Jessica Lerner is a senior reporter and buy-side specialist for Bond Buyer where she writes the daily market column, the monthly volume story and longer trend stories. Prior to this, she worked as a beat reporter at two Connecticut newspapers. She earned her master's in business and economics reporting from the Craig Newmark Graduate School of Journalism and her bachelor's in journalism and statistics from the University of Connecticut.

-

With the market "hungry" for high-yield bonds, declining cigarette sales have not had as much of an impact "as maybe it should or could in the future," said John Miller, head and chief investment officer of First Eagle's High Yield Municipal Credit team.

May 14 -

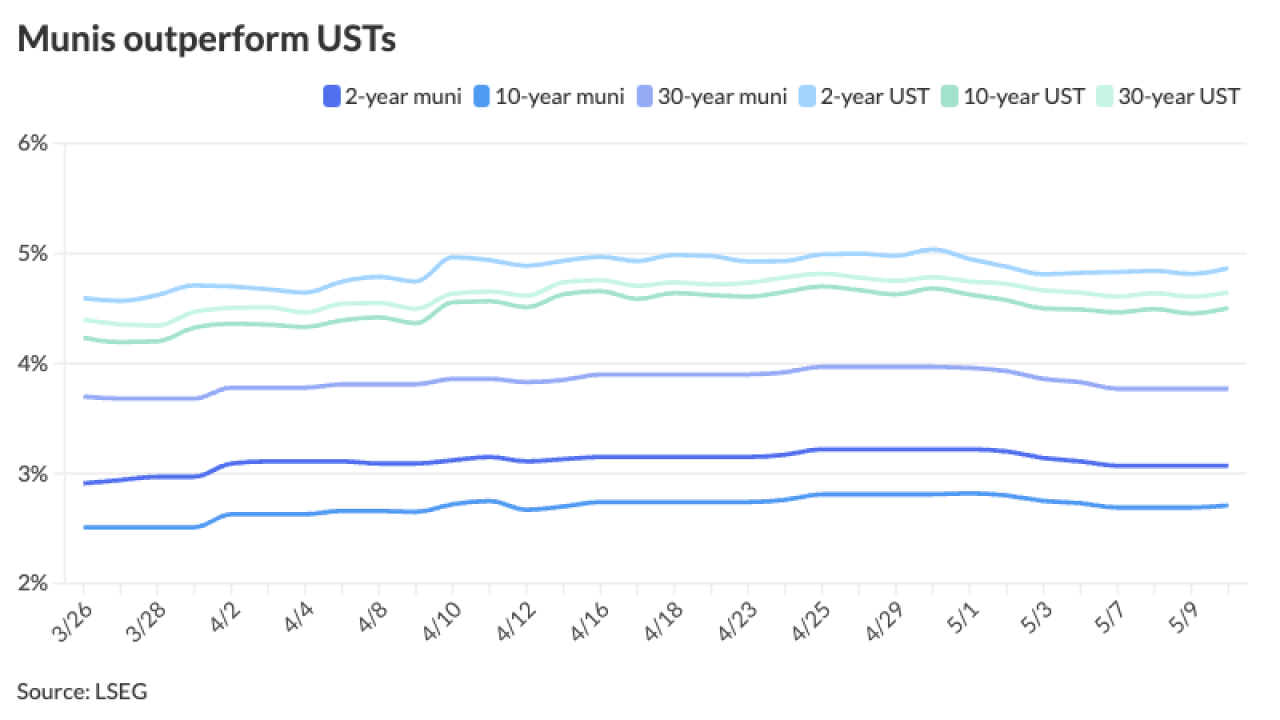

The muni market improvement has the asset class seeing gains of 1.08% so far in May, as year-to-date returns inch closer to "positive territory," said Jason Wong, vice president of municipals at AmeriVet Securities.

May 13 -

The New York City Transitional Finance Authority leads the new-issue calendar with a total of $1.8 billion of future tax-secured subordinate bonds in the negotiated and competitive markets.

May 10 -

Municipal bond mutual funds saw another week of inflows as investors added $1.053 billion in the week ending Wednesday, the second-largest figure this year.

May 9 -

The University repriced to lower yields up to 15 basis points Wednesday while Illinois accellerated its pricing of its tax-exempt GOs and were repriced yesterday afternoon with bumps of 10 to 13 basis points and saw $1.5 billion of retail orders alone.

May 8 -

April's "poor performance" pushed munis further into negative territory, but "despite the poor start to the year, they may still end the year positive," said Cooper Howard, a fixed-income strategist at Charles Schwab.

May 7 -

There is a town hall scheduled for Monday, according to a source.

May 6 -

The "historical runway" heading into Memorial Day is favorable, rolling into the summer redemption months of June through August, said James Pruskowski, chief investment officer at 16Rock Asset Management.

May 2 -

Healthcare issuance is up 122.2% year-over-year through April, rising to $9.062 billion through the first four months of 2024 from $4.078 billion over the same time period in 2023, LSEG data shows.

May 2 -

Munis posted losses in April, returning negative 1.24%. The asset class is also seeing losses of 1.62% year-to-date.

May 1