Jessica Lerner is a senior reporter and buy-side specialist for Bond Buyer where she writes the daily market column, the monthly volume story and longer trend stories. Prior to this, she worked as a beat reporter at two Connecticut newspapers. She earned her master's in business and economics reporting from the Craig Newmark Graduate School of Journalism and her bachelor's in journalism and statistics from the University of Connecticut.

-

For the coming week, investors will be greeted with a new-issue calendar estimated at $7.282 billion.

July 7 -

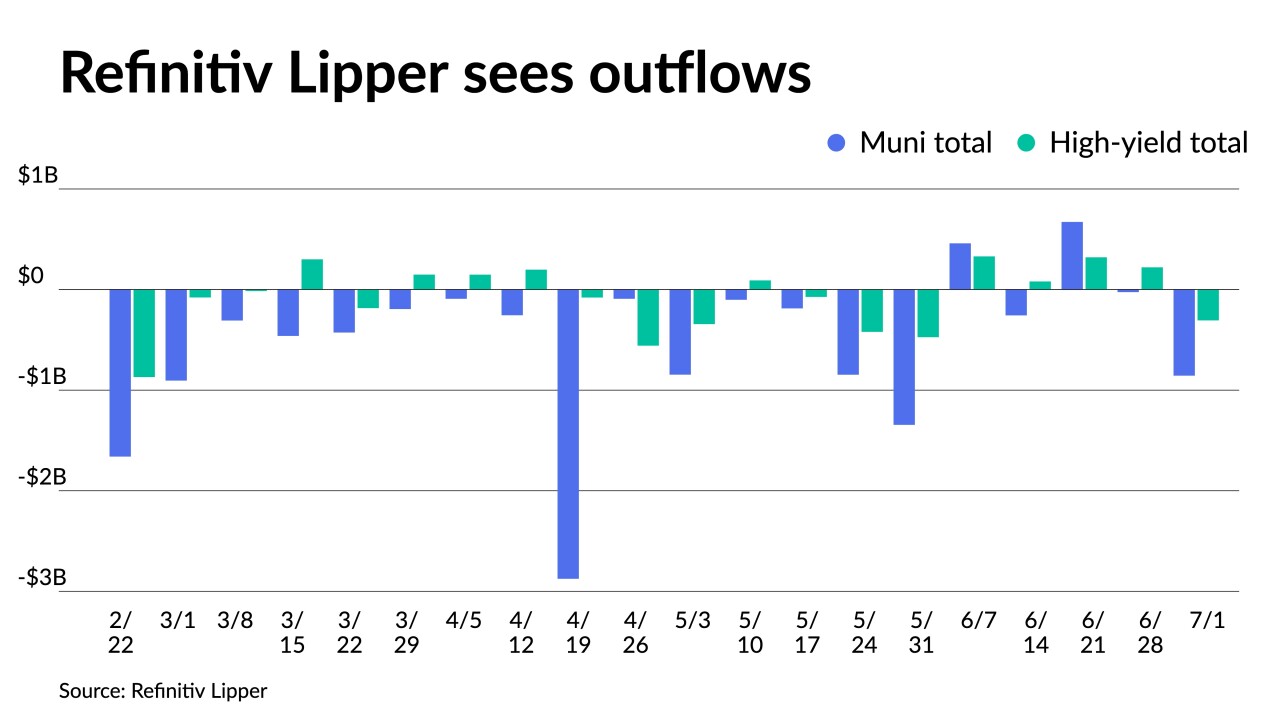

Municipal bond mutual fund outflows intensified as Refinitiv Lipper reported investors pulled $855.719 million from the funds for the week ending Wednesday following $25.331 million of outflows the week prior.

July 6 -

The Investment Company Institute reported investors pulled $136 million from municipal bond mutual funds in the week ending June 28, after $338 million of inflows the previous week.

July 5 -

"Lower volumes, lighter primary issuance, and heavier reinvestment cash flows are likely going to contribute to a continued bout of muni relative performance," said Birch Creek Capital strategists.

July 3 -

For the coming week, investors will be greeted with a new-issue calendar estimated at $304.5 million. This marks the lowest week of issuance in 2023.

June 30 -

Total volume for the month was $34.436 billion in 744 issues, down from $37.775 billion in 984 issues a year earlier, according to Refinitiv data.

