Jessica Lerner is a senior reporter and buy-side specialist for Bond Buyer where she writes the daily market column, the monthly volume story and longer trend stories. Prior to this, she worked as a beat reporter at two Connecticut newspapers. She earned her master's in business and economics reporting from the Craig Newmark Graduate School of Journalism and her bachelor's in journalism and statistics from the University of Connecticut.

-

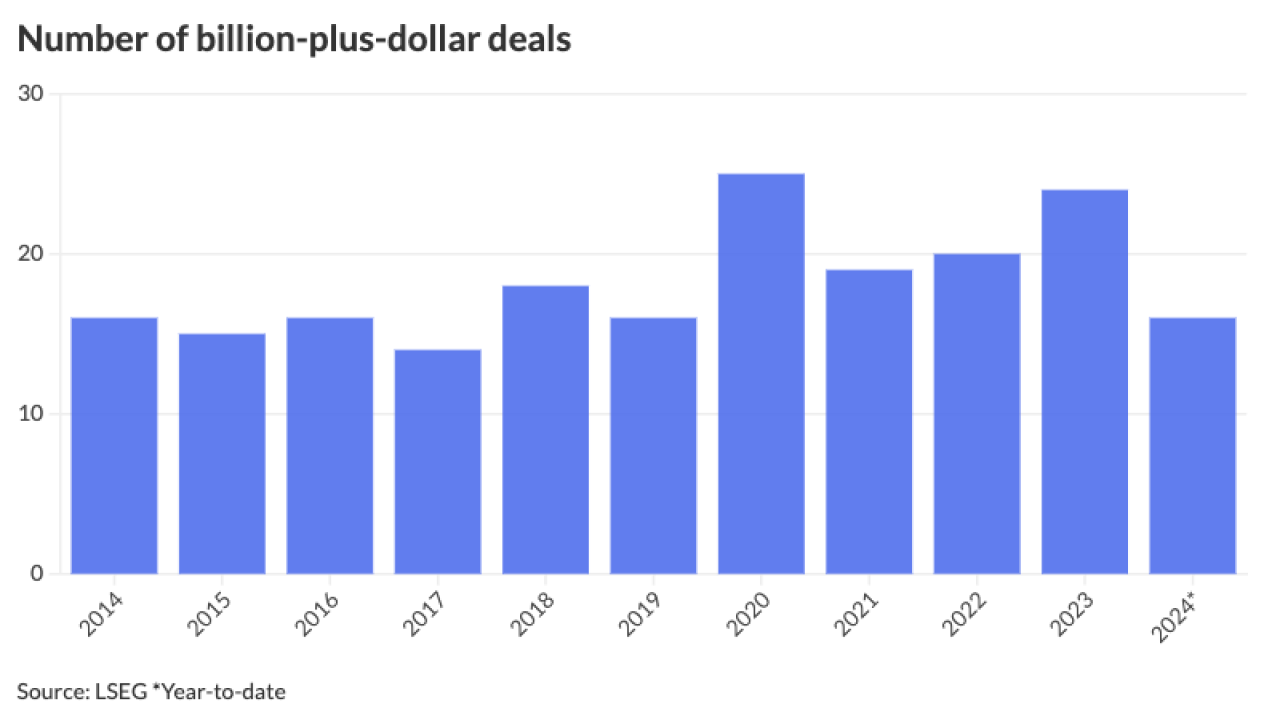

The top two municipal bond insurers wrapped $7.132 billion in the first quarter of 2024, up from the $5.735 billion of deals in the first quarter of 2023, according to LSEG data.

