.4% by yearend.

September 21 -

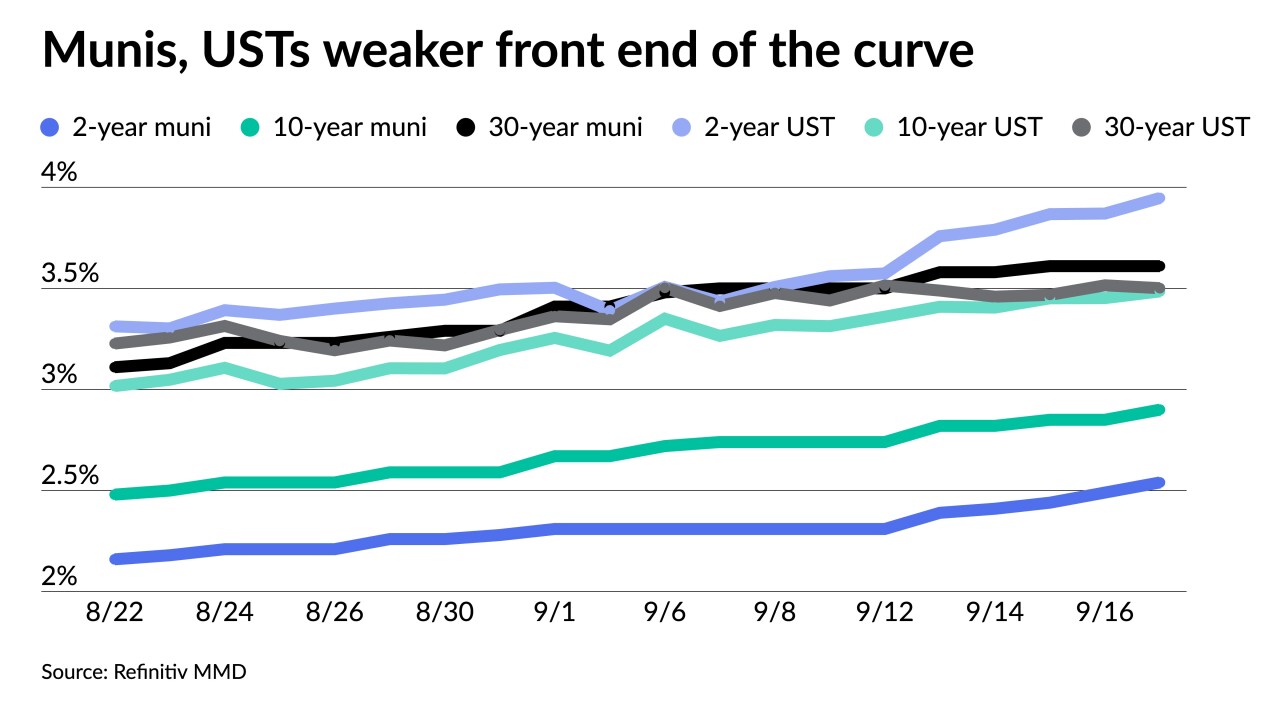

Short triple-A yields have risen more than 30 basis points over the past eight sessions while the long bond has risen 19, per Refinitiv MMD data.

September 20 -

Triple-A muni yields rose another five basis points on the short end while UST rose up to seven. UST yields are the highest since 2007.

