Jessica Lerner is a senior reporter and buy-side specialist for Bond Buyer where she writes the daily market column, the monthly volume story and longer trend stories. Prior to this, she worked as a beat reporter at two Connecticut newspapers. She earned her master's in business and economics reporting from the Craig Newmark Graduate School of Journalism and her bachelor's in journalism and statistics from the University of Connecticut.

-

Narens' hiring complements Stifel's public finance practice and the types of deals the firm is doing, said Betsy Kiehn, managing director and head of Stifel's Municipal Capital Markets Group.

March 13 -

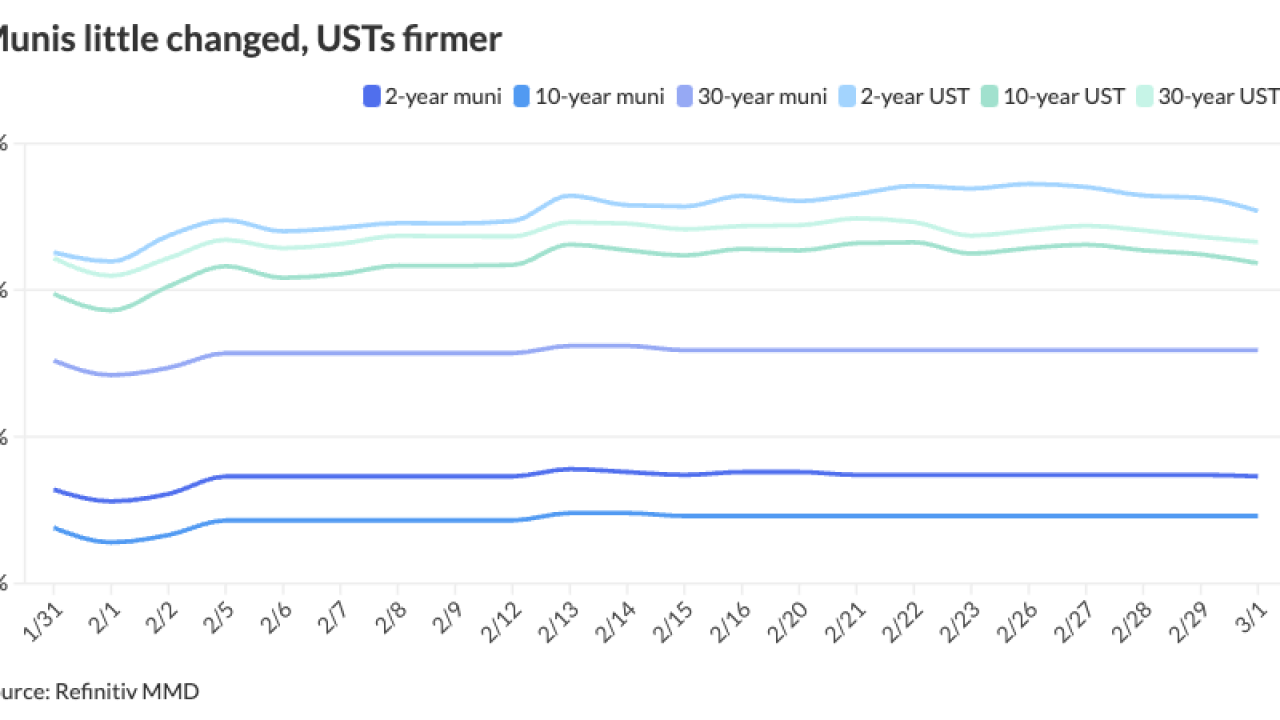

"The muni AAA [high grade] curve has been relatively steady thus far in March, but lags relative to the broader fixed income market after sizable muni outperformance in February," said J.P. Morgan strategists.

