Jessica Lerner is a senior reporter and buy-side specialist for Bond Buyer where she writes the daily market column, the monthly volume story and longer trend stories. Prior to this, she worked as a beat reporter at two Connecticut newspapers. She earned her master's in business and economics reporting from the Craig Newmark Graduate School of Journalism and her bachelor's in journalism and statistics from the University of Connecticut.

-

Market participants agree issuance will not hit the highs seen in 2020 and 2021, but they are split on whether issuance will surpass the $384.086 billion of debt issued in 2022.

June 20 -

Investors will be greeted with a new-issue calendar estimated at $5.031 billion led by several New York issues.

June 16 -

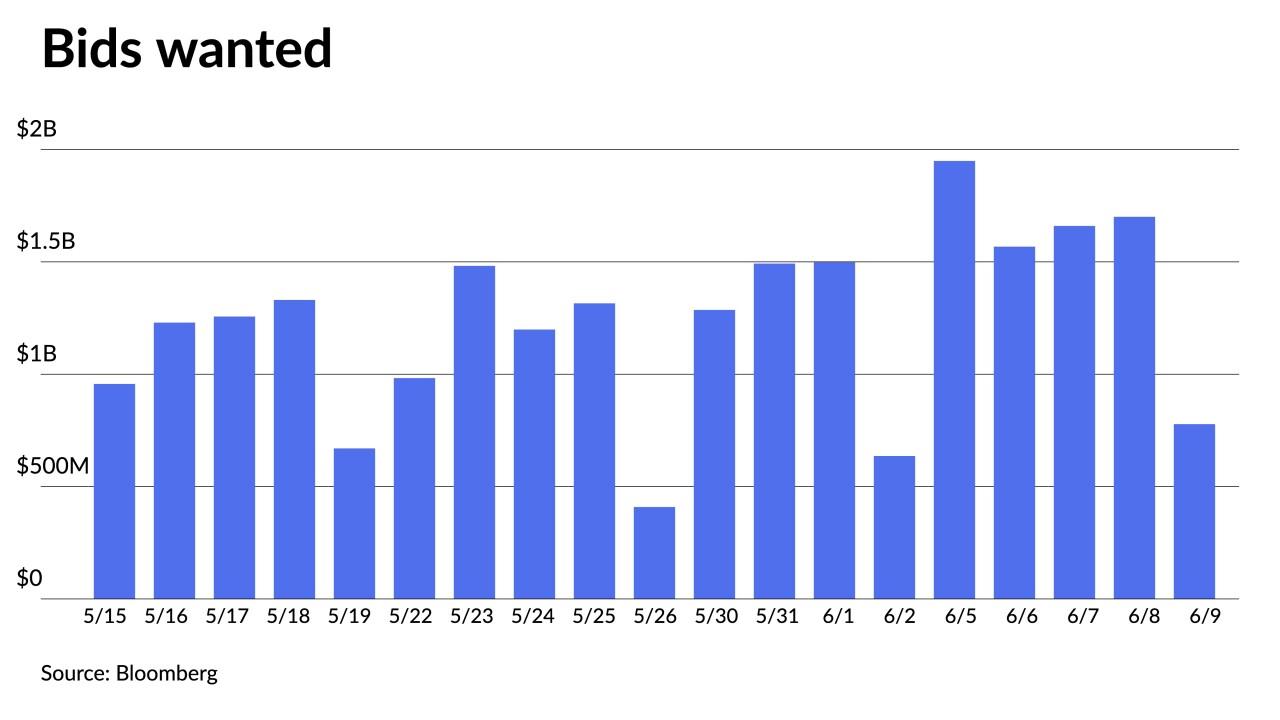

Those "holding out for wider yields or relative value" are frustrated due to an extremely tight muni range, but FHN Financial's Kim Olsan said, "the reality is that supply has yet to materialize to force that change."

