Jessica Lerner is a senior reporter and buy-side specialist for Bond Buyer where she writes the daily market column, the monthly volume story and longer trend stories. Prior to this, she worked as a beat reporter at two Connecticut newspapers. She earned her master's in business and economics reporting from the Craig Newmark Graduate School of Journalism and her bachelor's in journalism and statistics from the University of Connecticut.

-

While it's been a tough year across fixed-income generally, a Wall Street muni retrenchment marks an opportunity for regional and middle-market firms to gain more of a foothold, market participants said.

November 6 -

Friday's employment report was good news for the Federal Reserve, with fewer jobs created and a smaller rise in earnings, leading analysts to cautiously increase expectations that the hiking cycle is over.

November 3 -

"The lack of standardization is a very real problem that impacts all facets," said Ted Chapman, managing director and investment banker at Hilltop Securities.

November 3 -

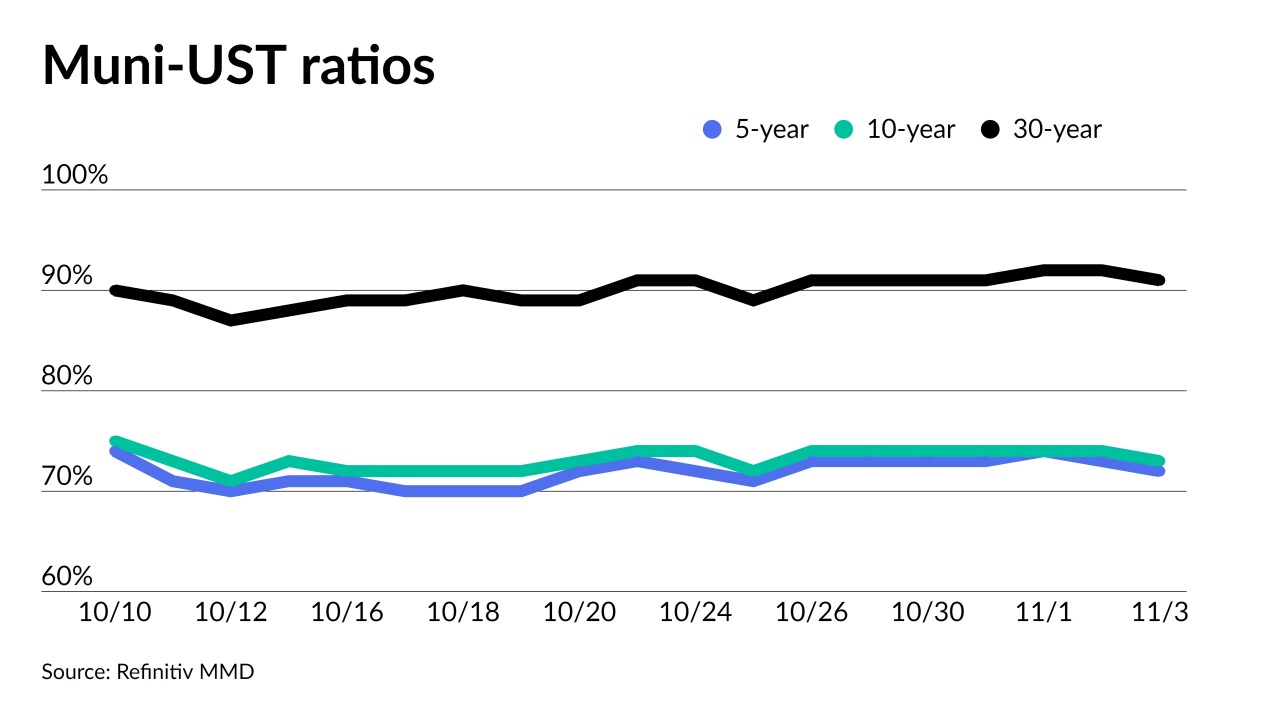

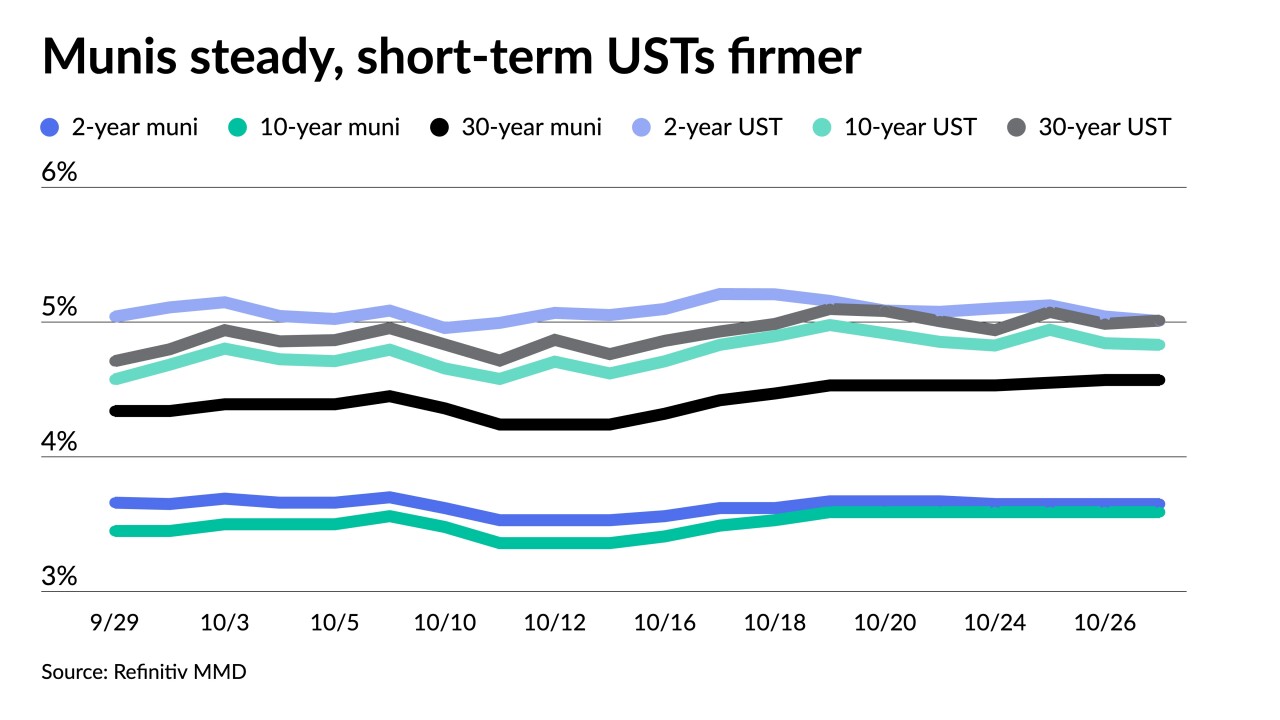

Triple-A muni yields fell 10 to 14 basis points while UST saw gains of up to 16bps out long as market participants consider a potential end to Fed rate hikes.

November 2 -

"The big question is: who's next? I don't think UBS is the end," said a veteran sellside market participant.

November 2 -

Municipals closed out October in the red, the third consecutive month of losses for the asset class.

November 1 -

While the FOMC statement will likely have very few changes, the post-minutes release press conference will be the wildcard.

October 31 -

October's total volume rose 29.3% to $37.156 billion in 661 issues from $28.738 billion in 614 issues a year earlier. New-money grew more than 30% while refundings were up by nearly 75%.