September 19 -

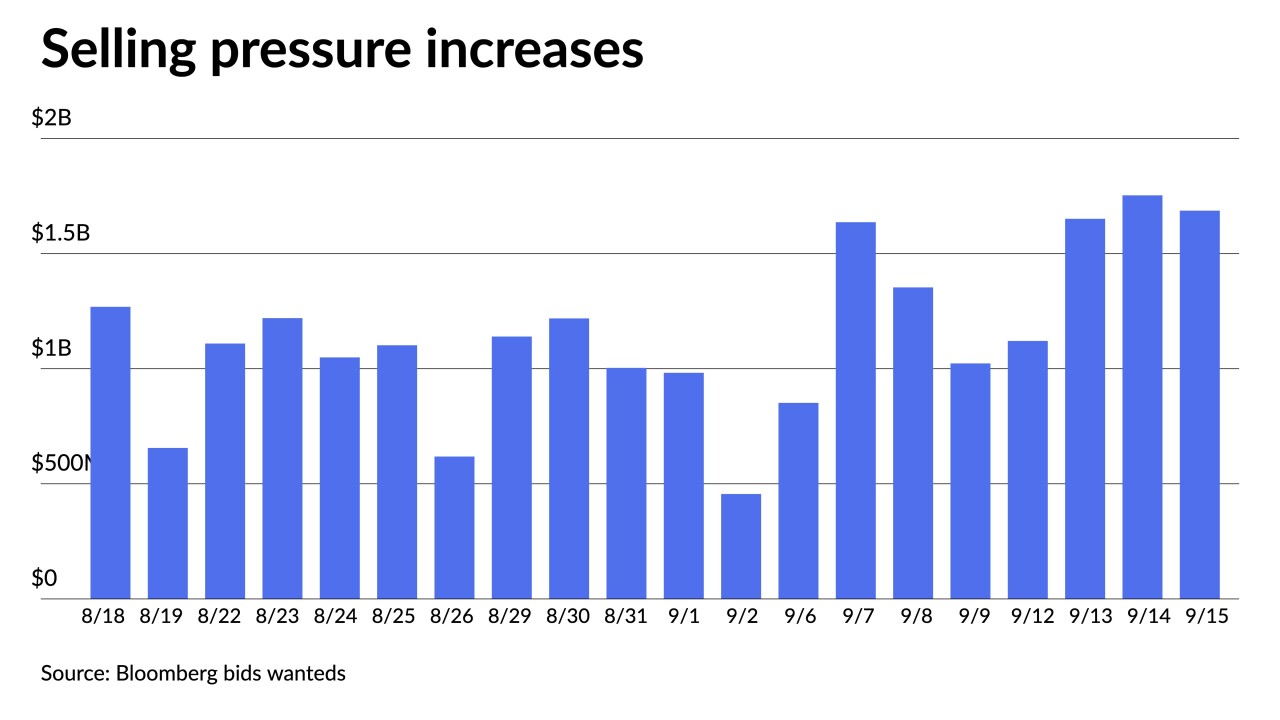

Municipals saw more cheapening on the short end Friday as selling pressure persisted all week.

September 16 -

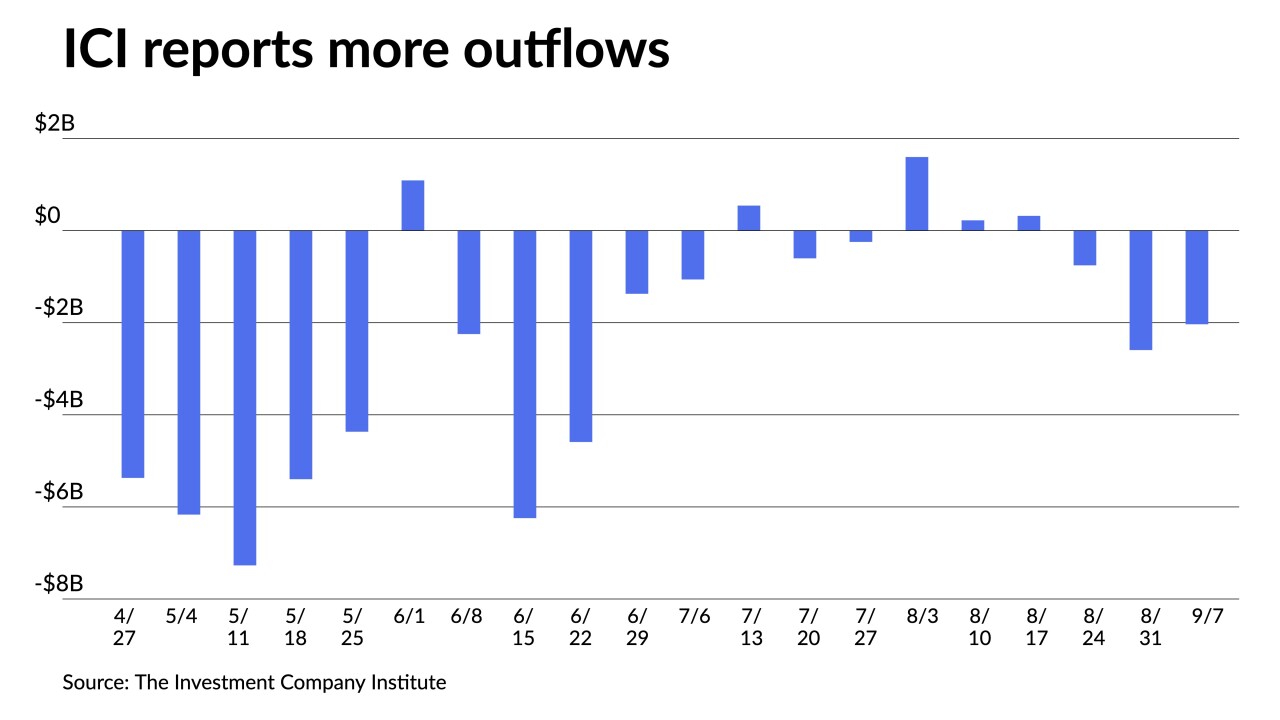

"Everyone is trying to figure out when the outflow cycle is over," said Craig Brandon, co-director of municipal investments at Eaton Vance.

