Jessica Lerner is a senior reporter and buy-side specialist for Bond Buyer where she writes the daily market column, the monthly volume story and longer trend stories. Prior to this, she worked as a beat reporter at two Connecticut newspapers. She earned her master's in business and economics reporting from the Craig Newmark Graduate School of Journalism and her bachelor's in journalism and statistics from the University of Connecticut.

-

"The Fed remains data dependent as always, but it now appears that the 'more good data' bar is not as high as it was before, particularly with labor market developments becoming more important," said Michael Gregory, deputy chief economist at BMO Economics.

July 31 -

Issuance was lumpy in July, with three weeks of $10 billion issuance sandwiched between lower issuance due to the Fourth of July holiday at the start of the month and the FOMC meeting the last week.

July 31 -

Yields may move lower after the Federal Reserve "communicates its goals to ease policy in coming meetings," said Tom Kozlik, managing director and head of public policy and municipal strategy at HilltopSecurities.

July 30 -

"The overall muni market appears to be in a good balance despite the hefty slate of primary issuance that has occurred over the past few months," Birch Creek Capital strategists said.

July 29 -

U.S. Soccer will issue $200 million of tax-exempt revenue bonds through the Fayette County Development Authority.

July 29 -

With Antonelli's hiring, IMTC will be able to more efficiently scale fixed-income management and maximize alpha opportunities for clients, the firm said.

July 29 -

The muni market tends to have "remarkable patience" in relation to USTs, said BofA strategists.

July 26 -

Despite munis being mixed Thursday, the muni AAA yield curve remains inverted, said Taylor Huffman, a client portfolio manager at PTAM.

July 25 -

Municipal bond insurance grew 24.4% in the first half, compared to the same period last year.

July 25 -

"While supply has been outsized over the last several weeks, the market has also seen outsized reinvestment demand over the last several months," said Nuveen strategists.

July 24 -

This week again sees elevated supply, as issuance sits at $9.673 billion, with Tuesday being a very busy day.

July 23 -

The initial reaction was a little bit a flight-to-quality trade in rates, which is supportive of USTs and munis as safe-haven assets do well during times of uncertainty, said Chris Brigati, senior vice president and director of strategic planning and fixed income research at SWBC.

July 22 -

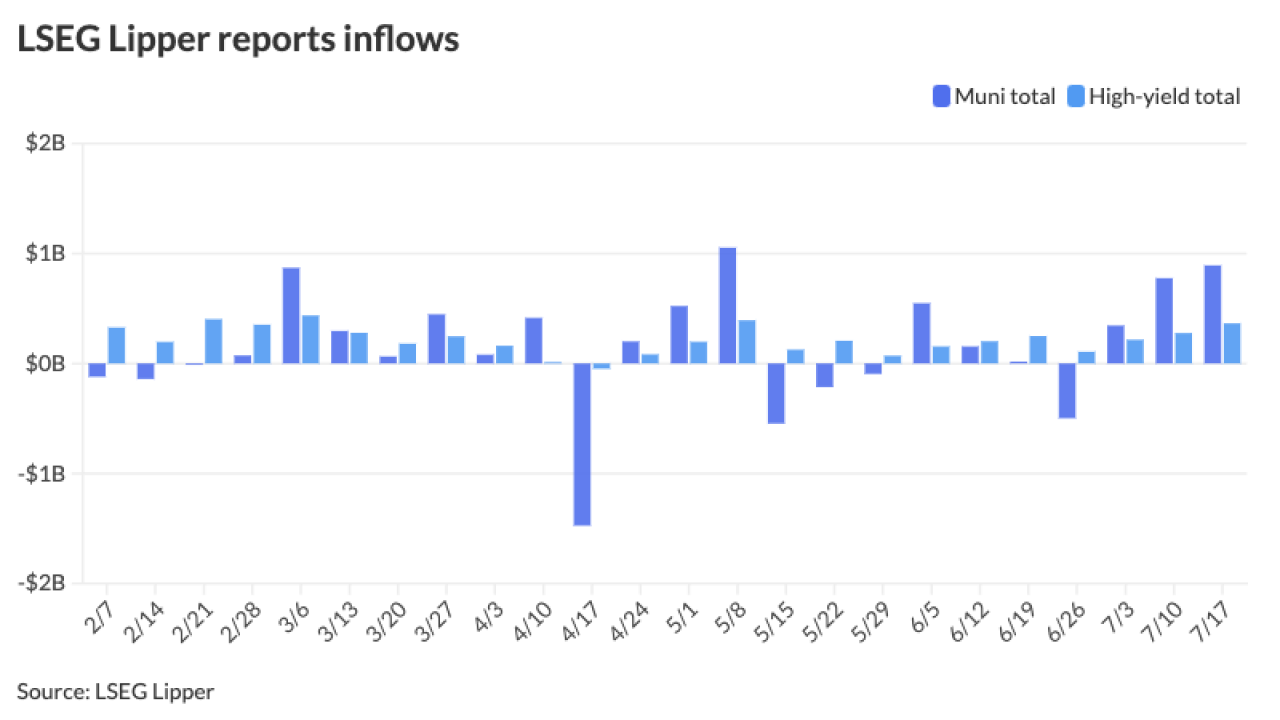

The high-yield sector continues to show strength, with inflows of $364.4 million for the week ending Wednesday, marking 13 straight weeks of inflows, according to LSEG Lipper.