April 12 -

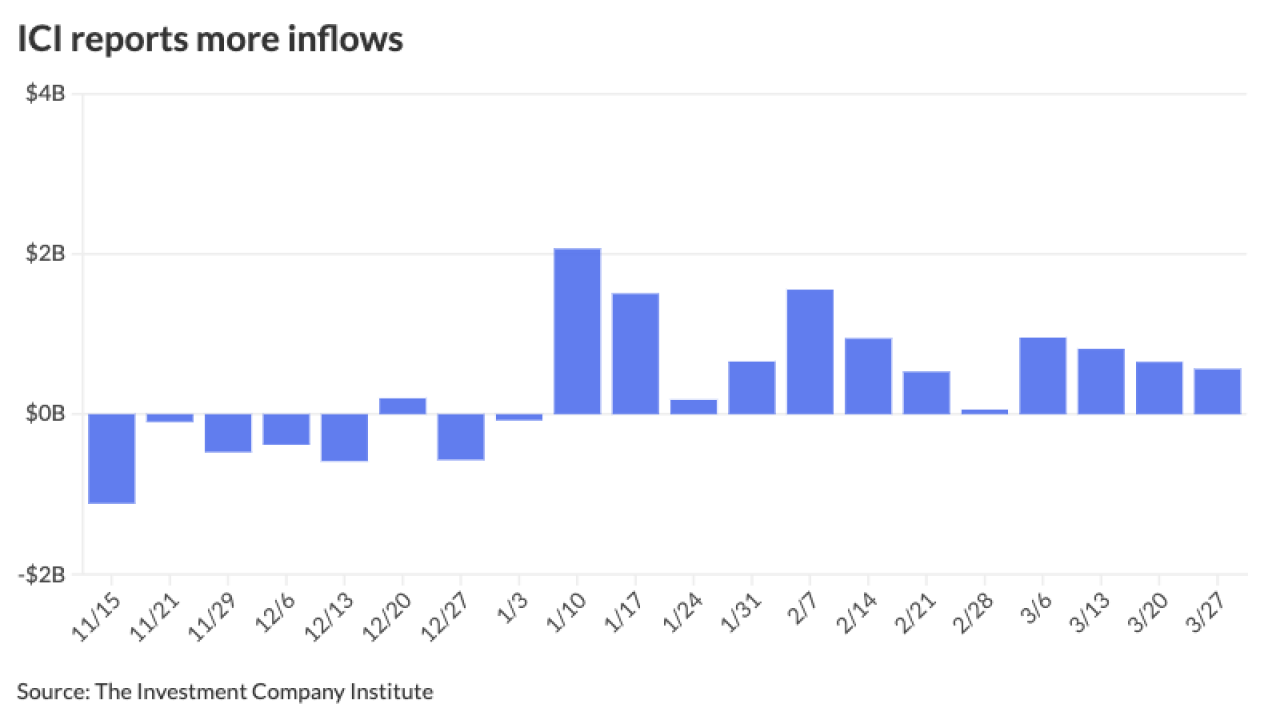

Municipal bond mutual funds saw the seventh consecutive week of inflows and the 14th week of inflows for high-yield funds.

April 11 -

The new hire comes on the heels of the firm's growth in bond insurance in the first quarter of 2024.

April 11 -

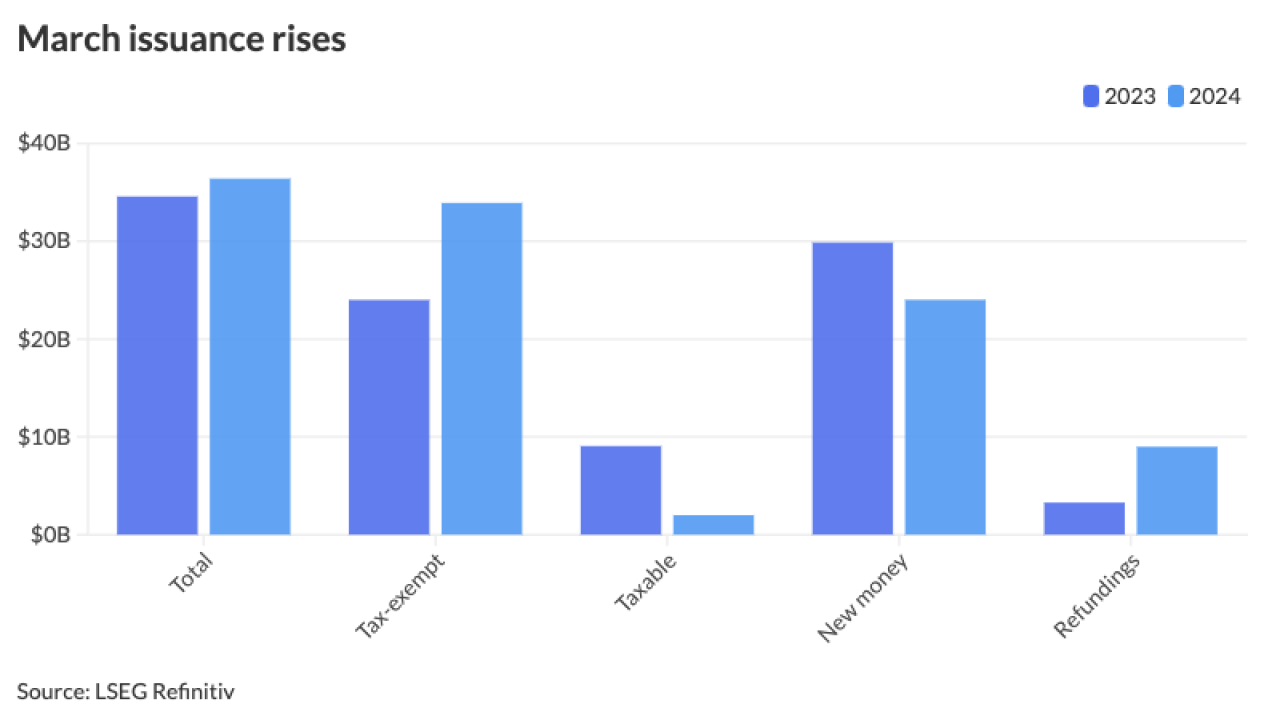

The pace of the issuance and the increase of refundings, surging 59.6% in the first quarter of 2024, have also led some firms to up their overall 2024 issuance projections.