March 12 -

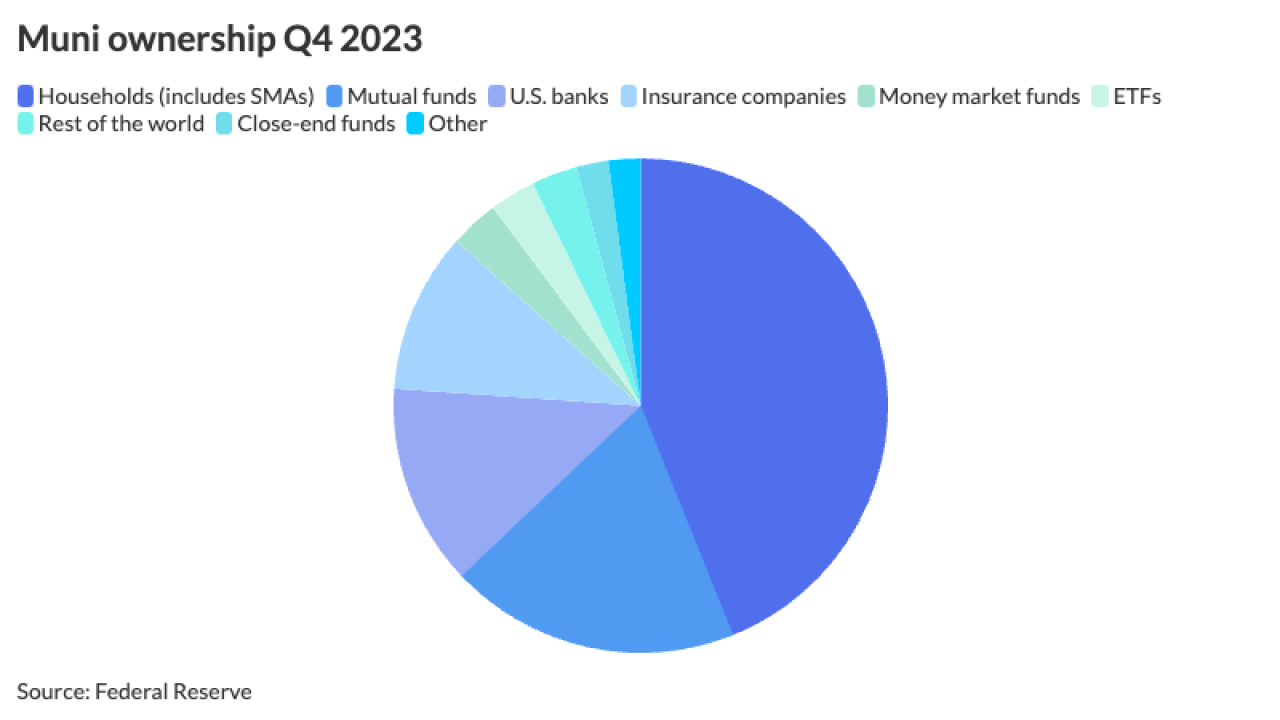

Over the past few years, retail has been a growing portion of the muni market, starting when the reduction of corporate taxes made it less advantageous for insurance companies and banks to own munis, said David Litvack, a tax-exempt strategist and chief investment officer at BofA.

March 12 -

Issuers have increased their debt sale in recent weeks, as issuance has come in above $70 billion year-to-date, according to LSEG data