July 22 -

The new-issue calendar is at $9.7 billion the week, led by the Texas Transportation Commission with $1.7 billion of first-tier and second-tier revenue refunding bonds.

July 19 -

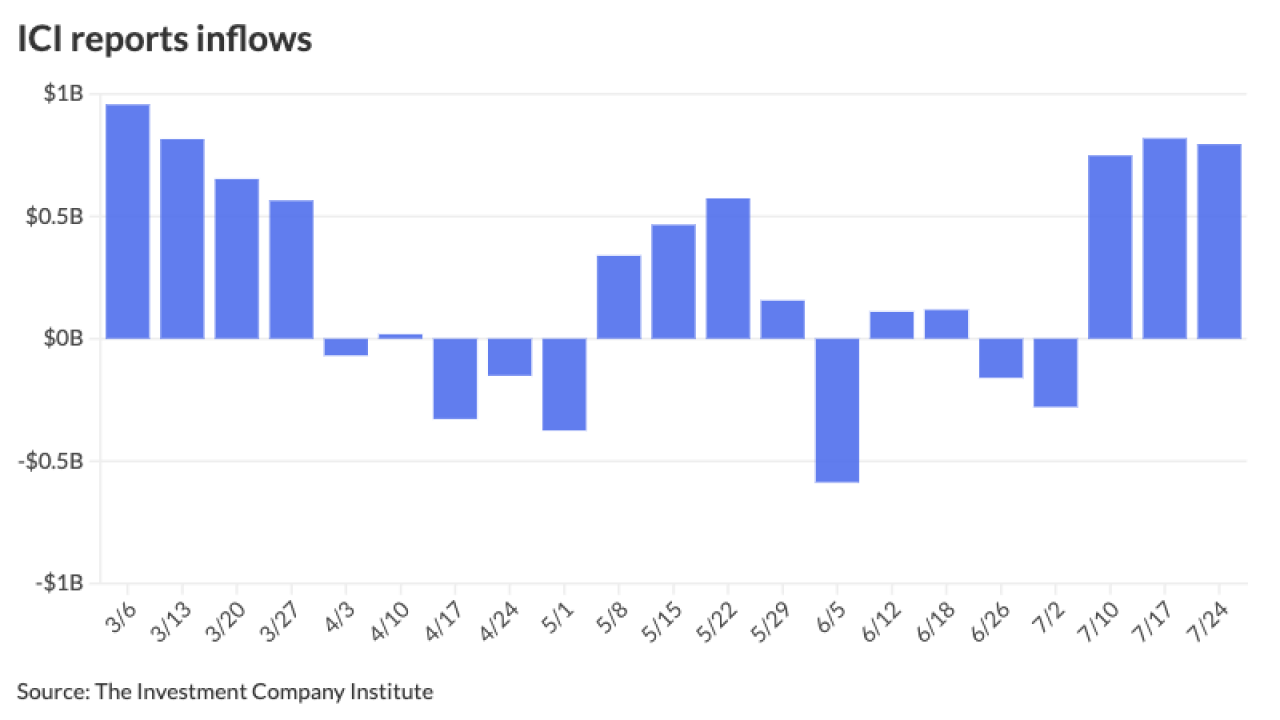

Municipal bond mutual funds saw inflows as investors added $891.4 million to funds after $775.3 million of inflows the week prior, according to LSEG Lipper.

July 18 -

Issuance has remained robust over the past two weeks, with Wednesday being a particularly busy day.

July 17 -

Volume is predicted to continue at "robust levels," possibly through the fourth quarter, said Matt Fabian, a partner at Municipal Market Analytics.

July 16 -

Financial markets are trying to "absorb" the outcome of higher odds of Trump winning in November, said James Pruskowski, chief investment officer at 16Rock Asset Management.

July 15 -

In the summer, the market will largely move "sideways" and underperform late in the third quarter to early in the fourth quarter, "while possibly recouping most of its losses late in the year depending on the outcome of November elections," said Barclays strategists.

July 12 -

"Bond yields are plunging [Thursday] as rate cut expectations soar following this morning's consumer price index release, which depicted the first month of deflation since July 2022," noted José Torres, senior economist at Interactive Brokers.

July 11