June 15 -

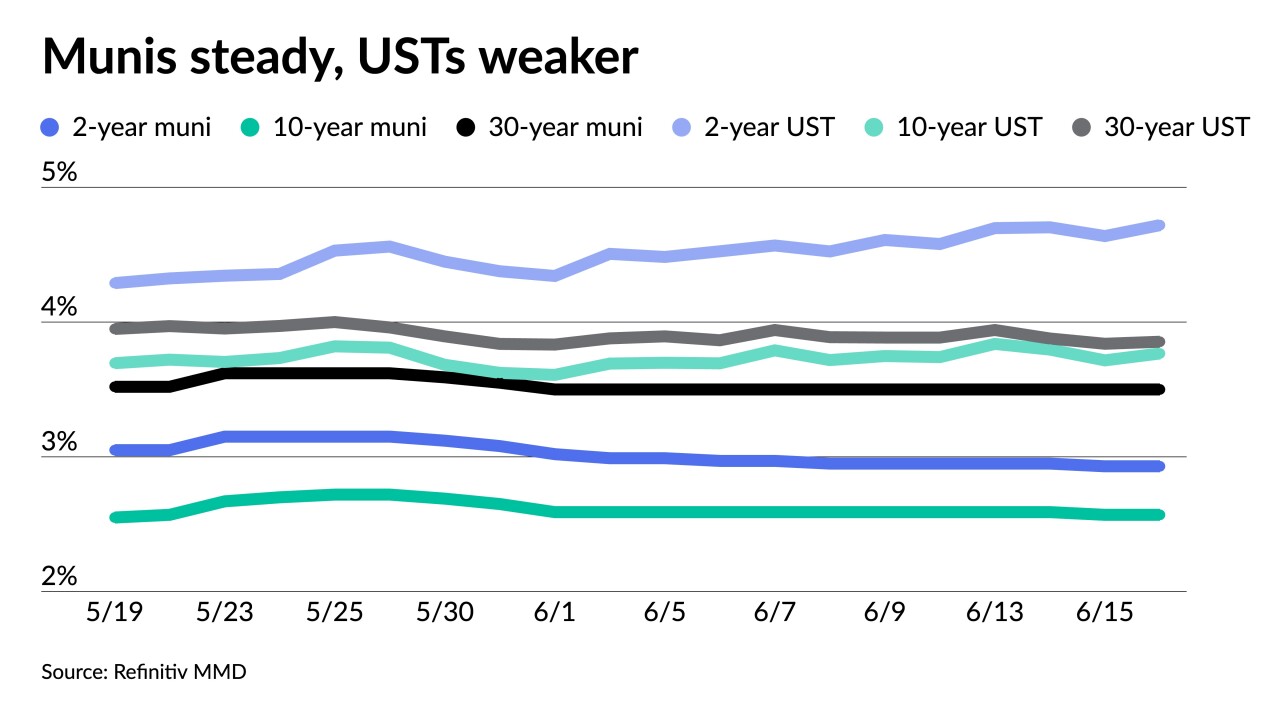

Munis did not follow USTs yet, "but given the outperformance of munis over the last couple days and while I wouldn't be surprised if they weaken a little given how expensive ratios are," said Breckinridge's Matt Buscone.