June 30 -

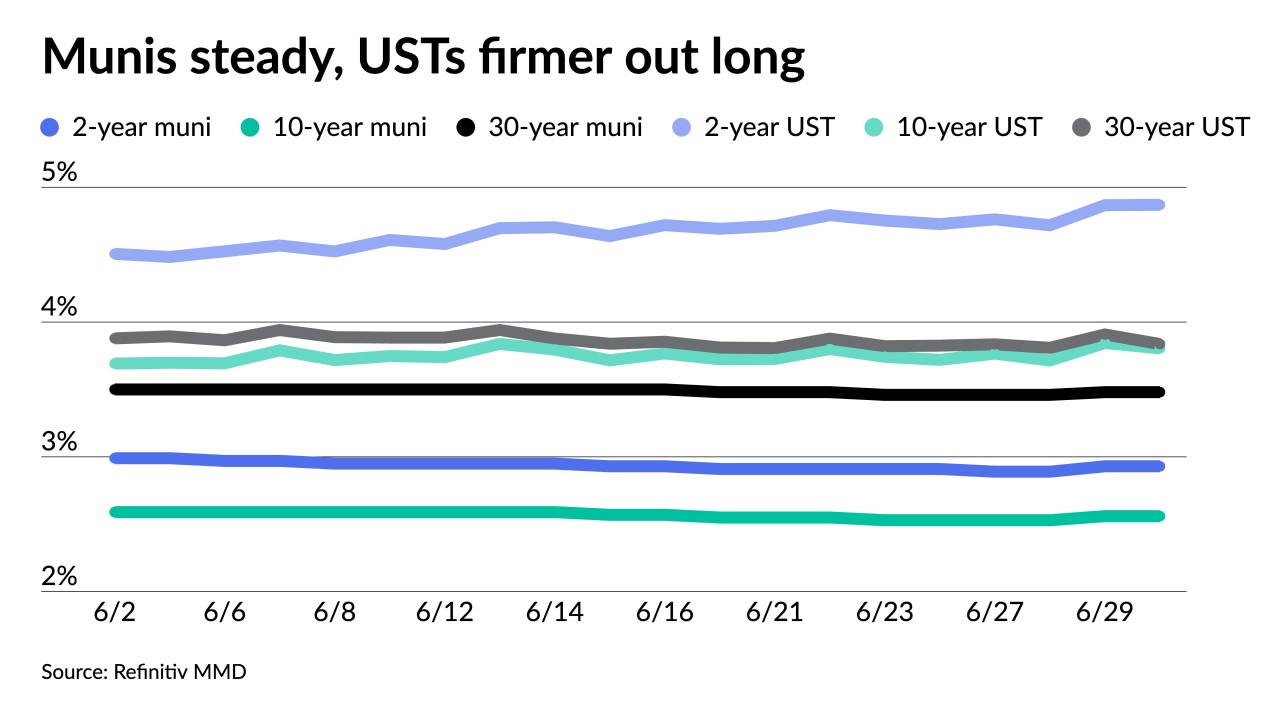

Triple-A yields rose one to five basis points, depending on the scale, as secondary trading showed cheaper prints and some new-issues had to be cheapened to clear the market while USTs saw larger losses of up to 16 basis points on the three and five year.

June 29 -

With the first half of the year ending on Friday, municipal sources say the second half of the year will be off to a good start.

June 28 -

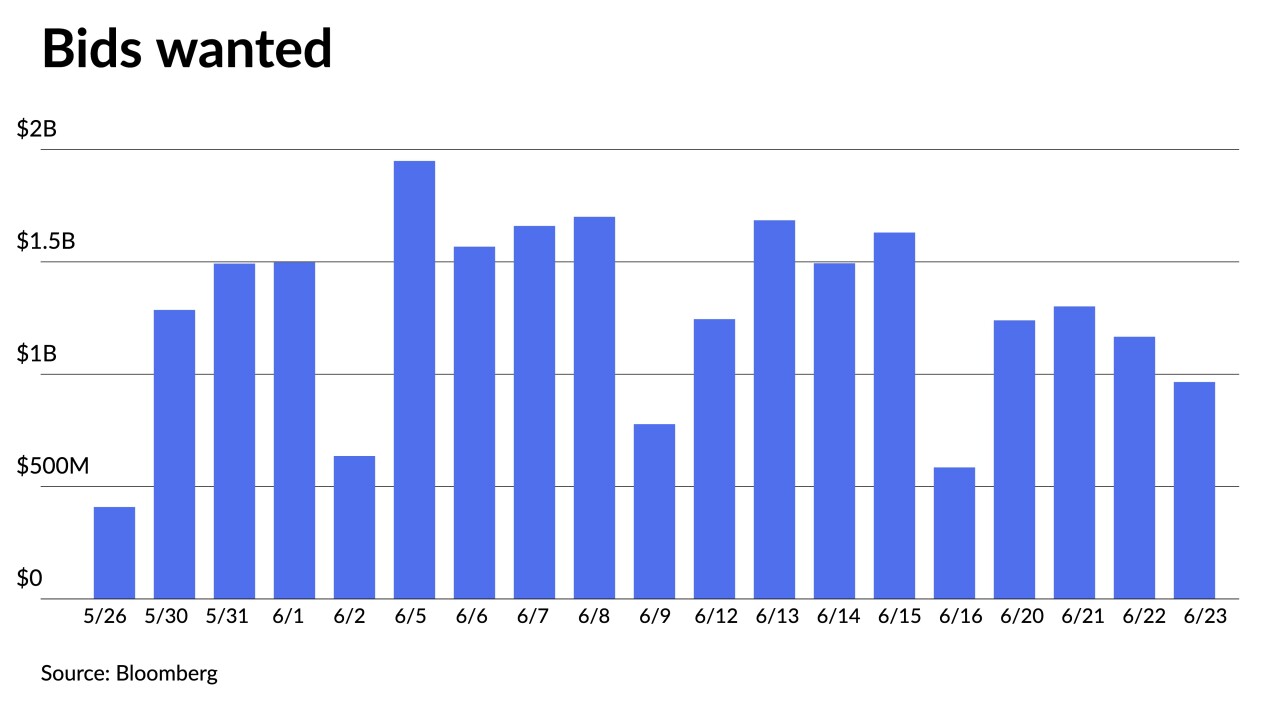

While supply has started to pick back up with an outsized primary market calendar this week, it's still not enough to meet demand, said Cooper Howard, a fixed income strategist at Charles Schwab.

June 27 -

Despite a slow start to the week, "buyers are becoming more constructive, and there's increased buying going on," said Pat Luby, a CreditSights strategist.

June 26