October 31 -

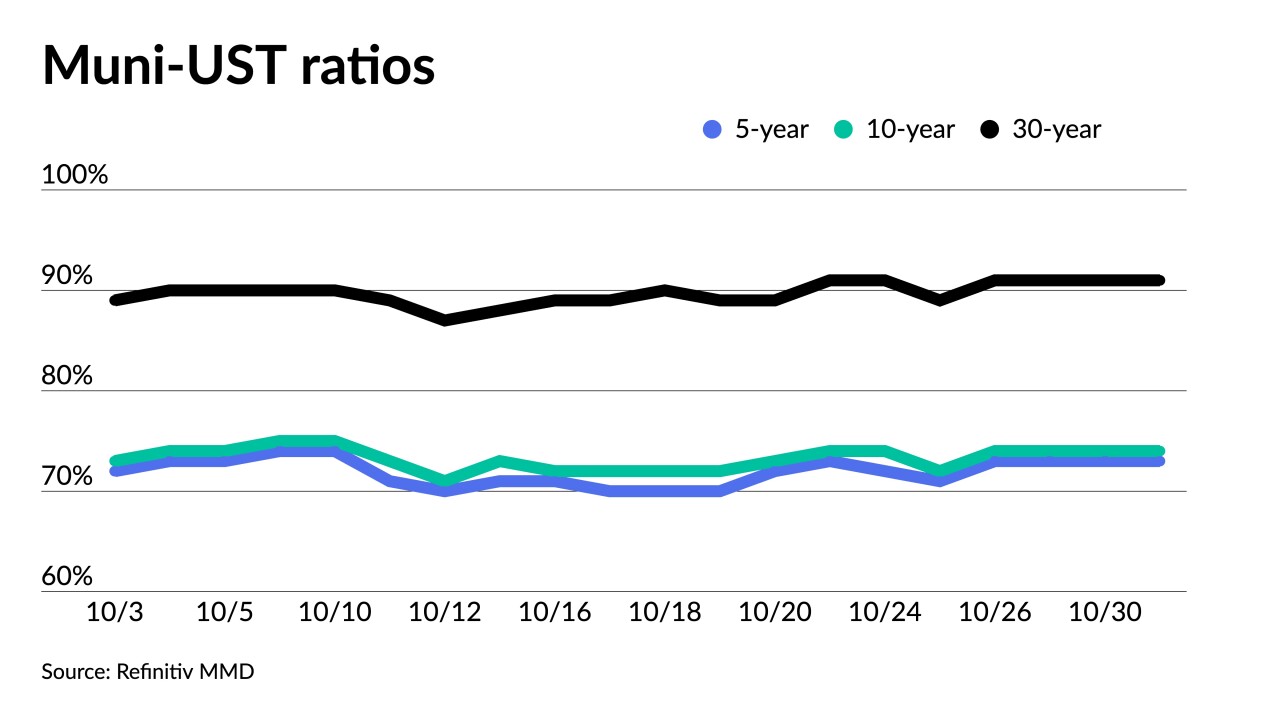

Another month of muni losses "may spark additional sale pressure as some investors throw in the towel, but we suspect any further weakness would represent a strong entry point for [investment grade] buyers," Birch Creek Capital said in a weekly report.

October 30 -

If Treasury rates become "more stabilized," it provides "a good reason to be somewhat constructive on munis for a while," BofA Global Research said in a report.

October 27 -

The tool will deliver users historical deal-based spreads to help in the new-issue market as well as find potential refunding opportunities, said SOLVE's Gregg Bienstock, senior vice president and group head of municipal markets.