April 11 -

"The news is sparking an equity market selloff while sending bond yields to the stars as investors dial down their Fed easing expectations again, this time to only two rate cuts this year," said José Torres, senior economist at Interactive Brokers.

April 10 -

Wednesday's CPI report will "shed more light on the path of inflation and the potential timing for rate cuts this year," said Cooper Howard, a fixed income strategist at Charles Schwab.

April 9 -

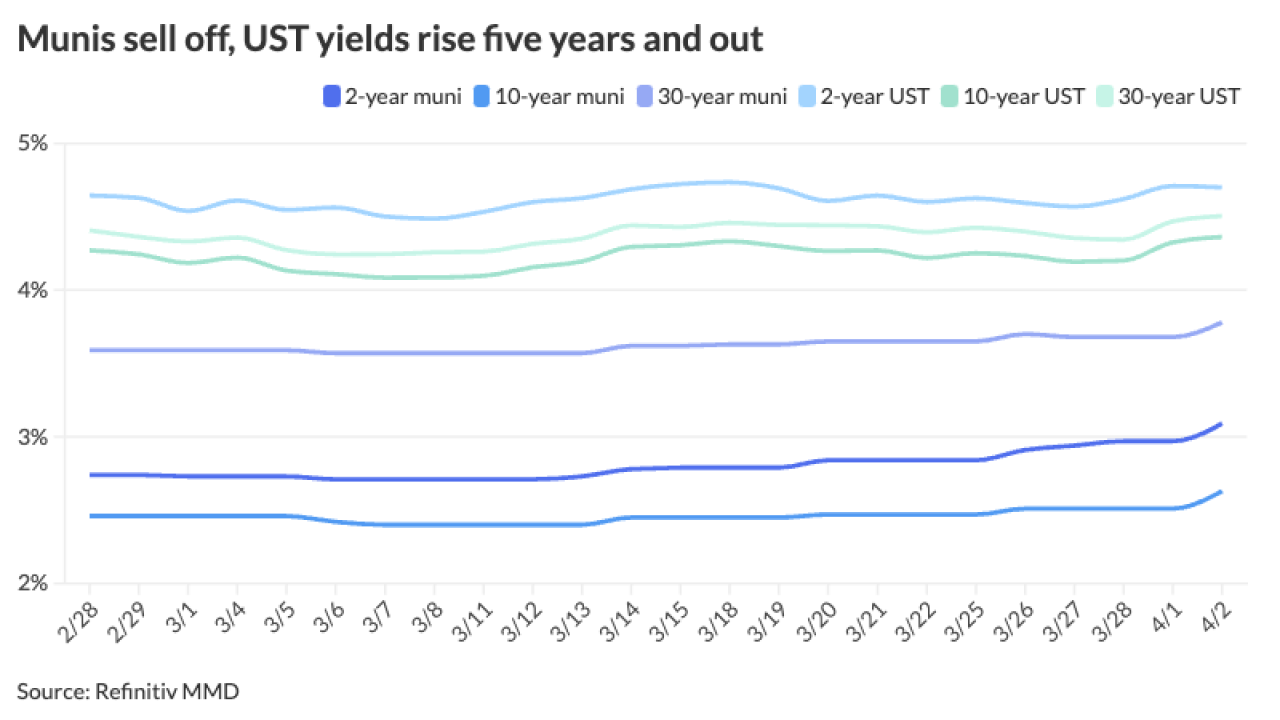

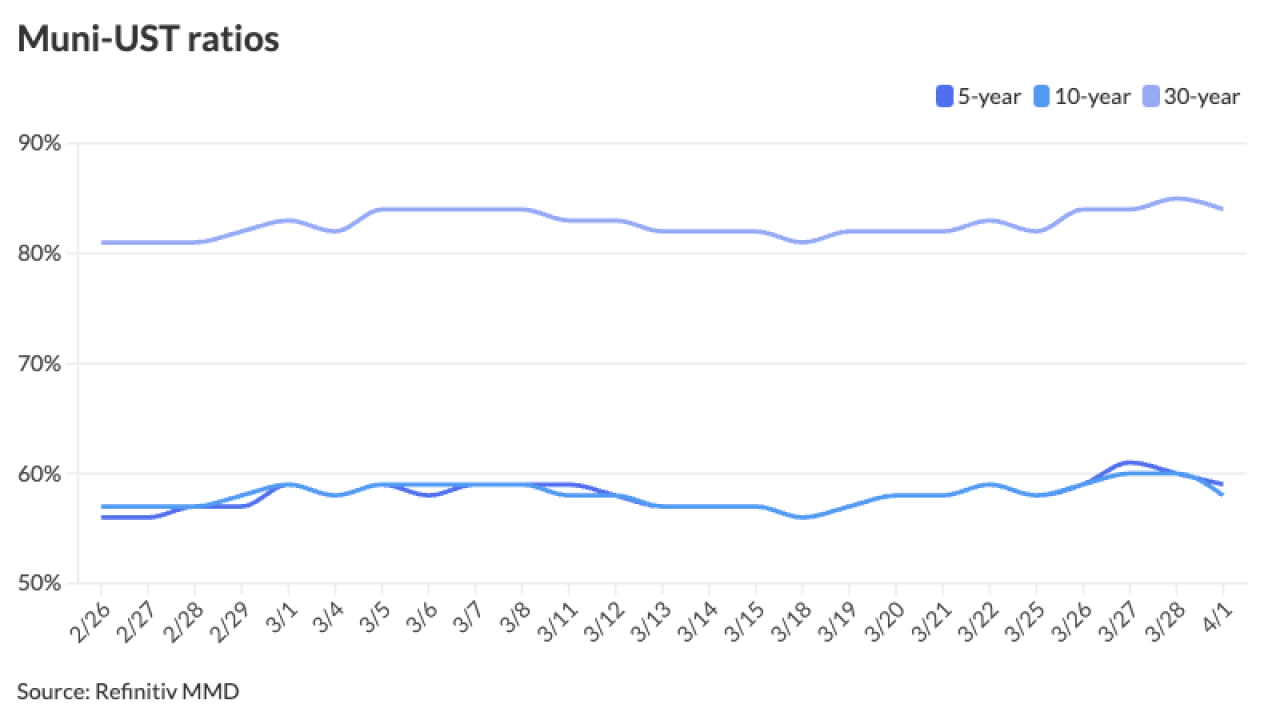

Muni to UST ratios also continue to rise across the curve, inching closer to more normal averages.

April 8 -

Some buying returned to the market Thursday from the buy-side and asset managers as dealers attempted to sell bonds, said Chris Brigati, senior vice president and director of strategic planning and fixed income research at SWBC.

April 4 -

Two mega deals recently priced with make-whole calls for bonds due in 2034 and shorter where the market does not appear "to be penalizing issuers for including an optional make whole call feature in the short maturity tax-exempt bonds," said Pat Luby, head of Municipal Strategy at CreditSights, in a report.

April 4 -

"Most spots on the muni AAA HG curve are at or near year-to-date highs, and the muni HG curve showed significant underperformance across the curve in March, relative to the broader fixed income market, after sizable muni outperformance in February," said J.P. Morgan strategists.

April 3 -

Before Tuesday's selloff, muni yields have been rising over the last several weeks due to "outsized" new-issue supply, said Anders S. Persson, Nuveen's chief investment officer for global fixed income, and Daniel J. Close, Nuveen's head of municipals.

April 2 -