March 11 -

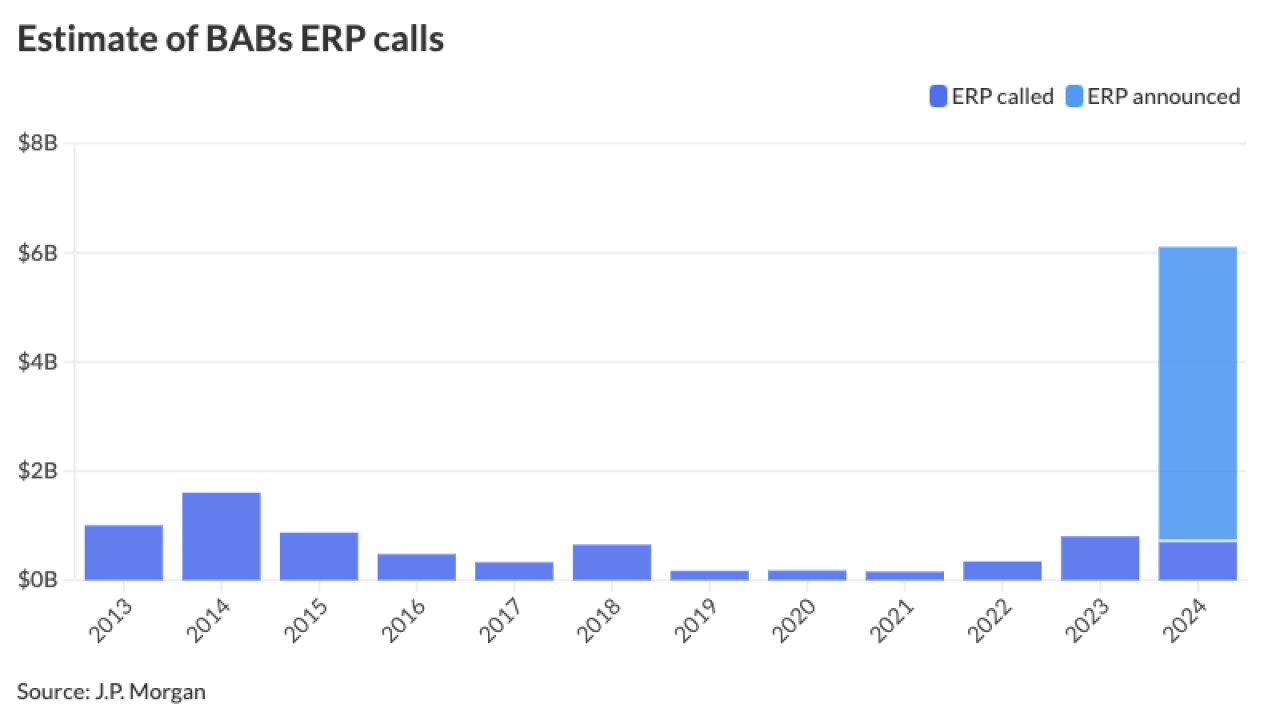

Market participants said it is yet to be seen whether issuers will pull back their BABs refundings due to concerns after several bondholders sent a letter to the trustee on a Regents of the University of California deal, saying it was "prohibited" from executing the redemption.

March 11 -

High-yield and taxable munis continue to outperform, supply grows but concentrates in larger deals led by $3 billion of state personal income tax revenue bonds from the Dormitory Authority of the State of New York next week.

March 8 -

Several investors in a challenge to a University of California Regents Build America Bonds redemption "may give issuers additional reason for pause when vetting similar refundings," J.P. Morgan strategists said.

March 7 -

It was a good day for munis with larger deals clearing the primary and secondary trading showing a more constructive tone with triple-A yields falling a few basis points amid a stronger session for all markets.

March 6 -

Harvard and Princeton coming to market is a "huge sign of confidence," said Clare Pickering, a Barclays strategist.

March 6 -

Large deals were repriced to lower yields while the secondary market was lightly traded, leading to little changed triple-A yield curves and underperformance to Treasury market gains. Despite a growing calendar, the supply demand imbalance remains with much cash on the sidelines.