June 14 -

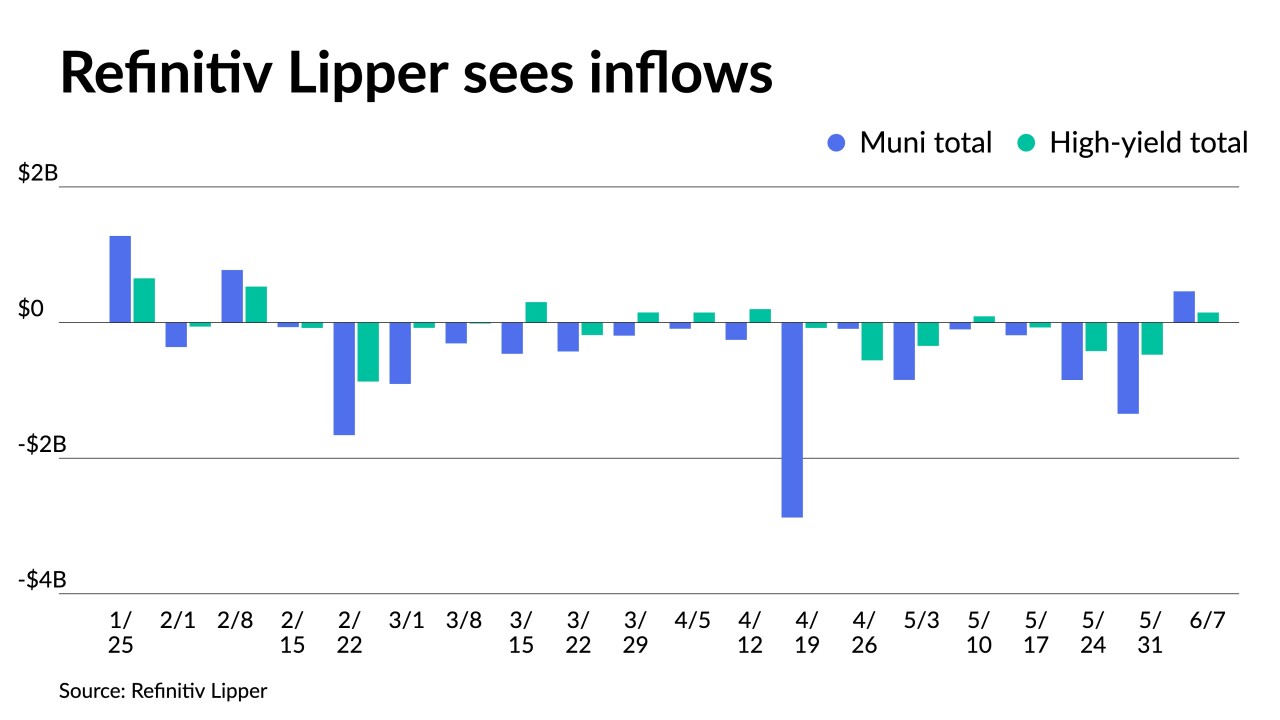

While "munis are set up for better performance, perhaps modest single-digit returns, the near-term outlook for fund flows will make for a challenging read," Oppenheimer's Jeff Lipton said.

June 13 -

Matthew Gastall and Daryl Helsing of Morgan Stanley delve into how municipals are performing versus other asset classes, where taxable munis fit and how they see the market performing heading into the summer reinvest. Jessica Lerner hosts. (36 minutes)

June 13 -

Elevated new issues, Federal Deposit Insurance Corp. sale lists, and heavy reinvestment cash "helped to offset each other [last] week and keep the muni market stable," said Birch Creek strategists.

June 12 -

Federal Reserve data shows that retail ownership of municipals rose $58.8 billion, or 3.7% quarter-over-quarter, to $1.67 trillion. Bank ownership fell in the first quarter by $13.3 billion.

June 12 -

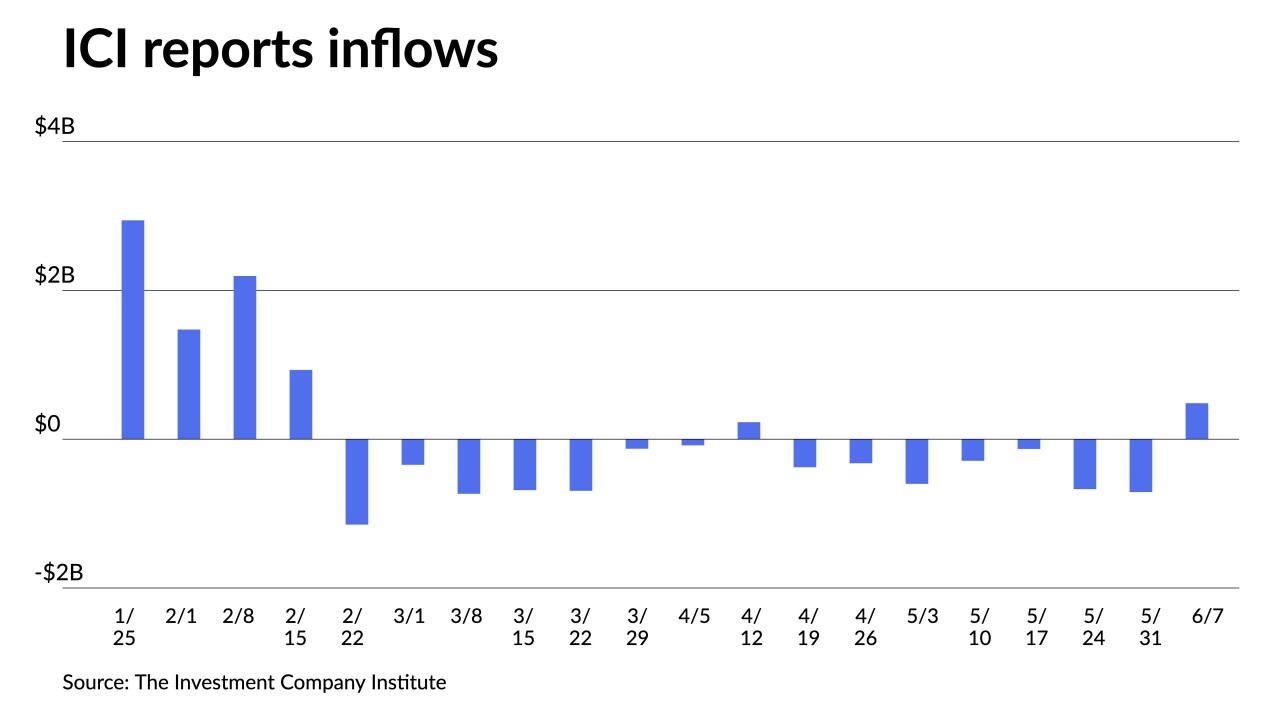

"How fund flows end up shaping up this week is going to be very meaningful for how we start the summer," said Tom Kozlik, managing director and head of public policy and municipal strategy at HilltopSecurities.