The uptick in supply amid tax season has led to a short-end correction and higher muni to UST short ratios, but the levels are still rather rich from a historical perspective.

April 1 -

March issuance came in at $36.405 billion, above the $34.579 billion 10-year average, according to LSEG Refinitiv data.

April 1 -

LSEG Lipper reported fund inflows of $447 million while high-yield muni bond funds saw another round of inflows at $246 million, marking the 12th consecutive week of positive flows in that space.

March 28 -

Most of the selling during tax season happens on the front end of the curve, said Wesly Pate, senior portfolio manager at Income Research + Management.

March 28 -

Absolute yields "remain attractive in the context of the trading range over the past three years and our longer-term projections for lower rates this year," according to J.P. Morgan strategists.

March 27 -

The onslaught of new-issuance and approaching month- and quarter-end led triple-A yields to rise up to seven basis points on the short end and as much as three to five elsewhere along the curve, despite stronger U.S. Treasuries. Short ratios rose as a result.

March 26 -

The UC Regents will close the books on its $1.1 billion refunding deal that included the refunding BABs Wednesday. Investors do not appear to be penalizing the issuer in secondary trading as spreads have stayed at or near the original pricing.

March 26 -

This week's new-issue calendar grows and includes some "common benchmark names like CA GO, NYC GO, and WA GO," Birch Creek strategists said.

March 25 -

The calendar is led by several high-profile deals, including $2.7 billion of GOs from California, $1.5 billion from New York City and $1.1 billion from Washington. High-yield gets another dose of unrated project finance debt from Miami Worldcenter Project tax increment revenue bonds. The Bond Buyer 30-day visible supply sits at $12.06 billion.

March 22