September 15 -

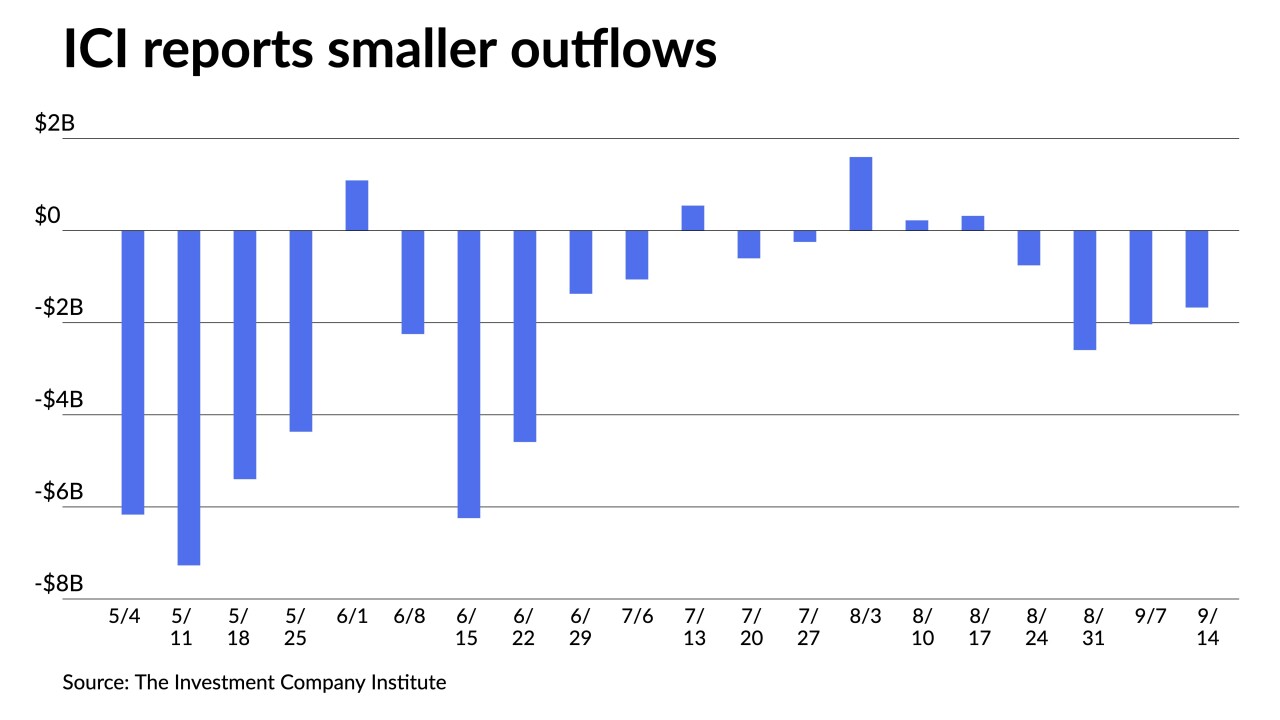

The Investment Company Institute reported $2.034 billion of outflows from muni bond mutual funds in the week ending Sept. 7 compared to $2.594 billion of outflows the previous week.

September 14 -

Muni and UST yields surged Tuesday on expectations the Fed will have to aggressively raise interest rates to bring down inflation.

September 13 -

Even after investors received an infusion of $18 billion of matured and called bond proceeds on Sept. 1, muni prices have continued to weaken, note CreditSights strategists Pat Luby and John Ceffalio.

September 12 -

The calendar for the week of Sept. 12 is at $6.6 billion while Bond Buyer 30-day visible supply sits at $14.15 billion.

September 9 -

Outflows from municipal bond mutual funds receded as investors pulled $1.090 billion out of funds in the latest week, versus the $3.416 billion of outflows the prior week, according to Refinitiv Lipper data.

September 8