Jessica Lerner is a senior reporter and buy-side specialist for Bond Buyer where she writes the daily market column, the monthly volume story and longer trend stories. Prior to this, she worked as a beat reporter at two Connecticut newspapers. She earned her master's in business and economics reporting from the Craig Newmark Graduate School of Journalism and her bachelor's in journalism and statistics from the University of Connecticut.

-

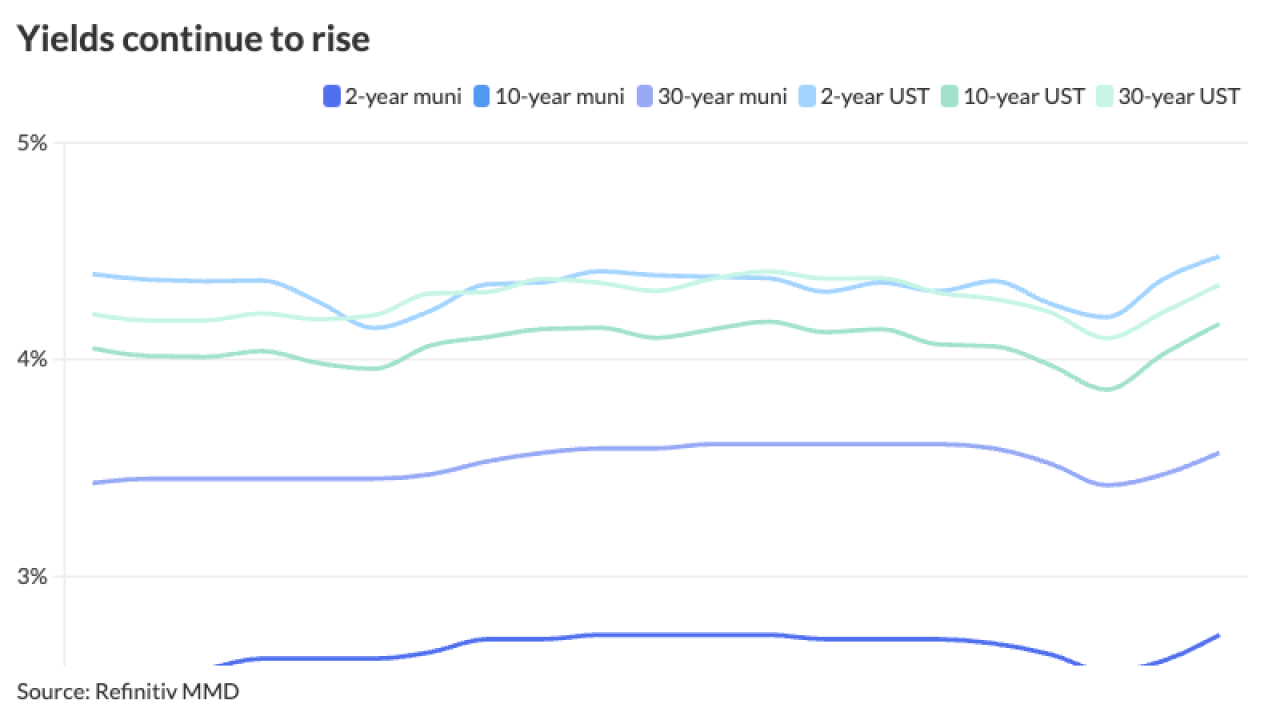

The volatility in USTs is giving municipals a difficult run to start February. The asset class lagged the selloff and outperformed the recent rally, which points to its resiliency — but those moves do not come without challenges.

February 6 -

Triple-A scales saw yields rise 10 to 13 basis points following a second day of UST losses as muni investors await a robust new-issue calendar.

February 5 -

The goal behind SOLVE's new product is to turn raw data into data-driven insights through AI, with munis being the first step before expanding to other key asset classes in fixed income, said Eugene Grinberg, co-founder and CEO of SOLVE.

February 2 -

The primary saw strong demand with the Triborough Bridge and Tunnel Authority doubling the size of its deal to $1.6 billion.