October 27 -

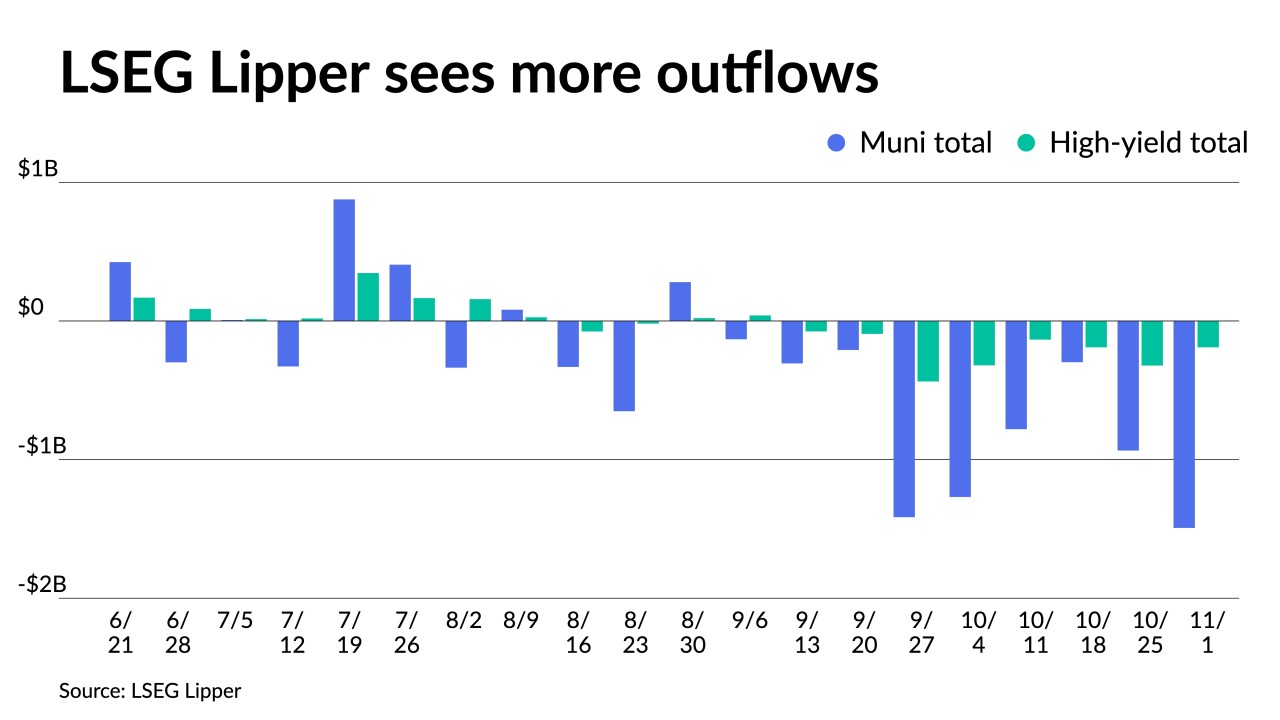

Investors continue to pull money from muni mutual funds with LSEG Lipper reporting $934.7 million of outflows for the week ending Wednesday after $297 million of outflows the week prior.

October 26 -

Municipal mutual fund losses continued last week — but to a lesser extent — as the Investment Company Institute Wednesday reported investors pulled $1.291 billion from the funds in the week ending Oct. 18 after $2.645 million of outflows the previous week.

October 25 -

Winterstein's firm advises buy-side and sell-side clients on vetting vendors, looking at synergies between different technologies and advising on their product set.

October 25 -

Munis experienced some firmness Tuesday, but "whether or not that's going to be for more than a nanosecond remains to be seen," said Jeff Lipton, managing director of credit research at Oppenheimer Inc.

October 24 -

The top bond counsel firms combined for a total of $265.112 billion in 5,327 transactions during the first three quarters of 2023, down from the $291.768 billion in 6,400 deals over the same period in 2022.

October 24 -

An elevated new-issue market is on the horizon with $14.87 billion, per The Bond Buyer's 30-day visible supply.

October 23 -

The new-issue muni calendar is estimated at $8.522 billion next week with $6.075 billion of negotiated deals on tap and $2.446 billion on the competitive calendar, according to Ipreo and The Bond Buyer.

October 20 -

LSEG Lipper data Thursday showed $297 million of outflows from municipal bond mutual funds for the week ending Wednesday after $780.1 million of outflows the week prior.

October 19 -

Municipal mutual fund losses continued last week as the Investment Company Institute reporting investors pulled $2.645 billion from the funds in the week ending Oct. 11. ETFs see more inflows, though.

October 18