June 8 -

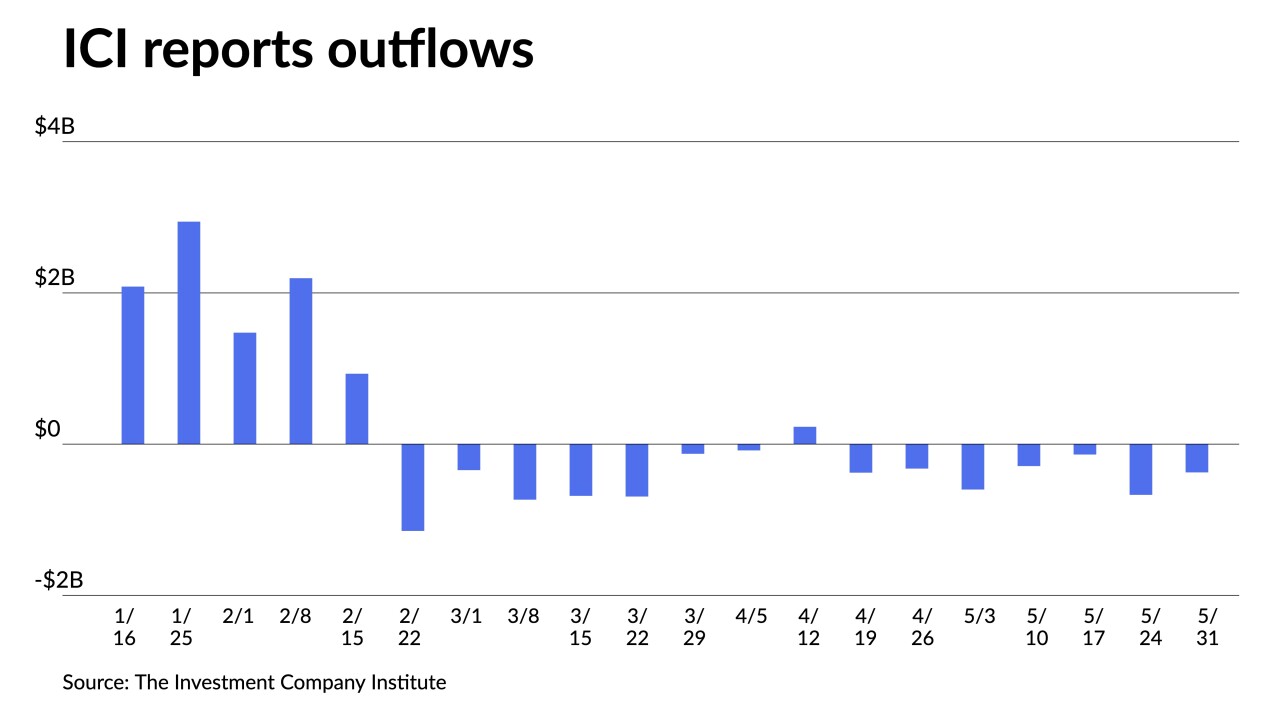

The Investment Company Institute reported investors pulled another $374 million out of municipal bond mutual funds in the week ending May 31, after $671 million of outflows the previous week

June 7 -

Gambone, who has 30 years of experience in the municipal finance industry, replaced retiring head of public finance Eileen Solla-Diaz.

June 7 -

"June started out fairly strong for the municipal market as the relative cheapness attracted investors looking for an opening to start buying bonds at higher yields," said Roberto Roffo, managing director and portfolio manager at SWBC Investment Company.

June 6 -

Last week, munis underperformed the Treasury market "across the curve through Thursday with yields lower just 13bps," according to Birch Creek strategists. However, they said Friday's rally "in the front end helped pull shorter maturity munis ahead."

June 5 -

For the coming week, investors will be greeted with a new-issue calendar estimated at $8.213 billion.

June 2 -

Outflows continue as Refinitiv Lipper reported investors pulled $1.345 billion from municipal bond mutual funds for the week ending Wednesday.

June 1 -

Strength that began on Tuesday and continued Wednesday marked the first sessions since early May for positive performance after a hefty selloff, noted Kim Olsan, senior vice president at FHN Financial.

May 31 -

Total volume for the month was $26.062 billion in 677 issues, down from $36.583 billion in 928 issues a year earlier, according to Refinitiv data.

May 31 -

Despite the firmer tone Tuesday, May performance has put munis on track for their worst May since 1986.

May 30 -

The Investment Company Institute reported investors pulled another $137 million out of municipal bond mutual funds in the week ending May 17, after $290 million of outflows the previous week.

May 24 -

"It's good news/bad news for fixed-income markets," said Nuveen strategists Anders S. Persson and Daniel J. Close.

May 23