February 1 -

Interval funds include venture capital, real estate, insurance and credit have seen growth over the past several years.

February 1 -

Fed Chair Jerome Powell said cuts are likely this year but are not guaranteed. He added that the Fed is looking for more signs that inflation is moderating. "We are prepared to maintain the current target range for the federal funds rate for longer if appropriate."

January 31 -

Issuance for the month is slightly above the $27.666 billion 10-year average, according to LSEG Refinitiv data.

January 31 -

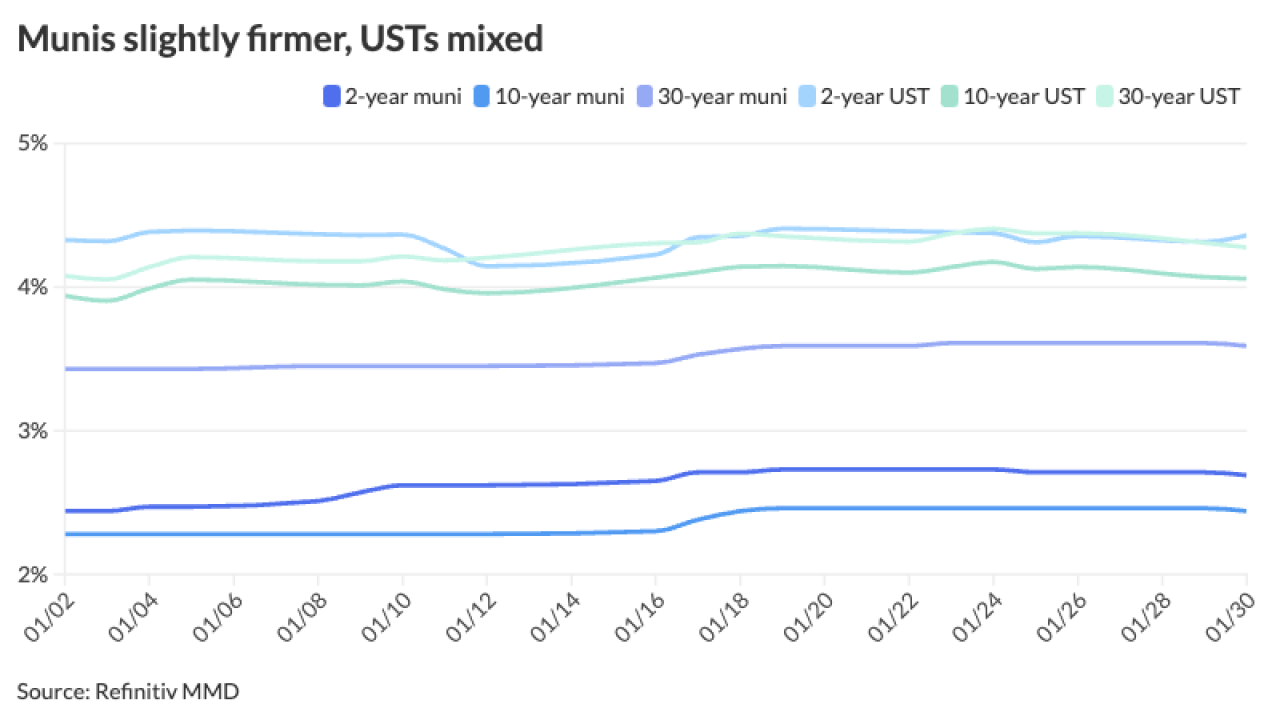

"Yields are attractive, and there's going to be a lot of demand and there's not going to be a lot of bonds," said Scott Diamond, co-head of the municipal fixed income team at Goldman Sachs.

January 30 -

"The market seems to be coalescing around the view that these historically rich ratios can be sustained through February, but that the market technical becomes far less favorable in March and April," said Birch Creek Capital strategists in a report.

January 29 -

The inflows into muni mutual funds mark a reversal from 2022 and 2023.

January 26