March 5 -

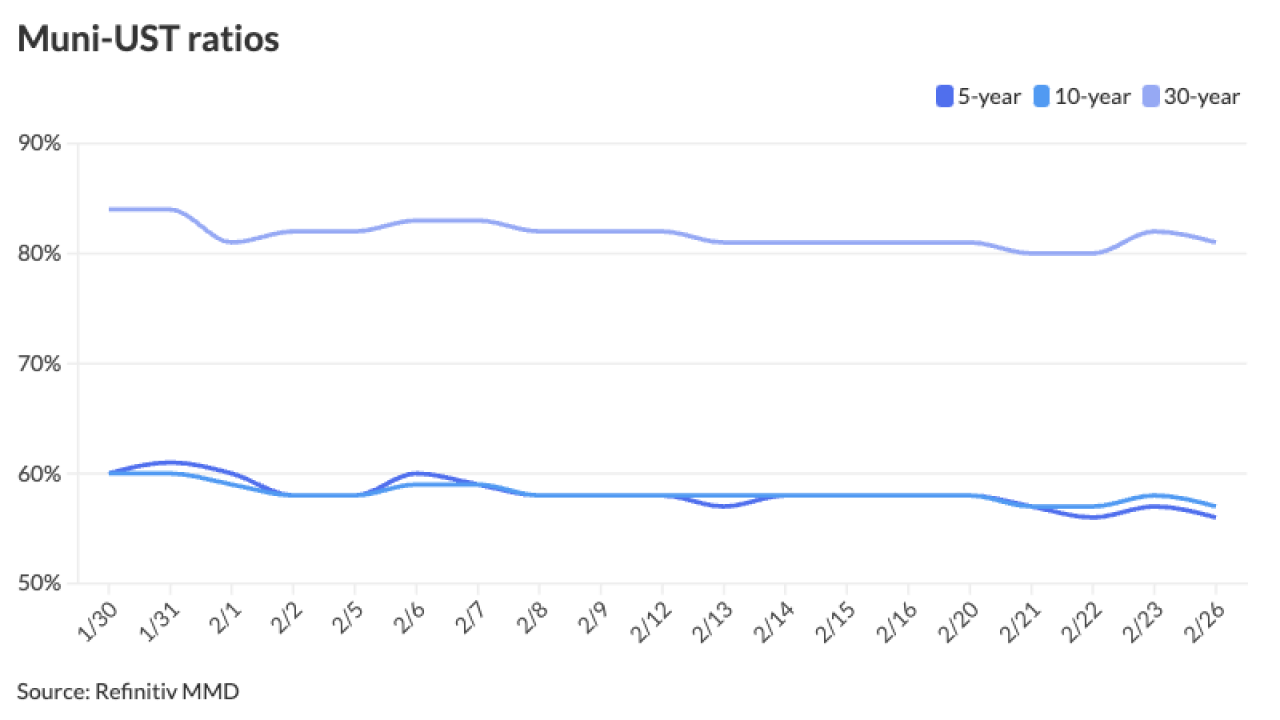

The muni market "exhibited similar themes from the past few weeks as extremely rich valuations and the upcoming unfavorable supply/demand picture have led to a measured buyer base," said Birch Creek Capital strategists in a report.

March 4 -

The bank has also hired some analysts to its infrastructure group over the past several weeks as it plans to beef up its muni team.

March 4 -

The negotiated calendar is led by the Regents of the University of California with nearly $1 billion of general revenue bonds.

March 1 -

High rates and high inflation, coupled with rich reserves, pushed off or delayed issuers coming to market in 2023, noted James Pruskowski, chief investment officer at 16Rock Asset Management.

March 1 -

Issuance is already slated to be healthy next week, with some large deals on the calendar.

February 28 -

Three of the hires are group heads in public sector and structured finance businesses at the firm.

February 28 -

Munis should remain well bid until issuance picks up "dramatically," said Nuveen's Anders S. Persson and Daniel J. Close.

February 27 -

CreditSights said states with the largest payments are Texas at $2 billion, Pennsylvania at $1.5 billion, South Carolina at $1.3 billion and California at $1.2 billion

February 26 -

With a recent court ruling and higher interest rates in their favor, more issuers are likely call back their outstanding BABs using the extraordinary redemption provision.

February 26 -

Supply is expected to increase in the coming weeks, and there may be more rate-direction volatility, said Kim Olsan, senior vice president of municipal bond trading at FHN Financial.

February 22